Martin Gilbert’s latest asset management vehicle is acquiring another Edinburgh fund manager in a £10.7 million deal that will shift the company’s centre of gravity in the UK closer to his Aberdeen home.

AssetCo, where Mr Gilbert is the largest individual shareholder, with an 8.5% stake, currently has its head office in south Wales.

But a hat-trick of acquisitions in the Scottish capital, including the latest conditional purchase of SVM Asset Management Holdings has given the business a distinctly Scottish flavour.

However the Granite City is not a contender for any potential new headquarters as its “renaissance” is mainly energy-focused rather than financial services, he said.

Mr Gilbert, who lives in Rubislaw Den, Aberdeen, told The Press and Journal the fast-growing firm’s future will most likely see it being run from Edinburgh and London.

SVM is a well-regarded fund management firm, with a recognised investment style and a very strong investment track record.”

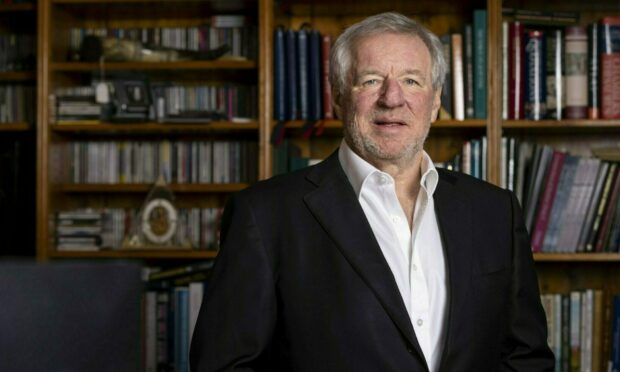

Martin Gilbert, chairman, AssetCo.

The firm he leads now boasts assets under management totalling £12.2 billion following a recent reverse takeover – worth nearly £99m – of US-based River and Mercantile (R&M) Group.

Mr Gilbert, co-founder and former chief executive of Aberdeen Asset Management, became deputy chairman of R&M in January 6 last year.

He is also chairman of fast-growing financial technology firm Revolut, and holds the same role at specialist investment company Toscafund, which owns 12.4% of AssetCo.

In addition, he is chairman of the Aberdeen-based Net Zero Technology Centre.

This morning we announced the proposed acquisition of SVM Asset Management. It is a highly regarded investment manager whose people and products will strengthen further our listed equity platform and our presence in Scotland. https://t.co/YivVtlgwko pic.twitter.com/GcsAqEgZzx

— AssetCo (@AssetCoplc) June 21, 2022

AssetCo was a provider of management and resources to the fire and emergency services in the Middle East before Mr Gilbert and other investors teamed up to acquire a 29.8% stake in the business at the start of last year.

Those other investors include deputy chairman Peter McKellar – the former global head of private markets at Aberdeen Standard Investments – who owns 3.1% of AssetCo.

Within a month of the financial big-hitters making their investment, the firm announced its intention to focus on becoming an asset and wealth business.

Acquisitions since then include Edinburgh firms Saracen Fund Managers, Revera Asset Management and now SVM.

We are pleased to announce that @AssetCoplc has conditionally agreed to acquire SVM Asset Management. This marks the next stage in the successful evolution of SVM and our fund management offering.

Full press release here: https://t.co/RghFUKctHw

Capital at risk pic.twitter.com/NN3pJLbEzE

— SVM Asset Management (@SVMAsset) June 21, 2022

AssetCo paid £2.75m in cash and shares for Saracen and then £2.8m – also in cash and shares – for Revera.

‘I’ve known Colin and Margaret for years’

Mr Gilbert, 66, said SVM – founded in 1990 by managing director Colin McLean and Margaret Lawson, the firm’s UK investment director – was a “very good fund manager” which he had “long admired”.

“I’ve known Colin and Margaret for years,” he said, adding AssetCo’s recent acquisition streak was likely over for now as the company focuses on integrating the R&M business.

The £10.7m initially agreed for SVM – £9m in convertible loan notes and £1.7m in cash – is subject to “balance sheet adjustments” on completion. The sale is conditional on Financial Conduct Authority approval but expected to cross the line in September.

“Hospitality was one of the things the world missed most during lockdown and people are ready, if offered first-rate service, to enjoy its benefits now.” My latest column for @pressjournal #aberdeen #aberdeenshire https://t.co/FvhHeZbdvs

— Martin Gilbert (@MartinGilbert83) May 27, 2022

SVM generated turnover of £4.3m and pre-tax profits of £2m in 2021. A restructuring of the business that is already under way is expected to leave it with net assets and cash reserves totalling about £8m.

Mr McLean will become a director of AssetCo’s Scottish business, with Ms Lawson continuing in her role managing UK equity portfolios.

All 21 employees will continue to be employed by SVM following the acquisition.

‘Immensely proud’

Mr Gilbert and Mr McKellar are among members of the AssetCo senior management team who will join SVM”s board.

“We are immensely proud to be building an asset management hub in Edinburgh that, over time, will broaden its client base across the UK and beyond,” Mr Gilbert said.

He added: “SVM is a well-regarded fund management firm, with a recognised investment style and a very strong investment track record.

“Its business model, people and product offering are its key assets, and it is core to AssetCo’s ambitions.”

Conversation