Oil giant Total plans to sell North Sea assets and may consider Aberdeen job cuts unless prices rise and taxes are cut.

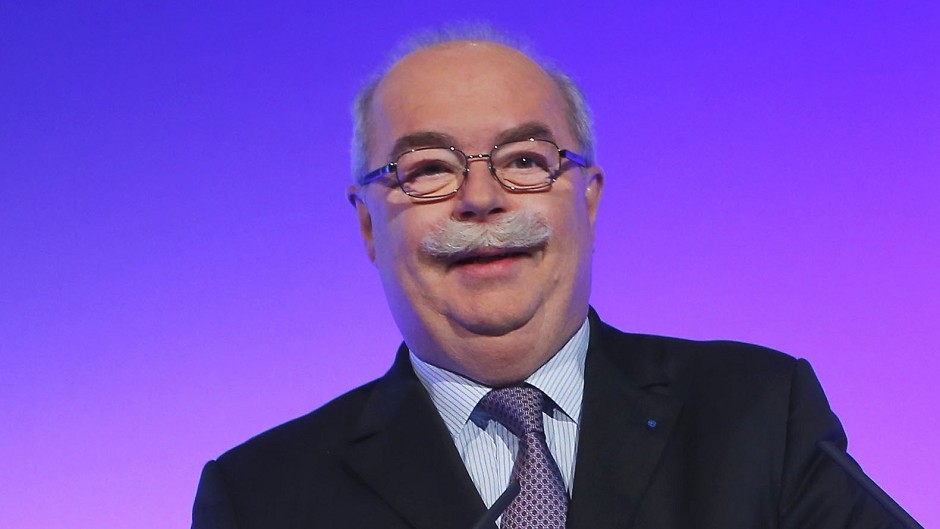

Chief Executive Patrick Pouyanne said the firm was not proposing upstream redundancies, but that it was slashing UK investment, and may “need less staff” if it continues.

He was speaking to journalists in London after the Paris-based company announced its net adjusted profit fell 17% to $2.8 billion in the quarter, compared with the same period a year ago.

Total, whose long-serving Chief Executive Christophe de Margerie died in a plane crash in Moscow last October, also said it was reducing staff numbers at the Lindsey refinery in Lincolnshire from 580 to 400.

Mr Pouyanne said the firm was taking action to lower costs during the downturn, but added: “Our motto is ‘what will be, will be’. We have to react but not to over-react.”

The reaction will involve an accelerated $5billion programme of asset sales, including in the North Sea.

“We have in mind to dispose of some assets in the North Sea, but I’m not disclosing which ones, it’s part of the programme,” the chief executive said.

On jobs, he said: “I know that my peers and competitors have announced plans of laying off. We consider that training an operator or an engineer, or a technician in the oil industry takes quite a long time.

“It’s an investment and we don’t want to lose these competencies so we’ve decided to do it in another way.”

The plan will include no upstream redundancies but a recruitment freeze which would remove 2,000 posts across the firm and save £130million.

However, Mr Pouyanne later suggested that UK staff could be axed if investment continued to decline, and called on the Treasury to take action at the Budget.

“Today at $50 per barrel and fiscal terms that have largely increased in the UK in the last years, it’s not profitable to maintain heavy investment in mature fields,” he said.

“I hope the UK Government will react. We are advocating, with other oil and gas companies in the UK, that maybe it is time to relinquish the fiscal pressure on oil companies.”

He added: “We have I think 1,300 people (in the UK), but obviously we will have to adapt our staff to our operations and to our investments, so if it’s less, we need less staff, that’s obvious.”

However, Mr Pouyanne also declared that “we will not give up” on new developments west of Shetland, which include the £3billion Laggan-Tormore project and £340million Edradour development.

The chief executive said history showed that previous slumps had required 18-24 months for the industry to recover.

“After that it could be longer at low price, or it could come back like in 2008 to a much higher price. We’ll see,” he said.