INDEPENDENT FINANCIAL ADVICE ON MONEY MATTERS AROUND THE HIGHLANDS, ISLANDS & MORAY

There are many investors who believe that the efficiency of markets – how quickly and fully all known information about a specific security is reflected in its price – is the main driver of how easy or difficult it is for judgemental (active) managers to beat the market.

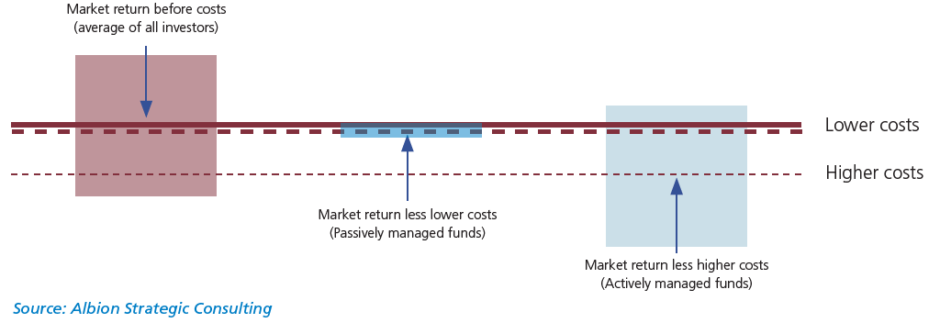

However, that is to miss a very important, yet simple concept: trading in the markets – to beat them or to replicate their return – is what is known in game theory as a zero-sum game. The return of the market is the average return of all investors before any costs have been deducted.

Financial advisor James Sinclair, of Achieve Financial Planning Ltd. says: “In real life, the returns achieved by investors need to consider the costs of transacting in the market, making trading a less-than-zero-sum game.”

Some investors may have done well and others badly.

The gains of the winners must be funded by the losses of the losers. In real life, the returns achieved by investors need to consider the costs of transacting in the market, making trading a less-than-zero-sum game.

It is also important to note that, on average, passively managed (systematic) funds tend to have materially lower costs than actively managed (judgemental) funds, both in terms of the direct cost of paying the fund managers their fee and the indirect costs associated with trading the underlying portfolios (buying and selling shares) that the manager incurs. The figure below illustrates the concept of the zero-sum-game-less-costs.

The simple maths of the less-than-zero-sum-game-after-costs therefore results in the inevitable truth that the average investor in lower cost (usually passive/systematic) funds will beat most investors invested in higher cost (active/judgemental) funds. That is a galling conclusion for the clever and hardworking active fund management community.

Costs really do matter. While the zero-sum game underpins the argument that a low-cost passive approach is likely to be an effective means to invest money, compared to a higher cost approach, market efficiency makes the task harder for active managers.

The basic premise is that prices reflect all publicly available information accurately and quickly and that in a free market the price represents the fairest assessment of value at any point in time, until the arrival of new public information. Its implications are immense; if it holds, then it will be particularly difficult, after costs, to make returns greater than the market without taking more risk than the market.

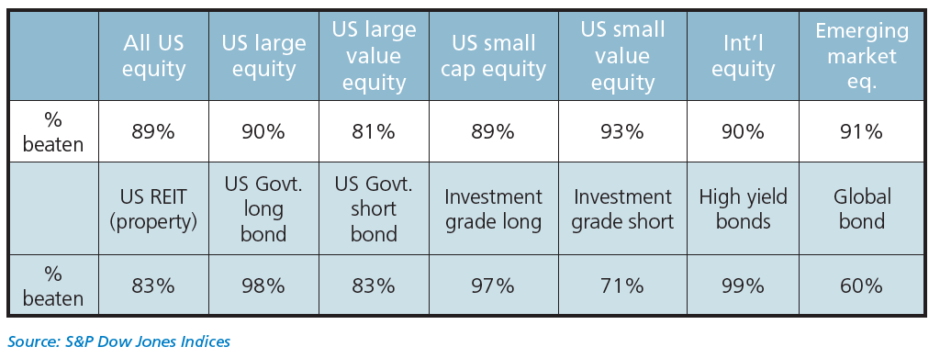

Indeed even in less-efficient markets such as smaller company, emerging markets and real estate the failure of the majority of active funds to beat the markets illustrates that after transaction costs which are significantly higher, any pricing anomalies cannot be exploited profitably as the table shows: US active funds beaten by their benchmarks – 15 years to year end 2019

Most investors will find that a passive investment approach will serve them well.

Next month’s topic is on At Retirement & Beyond

Contact your local Independent Financial Advisers for a no obligation initial discussion – Click to visit their website: