April is being billed as the bitterest month for the cost of living crisis with no signs of it set to ease.

Consumers across Scotland will likely have to spend an extra £21.13 per week on food and energy in April this year when compared to March 2021.

But that’s not the only everyday living cost set to soar, with even more added costs set to hit people in the pocket.

This month has been described as financially “horrendous” for people by one economic expert.

However, the warnings are that October could be even worse with a further £145-a-month hike to energy costs predicted.

This will leave one in four UK adults unable to afford their bills, according to research from Citizens Advice.

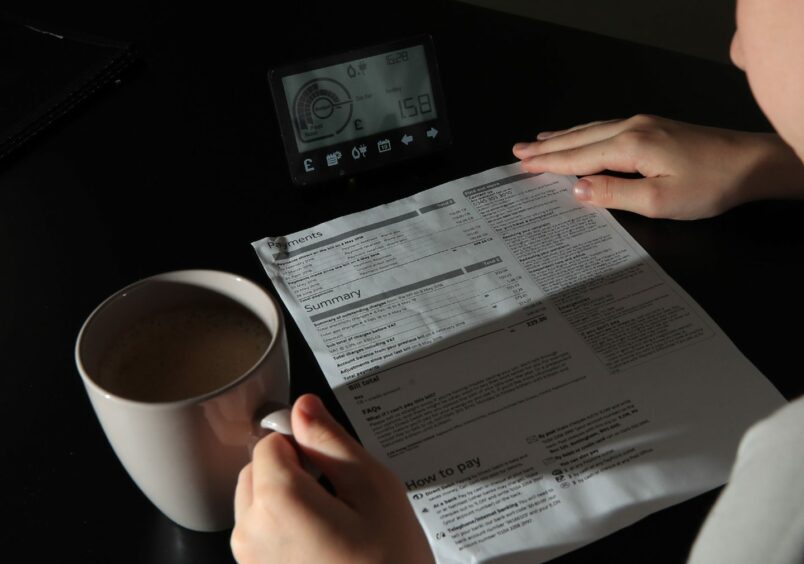

Rising energy bills

Residents across the north and north-east have already received letters informing them of massive hikes in their energy bills.

They are set to soar by nearly £700 after regulator Ofgem lifted the price cap by more than 50% which hits the first of April..

Consumers will have to pay up to £1,977 per year now, an increase from £1,271.

And there’s huge concern the Ukraine-Russia crisis will disrupt supplies across the world which could push prices up further in the UK.

Fears are rising it could lead many people to be forced to decide between “heating or eating”.

The search is on for people to come up with options on to how to save money on rising costs including energy bills.

Mortgages going up

North and north-east homeowners are facing an increase on monthly mortgage payments after the Bank of England announced a rise in interest rates by another 0.25% t0 0.75%.

Darren Polson, head of mortgage operations at law firm Aberdein Considine, said with the average variable rate in the UK at 2.1% and average payments of £704 per month, the 0.25% rise could result in borrowers paying £17 per month more.

It is the third consecutive monthly increase since December, when the central bank lifted the base rate from the record low of 0.1% introduced at the start of the pandemic.

Chief economic advisor to the EY Item Club Martin Beck said: “Overall, the EY Item Club anticipates no more than one or two further rate rises over the rest of 2022, leaving bank rate at 1%-1.25% at the end of this year.

“Higher borrowing costs will exacerbate the mounting cost of living pressures faced by households from rising energy prices, the rising price of other essentials and forthcoming tax increases.”

Hard month for consumers

Leading Inverness based economist Tony Mackay said: “April will be an horrendous financial month for people, particularly those living in the north of Scotland.

“It is the start of the new financial year 2022-23, so many UK and Scottish Government policies change.

“We are also still having to cope with the economic problems caused by the ongoing Covid pandemic.

April will be an horrendous financial month for people, particularly those living in the north of Scotland.”

Tony Mackay, economist

“Domestic gas and electricity prices will increase by at least 50% and there are fears that the ongoing war in Ukraine will force them up even higher, particularly if there cuts in gas supplies from Russia.

“The latest official inflation statistics show a 5.4% increase in prices.

“The UK Government will increase pensions and other benefits in April but those rises will be much lower than the huge increases in energy costs.

“There is also unlikely to be any significant rise in wages and earnings before the coronavirus pandemic ends. Many businesses can still only work part-time.

“There are particular problems in the area because of the ongoing decline in the North Sea oil and gas industry.

“Also energy prices in the Highlands and Islands are already much higher than the national averages because of the geography and relatively sparse population.”

Mobile phone contracts

Are you one of the millions of mobile phone customers seeing their bills rise by a steep 11.7% in April?

Both O2 and Virgin Mobile will be increasing their prices by 11.7 per cent while Three will hike costs by 4.5 per cent.

The announcement comes after BT, Plusnet, Shell, TalkTalk and Vodafone announced they would also be hiking their phone, mobile and broadband prices by up to 9.3 per cent.

Fuel prices – hitting consumers and businesses

Drivers have been hit with fuel costs reaching new highs.

Figures from data firm Experian Catalist show the average cost of a litre of petrol at UK forecourts has increased by 16p last month.

For independent haulier Sandy MacCallum, his fuel costs have jumped to nearly £1,000 a week.

The Lochanber-based driver said: “The fuel is killing us because running the lorries is so expensive.

“I’ve not been able to pay myself a wage and having to live off what I’ve got until things change.

“The fuel is costing me an extra £1,000 a week now and that’s all my profits and wages gone.

“We are trying to put the rates up here and there but having very little success.

“All the prices of everything is going up because of Brexit and Covid. Paying drivers wages, parts for the lorries and the actual prices of lorries themselves.

“It’s a growing problem throughout an industry that it very vital to society. People don’t realise how much you need lorries on the road.”

National insurance contributions

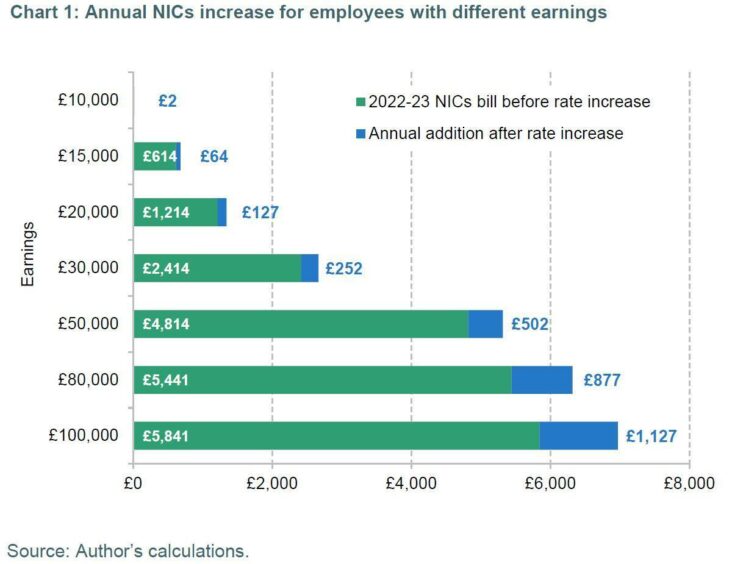

Last autumn the Government legislated for an increase in the rates of National Insurance contributions (NICs) in April 2022 which it said was needed to help the NHS recover after the pandemic.

The rates of NICs will increase by 1.25% from 12% to 13.25% – biting further into household finances.

This means households making as little as £15,000 a year will pay an extra £64 a year, while those on £100,000 will fork out £1,127, according to analysis by the Institute of Fiscal Studies.

The main rates of employee and self-employed NICs currently start to be paid on earnings (or profits) above £9,568.

From April, this threshold will increase to £9,880. The higher-rate threshold is £50,270 and will remain at that.

… but October could be even worse

The further £145-a-month hike to energy costs predicted for October could mean that one in four UK adults will be unable to afford their bills, Citizens Advice has warned.

The figure – equivalent to 14.5 million people – is a massive jump from the five million who already say they cannot afford April’s price increase of £60 a month.

Citizens Advice chief executive Clare Moriarty said: “These staggering findings must be a wake-up call to the Government. With one in four unable to afford their bills come October, measures announced so far simply don’t meet the scale of the challenge.

“Parents shouldn’t have to decide between giving their kids a hot bath or saving the money to buy them new school shoes.

“The Chancellor has a crucial opportunity to bring forward more support for those most in need in his spring statement next week. Increasing benefits in line with inflation, expanding the Warm Home Discount and announcing a more generous energy rebate should be top of his list.”