INDEPENDENT FINANCIAL ADVICE ON MONEY MATTERS AROUND THE HIGHLANDS, ISLANDS & MORAY

Taking on a new build can be an exciting challenge! It can also be adaunting prospect for some, particularly when you want to achieve a high environmental standard, so you need to be sure it’s for you. Finding the right people to work with, architects, builders and solicitors, is sometimes a challenge. Therefore, you will want to carry out some research, meet up with various builders and architects and ensure that you can establish a good rapport.

Building your own home, exactly the way you want it, is a dream to most people. However, before you get carried away with your dreams the first thing you need to do is to is work out how to finance the build.

It’s important that you have a clear idea of how much you can afford to borrow, and lenders are keen to ensure that you don’t overstretch yourself. For instance, the novelty of living in a caravan on-site soon wears off if the project slows down due to stretched finances! This can also lead to unnecessary stress for you and your builder, if you run out of funds halfway through the build. It is vital to obtain more than one quote as building prices can vary from one builder to the next.

Getting your finances in order is an important starting point for your self build project. If you need to borrow money, then finding the right mortgage for your build is crucial to ensuring the success of the project. Individual lenders have their own affordability assessments and what may be affordable with one lender, may not be with another. This is where an Independent Mortgage Broker can assist you, by carrying out a thorough assessment of your finances, to ensure that the build goes smoothly. This needs to be discussed and mortgage funding arranged, in advance of your build, even if you do not require funding until a later stage.

Self build mortgages are arranged on a stage release basis as the new house is completed, up to a certain Loan to Value (LTV) commonly 75% of the total overall cost. Common stages are plot purchase, foundations, wind and water tight and completion. It is crucial that you have some capital behind you, as builders will often look for payment of the kit upfront. Ensuring you are aware of when payments are due to the builder is an imperative part of the planning.

An Independent Mortgage Broker will assist you with the process from start to finish and is an important place to start.

Moira Ness CertPFS is a Director of East2West Financial Services a trading name of Fairstone Financial Management Ltd. Fairstone Financial Management Ltd is authorised and regulated by the Financial Conduct Authority.

Get Expert Help

Moira Ness CertPFS is a Director of East2West Financial Services a trading name of Fairstone Financial Management Ltd. Fairstone Financial Management Ltd is authorised and regulated by the Financial Conduct Authority.

visit East2West Financial Services website

DID YOU KNOW?

What type of Fixed Interest Investments do you have in your portfolio?

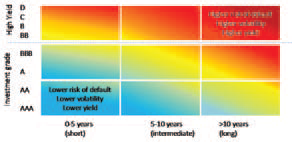

The astute investor understands that owning Fixed Interest Investments is an insurance policy if you do not have the stomach or financial capacity to suffer equity-like losses. The idea is that you are diversifying away from highly volatile investments in order to temper your losses when the equity markets fall.

The astute investor understands that owning Fixed Interest Investments is an insurance policy if you do not have the stomach or financial capacity to suffer equity-like losses. The idea is that you are diversifying away from highly volatile investments in order to temper your losses when the equity markets fall.

Many investors will however be unknowingly holding Fixed Interest Investments that may actually act in a similar fashion to equity investments and may therefore not provide the hoped-for reduction in volatility.

It is therefore vital to check your holdings to ensure that your Fixed Interest Investments are in line with your needs should a stock market crash happen.

FIXED INTEREST CHOICES RANGE FROM CASH-LIKE TO EQUITY-LIKE

An Independent Financial Adviser will be able to analyse your existing portfolio

James Sinclair FPFS is a Chartered Financial Planner at Achieve Financial Planning Ltd, which is authorised and regulated by the Financial Conduct Authority.

visit Achieve Financial Planning’s website

Next month’s topic is on Life Planning & Goals

Your Local to Highlands, Islands and Moray Contributors – Click to visit their website.