Production starting from a North Sea gas field has been hailed as a boost to the UK’s energy security as the globe faces shortages and higher prices in the wake of war in Ukraine.

It came as Prime Minister Boris Johnson and the bosses of offshore oil and gas companies including Shell and BP discussed ramping up investment in the North Sea and boosting supply of domestic gas in a meeting on Monday.

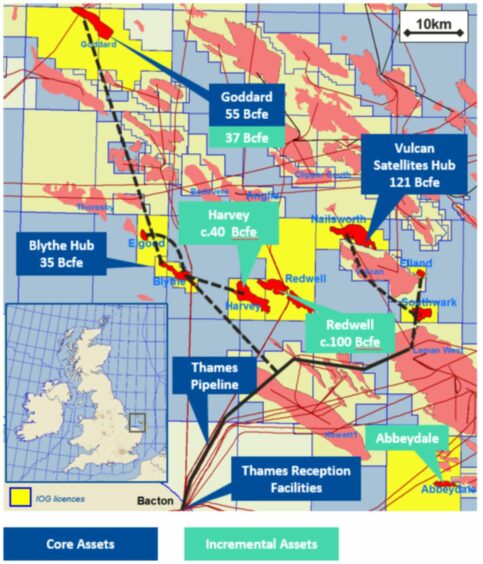

IOG said its flagship Saturn Banks delivered first production to the Bacton Terminal on England’s east coast on Sunday.

The field is an amalgamation of several discoveries which the company estimates contains around 410 billion cubic feet of gas in the Southern North Sea.

The project has faced numerous issues and delays, ranging from a problem with rig stability at the Southwark field to Covid-related woes and even storms battering the UK pushing back first production.

Underlining the complexities of the global market for oil and gas, London-based IOG recently announced it had cancelled a contract to sell the gas to Russian giant Gazprom and instead will now sell it to BP.

Offshore Energies UK (OEUK) external relations manager Jenny Stanning said: “This new source of gas, from the UK’s own waters, boosts our energy security at a time when the Ukraine crisis has reminded us of the urgency and importance of maintaining our own energy supplies.”

“The UK is reducing its overall energy use and moving to lower carbon sources of energy but that is a long-term project.

“In the meantime, 24 million households heat their homes with gas which also produces about 40% of our electricity.

The UK needs secure supplies of energy – and the most secure place to get it is from our own surrounding seas.”

— Jenny Stanning, external relations director, Offshore Energies UK (OEUK)

“That means the UK needs secure supplies of energy – and the most secure place to get it is from our own surrounding seas.”

Alistair Macfarlane, area manager – Southern North Sea and East Irish Sea at the Oil and Gas Authority (OGA), added: “As the UK transitions to net zero it will need a stable and secure supply of domestic gas to reduce its reliance on imports, which often have a larger carbon footprint, and so first production from the Saturn Banks project is a positive development.”

Concerns over world supply of oil have spiralled in the wake of Russia’s invasion of Ukraine, which has caused countries and companies to spurn the aggressor and impose sanctions – including a ban on its hydrocarbon exports.

Russia only accounts for 8% of the UK’s oil (now sanctioned) and 4% of its natural gas – the majority of UK energy imports come from Norway as well as nations in the OPEC oil cartel such as Qatar, Saudi Arabia and Venezuela.

UK business secretary Kwasi Kwarteng has said he’s exploring options to cease all Russian gas coming to the UK.

UK ministers have also raised the prospect of rethinking the UK ban on fracking amid soaring gas prices.

Further, Boris Johnson is preparing to visit Riyadh and meet Crown Prince Mohammed bin Salman in the hope his kingdom can raise its production of oil and gas to make up for a reduced reliance on Russia.

The Prime Minister reaffirmed his steadfast commitment to the North Sea oil and gas industry.”

— Downing Street spokesman

Speaking about meetings held with oil and gas companies on Monday, a Downing Street statement said: “The Prime Minister reaffirmed his steadfast commitment to the North Sea oil and gas industry as a key asset in the UK’s plans for achieving greater energy independence, in ensuring the country’s smooth transition to net zero and in being part of the solutions needed for a cleaner future – which are ever more crucial as we move away from Russian hydrocarbons following Putin’s illegal invasion of Ukraine.

“This was welcomed and echoed by industry leaders, who made clear that the oil and gas industry are fully behind the UK’s energy transition.

“The Prime Minister and CEOs discussed increasing investment in the North Sea oil and gas industry, and boosting supply of domestic gas. They agreed to work together going forwards to help accelerate this further.”

Oil price shock

Nathan Piper, the head of oil and gas research at bank Investec, said that the world is not just facing an oil price shock, as in the 1970s, but also shocks in other areas such as gas and food.

“We really haven’t got an awful lot of good news, because it isn’t just an oil price shock, and it’s really crucial to express that, and also this is not just a Russia-Ukraine shock, that has added on top of what was going to be a high oil price and gas price year anyway,” he said.

This is going to be a cost of living crisis for people for a long time to come.”

— Nathan Piper, the head of oil and gas research, Investec

“We’ve got to be up front, this is going to last for a while. This is not just this year, and maybe if there’s a peace accord between Ukraine and Russia it all goes away.

“Maybe it moderates, but this is going to be a cost of living crisis for people for a long time to come.”

It underlines the incredibly high costs that will start to hit households across the UK.

Energy bills are already set to soar by more than 50% for the average household from April 1.

Experts say that if gas prices stay as high as they are now, then household energy bills could increase by another 50% in October.

Insulation not oil?

More than 30 campaign groups are urging the Government to provide more support for households, cut gas use and shift to renewables as bills soar.

The groups also warn that the best solution to high gas prices is to use less gas, with better energy efficiency and insulation, and through switching to electric heat pumps which use less energy to heat homes than gas boilers.

They are calling for billions more pounds in funding for insulation and boosting heat pump installation, which they said could be funded from sources such as the sale of green gilts and the UK Infrastructure Bank.

And the Government must expand renewable energy sources such as wind and solar to end reliance on gas for electricity generation and support the switch to electric heat pumps and vehicles, the groups urge, including removing “onerous” planning restrictions which hold back onshore wind.

They call for further expansion of North Sea oil and gas drilling to be ruled out and say the ban on fracking should remain – warning that both energy sources are unpopular with the public, would worsen the climate crisis and fail to cut bills.