A man has appeared in court charged with defrauding hundreds of investors out of £13 million through an illegal “Ponzi” scheme.

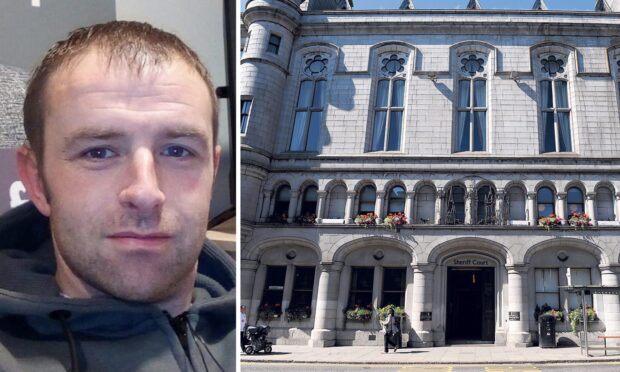

Alistair Greig, 65, is also accused of moving £5.8 million of stolen money out of the United Kingdom contrary to the Proceeds of Crime Act 2002.

The prosecution alleges that investors – most of whom were resident in Scotland and in the Aberdeen area in particular – were offered the opportunity to receive high guaranteed interest rates on short-term deposits.

When the deposit reached maturity, the investors were promised they would receive or be credited with interest.

But The Crown claims that in reality the interest that was paid, and any capital returned, was not the product of successful investment but came from funds put in by other participants in the scheme.

At the High Court at Livingston yesterday, prosecutors alleged that Greig operated the scheme for almost 13 years, between August 30, 2001 and August 19, 2014.

The main vehicle for his alleged criminal activity is said to have been a business called Midas Financial Solutions (Scotland) Limited.

The financial advice service was based in Aberdeen is said to have continued a scheme Greig operated when he previously worked for a firm known as Park Row Associates Ltd.

The criminal charges were brought following a raid on MFSS’s offices by the Financial Conduct Agency (FCA) and the police after a whistleblower provided information to the authorities in August 2014.

Greig is alleged to have obtained a total of £12.982,789.23 from the investors under false pretences.

He is also alleged to have accepted deposits without being an authorised or an exempt person under the Financial Services and Markets Act 2000.

Greig, who currently lives in Boston, Lincolnshire, is charged with forming the allegedly fraudulent scheme at business addresses in Aberdeen, residential addresses in Ellon, Aberdeenshire, and elsewhere in the UK.

The prosecution claims he contacted potential investors and pretended that he would invest their money in high interest accounts with the Royal Bank of Scotland, promising that the returns on their capital and interest payments were “guaranteed”.

The Crown alleges that the RBS had no such high interest accounts at the time and the return of the investors’ cash was not in fact guaranteed.

In truth, the charge states, the money returned to investors was not interest made on the deposits but sums of money deposited in the scheme by other investors.

The Crown also states that neither he nor the investment scheme were authorised by the Financial Services Authority (FSA) or its successor the Financial Conduct Authority (FCA) to accept or hold deposits although he claimed they were.

Greig denies all the charges and is due to stand trial at the High Court in Edinburgh in February 2020.

Notorious Madoff operation saw US depositors cheated of billions

The Ponzi scheme exploits its investors to give the illusion of earning profits as they are instead fleeced for huge sums.

It works by using the money paid in by new investors to provide payouts to the operator and any earlier investors.

The schemes are named after Boston businessman Charles Ponzi, who became notorious after using the technique in the 1920s.

He made the attractive promise of 50% returns on investments in just 90 days.

To avoid having too many investors reclaim their “profits,” the schemes encourage them to stay in the game and earn even more money.

Former US stockbroker Bernard Madoff was responsible for one of the most infamous Ponzi schemes.

He used his previous good name to lure investors in by guaranteeing unusually high returns.

With losses estimated to be between $50 billion and $65bn, his was the largest investor fraud in US history. He was jailed in 2009 and remains in federal prison, now aged 81.