The cost of living crisis will hit communities in the north of Scotland hardest, a leading economist has warned.

It comes as Britain’s rate of inflation hit its highest level for nearly 30 years according to official figures.

The Office for National Statistics (ONS) said Consumer Prices Index (CPI) inflation jumped from 5.1% in November to 5.4% in December – the highest since March 1992, when it stood at 7.1%.

The rise came as a shock to many economists who had expected inflation of 5.2% in December.

Oil & gas decline to blame

Inverness based economist Tony Mackay believes the north of Scotland is suffering from higher costs due to “significantly lower” growth in average weekly earnings due to the decline in the North Sea oil and gas industry and Highlands tourism being hit by Covid-19.

The latest estimate of growth in average weekly earnings was +4.2%, however, Mr Mackay said the growth in weekly earnings in the north of Scotland has been lower, around 2%.

He said: “The two main reasons are the decline in the North Sea oil and gas industry has seriously impacted earnings in the Aberdeen area and Shetland.

“And the importance of the tourism industry in the Highlands, which has been badly affected by the coronavirus pandemics, particularly the numbers of visitors from the USA and elsewhere overseas.

Inflation has hit the north worse than in the rest of the UK and I expect that to continue during 2022 because of the rises in energy bills.”

Tony Mackay, leading economist

“Also, there will soon be huge increases in most people’s energy bills and they are much higher here in the North than the national averages because of the climate and geography.

“Inflation has hit the north worse than in the rest of the UK and I expect that to continue during 2022 because of the rises in energy bills.”

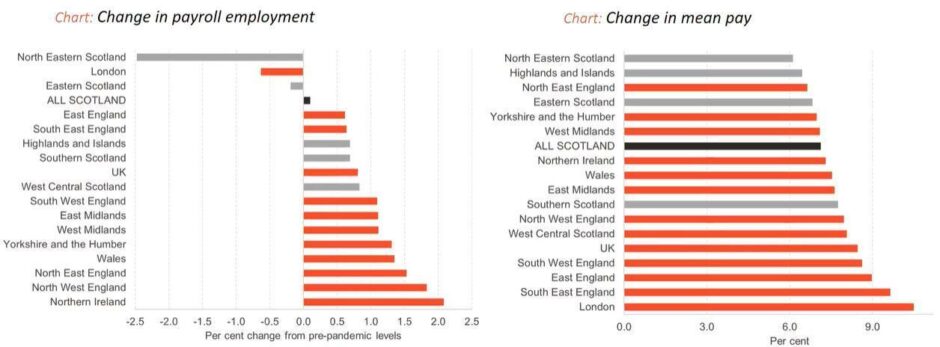

Experimental results from the Office of National Statistics show there has been a 2.5% drop in payroll employment for the north-east from pre-pandemic levels.

The region has also seen the lowest increase in mean pay, compared to the rest of the UK.

The Scottish Government’s Office of the Chief Economic Adviser published a report showing the average monthly pay for different areas of the country.

Big differences between monthly pay

The estimated Scottish monthly pay is estimated at £2032, equivalent to £24,384 a year, according to analysis of figures from Scottish Government’s Office of the Chief Economic Adviser for November.

The Highlands and Islands monthly average was £1932, or £23,184 a year, making it -4.9% below the Scottish average.

The areas with the lowest average monthly earnings were Lochaber, Skye and Lochalsh on £1833, which was –9.8% below the average.

This was followed by Orkney which was £1837 at -9.6% average.

The Federation of Small Businesses’ Highlands & Islands development manager David Richardson said businesses were aware of low pay and were struggling to meet expectations.

He highlighted a recent survey that showed more than a half of all businesses had increased pay to attract and retain staff – more for tourism & hospitality businesses.

He said: “Worryingly, 35% of employers told us that they were unable to pay sufficiently high wages to attract the staff they need, and over a half of tourism & hospitality businesses said likewise.

“Many of the businesses facing the biggest staffing deficits have depleted reserves, Covid loans to repay and substantial increases in costs like utility bills to meet.

“This has already reduced the ability of a quarter to reinvest in their businesses, and two in ten are worried about their survival.

“The only way forward appears to be scaling back on operations, which many are doing, and/or putting prices up.

“In fact, seven in ten businesses have had to put their prices up this year or are going to in 2022, seven in ten of them by between 5% and 20%.”

Clothing, food and energy on the rise

ONS figures also showed food and drink prices lifted by 4.2% year on year in December, which is the biggest rise since September 2013.

Clothes shops also put up prices by an average 4.2%.

But the biggest hit to consumer pockets continues to be the rises in energy bills after an October increase to the price cap, with experts warning over a leap of more than 50% in these costs when the next revision is due in April.

Kevin Brown, savings specialist at Scottish Friendly, said the Bank of England faced “growing pressure” to stem inflation with interest rate rises.

He said: “Inflation continues to rise faster than many people’s expectations and it looks increasingly likely that it will hit at least 6% before the summer.

“The vast majority of working adults in the UK have never experienced inflationary pressures like this and it’s going to be impacting more and more families.

“We’re now seeing prices rise right across the board with food, furniture and household goods, clothing and footwear and fuel costs all on the up.

“Everyone knows energy prices are soaring, but households won’t feel the full effect until the new energy price cap is set in April, which could push energy bills up by as much as 50%.

“To make matters worse, workers pay is now falling in real terms for the first time in more than a year as inflation is rising faster than average wage growth.

“Families at the bottom shouldn’t carry the burden for the speed at which the economy has recovered.

“The Bank of England will face growing pressure to quickly raise interest rates again to try and slow the rate of inflation, while the government should also be considering ways to support households struggling to make ends meet.”