With investment creeping into brewing and pubs, Peter Ranscombe asks if there’s still money in craft beer or has the market gone flat?

Despite the massive switch to reading or watching news online, there are still moments when you can’t beat the impact of a front page headline in a newspaper – and a warning about paying £20 for a pint of beer falls squarely into that category.

Splashed across page one of a tabloid at the start of September, Tom Stainer, chief executive of the Campaign for Real Ale predicted the price of a pint would need to rise to between £15 and £20 for pubs to absorb all the increases associated with the cost-of-doing-business crisis.

Even with the UK Government subsequently promising a six-month energy price cap for firms, the rising cost of grain, labour and transportation is enough to make even the most seasoned brewer splutter into the foamy head of their ale.

Whisky twins invest in beer

Yet a string of recent investments across the north and north-east offers some hope for barflies that investors are still prepared to back the craft brewing sector.

One of the most noteable came in August from Urquhart Brothers.

The Moray-based investment company was set up by identical twins Richard and Stuart Urquhart – part of the family behind whisky firm Gordon & MacPhail – earlier this year.

Urquhart Bros took a stake in Speyside Brewery, in Forres, allowing founder Seb Jones to reopen the business he had founded in 2012, but which he had been forced to mothball due to the Covid pandemic lockdowns.

“It was a no-brainer really to bring it back to life, post-Covid,” explained Naidene Urquhart, one of the brewery’s new directors.

“We could tell that, with the correct investment, it was definitely going to be something we would like to bring back to the area.”

This is not a short-term investment. It is something we would like to stick at for a long time.”

Naidene Urquhart, director, Speyside Brewery.

Ms Urquhart is realistic about the energy crisis and its effect on inflation.

She said: “Of course, it’s a concern, but it’s not just in brewing. It’s a concern for all industries.

“This is not just a short-term investment – it is something we would like to stick at for a long time.

“Things tend to go round in circles, so even though things are not looking great now with the rising costs, I’m confident that within the next few years, hopefully, things will settle back down.”

Her comments were echoed by Mr Jones, who underlined the long-term outlook for the business.

He said: “One of the advantages with our new position is we can think much more long term; 15-year kind of timescales, rather than operating month-to-month, which a lot of breweries do.

“That’s one of the reasons why the industry itself is actually quite fragile.”

As well as Speyside Brewery, Urquhart Bros signalled its commitment to the sector earlier this year by investing in Quantock Brewery, in Somerset, one of the brewing partners for Edinburgh-based beer subscription service Flavourly.

Inspired by craft brewing revolution in US

While the Urquhart family is bringing a brewery back to life after a hiatus, Jon Erasmus is starting from scratch in Inverness.

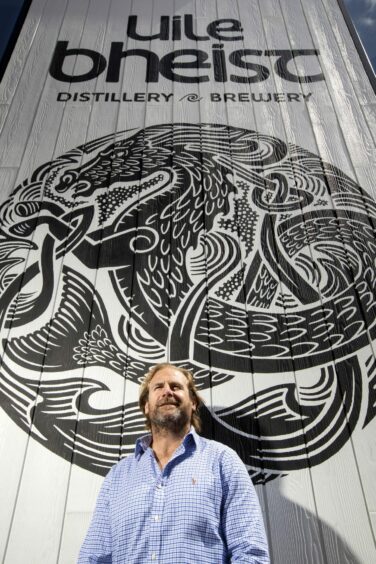

As reported in The Press and Journal in June, Mr Erasmus is building the first whisky distillery in the Highland capital for nearly 40 years with an integrated brewery to boot.

He was inspired by the craft brewing revival in the US during the 1990s, and the idea of having a brewery taproom, which could become a popular tourism attraction.

After an initial battle with Highland Council over his plans for a glass-fronted brewery at his Glen Mhor Hotel in the Highland capital, he gained planning consent in 2015.

Post-lockdown, those plans have now morphed into the £6 million Uilebheist Distillery and Brewery, which will be powered by a hydro-electric scheme on the River Ness.

As well as selling his beers at Glen Mhor Hotel, Mr Erasmus plans to supply his other businesses too.

He is co-owner of The Boat Country Inn and Restaurant in Boat of Garten, the Seaforth Inn, Ullapool, and MacKays Hotel in Pitlochry.

“My businesses are very much about tourism, and what we’re trying to do with our business in Inverness is create a showcase for tourists,” he said, adding: “It’s going to be a real visitor attraction.

We’re trying to stay true to the brew-stillery concept. One of the things we’re talking about is using a brewer’s yeast in the fermentation process for the whisky.”

Jon Erasmus, the driving force behind Uilebheist.

“Phase one of the project is putting together the brewery, distillery and 60-seater taproom.

“We’re trying to stay true to the ‘brew-stillery’ concept – one of the things we’re talking about doing is using a brewer’s yeast in the fermentation process for whisky.

“Phase two will be bringing on the bigger visitor experience side of it.

“With the hotel and brew-stillery, we’ll only be able to have about 150 people on site. Phase two will take that number up to 500-plus.”

It’s not just breweries that are attracting investment in the sector either.

Kenny Webster – owner of Isle of Skye Brewery, the Black Wolf Brewery at Throsk, near Stirling, and North Coast Brewery in Kinloss, which bought WooHa out of administration last year – recently took over historic Glasgow pub The Griffin.

“I’d been looking to buy a traditional pub for a while,” said Mr Webster, a former co-owner of Macduff-based soft drink firm Sangs.

He added: “It’s a good opportunity to step into this market.

“There are rising costs in our own business but we’ve got to work with what we’ve got.”

While the pub will operate under the Isle of Skye banner, Mr Webster plans to sell beers from his two other breweries at the bar, as well as guest ales from other producers.

Adam Hardie, head of food and drink at Aberdeen-based accountancy firm Johnston Carmichael, sounded a note of caution when it comes to valuations for investments.

Mr Hardie said: “The cessation of hospitality during Covid was very tough on beer, which is the main product offered by pubs.

“It is not going to get any easier amid soaring energy costs.

In the longer term, craft brewing remains an attractive sector but the days of frothy valuations are over.”

Adam Hardie, head of food and drink, Johnston Carmichael.

“Breweries and their owners are always looking for investment but it is a challenging time for the industry.

“At the moment, the main deal activity is consolidation amongst the bigger players.”

He added: “In the longer term, craft brewing remains an attractive sector but the days of frothy valuations are over.

“Investors will be more cautious and deals will be more conservative.”

Conversation