Families in property hotspots in Aberdeen and Aberdeenshire will be £140,000 better off following changes to inheritance tax (IHT) thresholds, a property and estate planning law specialist has said.

Married couples will be able to pass on assets worth up to £1million, including a family home, without paying any IHT at all from April 2017.

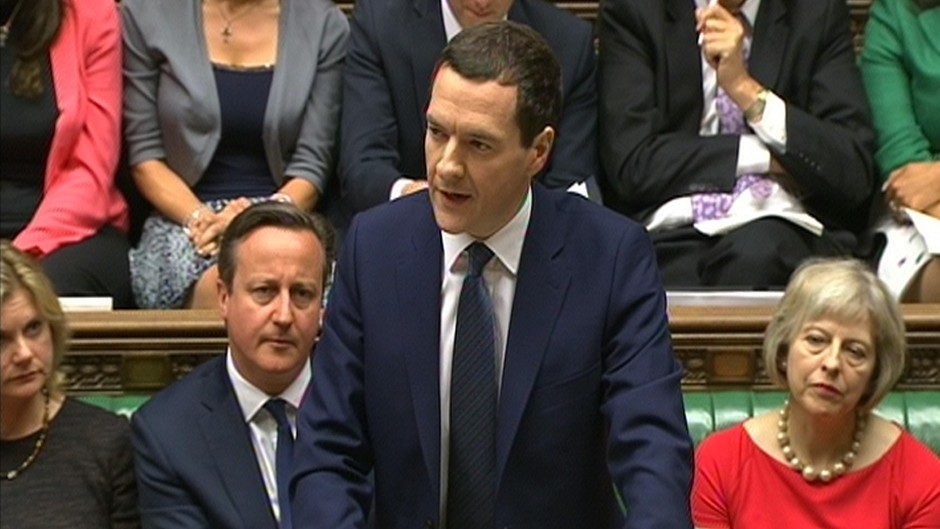

The changes, announced by Chancellor George Osborne as part of his summer budget, will mean that 94% of families will pay no tax at all.

Aberdein Considine estimates that those living in the west end of Aberdeen and the Royal Deeside corridor in Aberdeenshire stand to benefit most from the changes.

The regions are home to all ten of Scotland’s most expensive postcodes and the majority of the country’s £1million plus homes.

Thousands of property owners have seen the value of their homes soar in recent years, particularly in places like Cults, Kingswells, Bieldside and Milltimber.

This has raised concerns for many about the amount of tax their estate will incur after their death.

IHT is currently levied at a rate of 40% on the value of an estate above the tax-free threshold, which has been frozen at £325,000 per person since 2009. Married couples are entitled to double the allowance, passing on assets to their children or other relations worth up to £650,000 before a tax charge is triggered.

However, the Chancellor has now added a “family home allowance” worth £175,000 per person to the existing £325,000 tax free allowance from April 6, 2017.

Bob Fraser, a Senior Partner at Aberdein Considine said the region is likely to benefit most from the changes.

“Property prices in the west end and Deeside have been rising quite sharply for a number of years now,” he said.

The Budget also included measure for anyone looking to downsize to a smaller property – offering them an “inheritance tax credit” so that even if they sell an expensive property they will still qualify for the new threshold.

The inheritance tax policy will be funded by limiting the amount of tax relief on pension contributions given to those earning more than £150,000 a year.

This is an attempt to encourage pensioners to free up larger properties for growing families.