A rapid return to pre-pandemic levels of economic growth in Scotland is at risk, a survey has found.

Reporting “increased concerns” in the Scottish economy, the latest Scottish Chambers of Commerce (SCC) Quarterly Economic Indicator Survey said businesses were worried over rising costs, recruitment challenges and the return of Covid-19 restrictions.

Key findings from the Q4 report, published in partnership with Strathclyde University’s Fraser of Allander Institute (FoA), found surging inflation to be a huge problem.

With inflation rising to 5.1%, its highest rate in 10 years, businesses across all sectors noted concerns, reaching record highs.

There was a 17% increase in the number of firms in the financial and business services (FBS) sector reporting concerns about rising costs, compared with Q3.

There was also declining profitability, with businesses reporting negative net balances for both cashflow and profits – both of which are down on Q3.

The manufacturing, retail and tourism sectors all experienced a decrease, which firms blamed on the difficult trading environment and the increased costs of doing business.

Scottish Chambers of Commerce president Stephen Leckie warned business confidence remains “highly volatile”, with a strong return to economic growth now at risk.

He said: “This latest survey shows the white heat of business activity that followed the lifting of restrictions in the summer months is now starting to cool.

“Business confidence continued to rise in the past quarter, however, this remains highly volatile as the Omicron variant triggered the return of Covid-19 restrictions, plunging Scotland’s businesses back into a spate of economic limitations and curtailments.

“The continued strong return to economic growth many businesses might have expected in the next quarter is now clearly at risk and the recovery could take longer than hoped for, due to continued uncertainty over what economic deterrents are likely to remain in place and for how long.”

North-east wages cause for concern

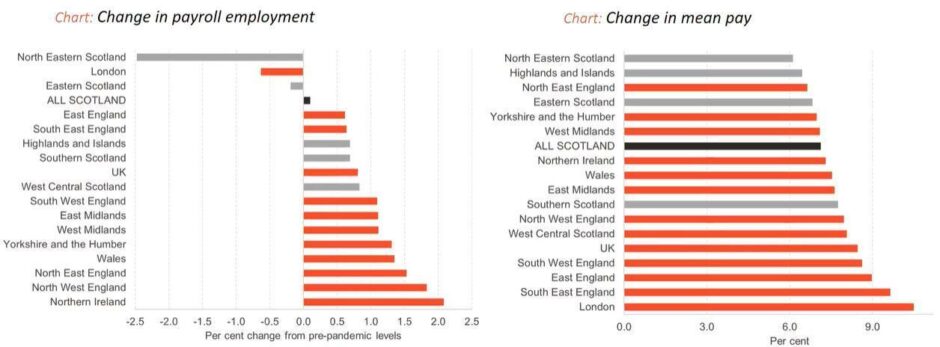

FoA director Mairi Spowage highlighted the impact on employment and wages in the north-east as a “particular concern”.

Experimental results from the Office of National Statistics show there has been a 2.5% drop in payroll employment for the north-east from pre-pandemic levels.

The region has also seen the lowest increase in mean pay, compared to the rest of the UK.

Ms Spowage said: “Despite growth faltering in the autumn due to rising prices and supply chain constraints, expectations are still much better for the outlook in 2022 and beyond, compared to what was feared earlier in the pandemic.

“The removal of the furlough scheme, based on the evidence we have seen to date, has not had the negative impact on employment and unemployment that was feared.”

But she added: “What is emerging are early signs that Scotland’s recovery may be lagging behind the UK as a whole.

“The impact on employment and wages in the north-east stands out as a particular concern, given the importance of high wage oil and gas jobs in that region.

“What is clear is that we are not past the point where government support for various sectors is likely to be required in order to reduce long-term scarring on the economy.”

Export growth weak

Ongoing issues in the domestic and global supply chain continue to impact on Scottish export sales and orders, the report says.

All sectors reported marginal improvements in the past quarter.

But overall export growth remains weak, with the impact of Brexit continuing to lead to delays, certification challenges and increased shipping costs – all of which are intensified by the wider impact of Covid-19, SCC says.

Mr Leckie added: “Exports remain frustratingly lacklustre which is a concern, given exports remain a crucial part of a sustained economic recovery and internationalisation of Scotland’s economy.

“Alongside the removal of Covid-19 restrictions, businesses are looking towards the UK Government’s new free trade agreements, continued negotiations to remove barriers to exporting and the possibility of more routes to new markets.”

Increased recruitment difficulties

Concerns were also raised about sectors including construction, FBS and retail starting to experience increased recruitment difficulties and labour shortages.

Rising business costs were also highlighted in the report. Concern over raw material prices and other overhead costs remain “notably high” for construction firms.

In the manufacturing sector, 92% of firms reported increased concern over raw material prices which is a record high for the survey.

Mr Leckie said: “Many businesses have had a tough winter and the rising cost of doing business is now also dragging on growth, with increasing cost pressures for raw materials and goods driving down profitability.”