A tax on North Sea oil and gas companies has “backfired” after it emerged receipts were lower than expected.

The UK Treasury “got everything about this tax wrong – including its sums”, after it emerged the windfall tax on North Sea producers raised nearly 25% less than expected. last month.

Figures from the Office for Budget Responsibility (OBR) come amid stark warnings of the impacts of the tax on the sector, or energy profits levy (EPL), with largest producer Harbour Energy culling jobs.

Director of policy and marketing at Aberdeen and Grampian Chamber of Commerce Ryan Crighton said the plan to raise extra cash on the back of eyewatering profits made by oil and companies last year was putting investment in greener energy at risk.

He said: “The Chancellor has ignored repeated warnings from some of the North Sea’s most experienced figures that a 75% tax rate will force them to invest elsewhere.

“Increasingly this is coming home to roost. And he has also failed to extend the Investment Allowance to low carbon technologies like hydrogen and offshore wind farms, a move which could have turbo-charged the energy transition here.

“We should be using these higher energy profits as our deposit on a greener, cleaner future. Instead, the Chancellor has chosen to take a blind gamble with a sector that supports over 200,000 UK jobs.

“It has backfired. He must now change course.”

Tax raised disappointment

Cash receipts in December were £600m, 24.5% “below profile”, according to the OBR.

This was the first instalment of EPL payments on profits for the 2022 financial year, with the second and final due in January.

The OBR said the shortfall could “reflect the volatility in oil and gas prices resulting in lower EPL liabilities than our forecast assumed”.

Meanwhile, a North Sea expert has warned hundreds of oil and gas discoveries could be abandoned.

Professor Alex Kemp of Aberdeen University said there is currently are “over 300” offshore finds that are not yet “under serious examination for development”.

Most of the unexplored discoveries are “relatively small”, meaning it is unlikely firms will take the risk of investing in them for limited reward, according to the leading petro-economist.

North Sea still has ‘large volume’ of resources

Uncertainties around commodity prices and the energy profits levy make it even more improbable companies will explore potential reserves.

International benchmark Brent crude oil slumped to below £65 ($80) in December, a return to a level before Russia’s invasion of Ukraine, while European gas prices also slumped during the month to pre-Ukraine levels.

Hopes for coming month

The OBR said in November it expects the tax man to raise £20.7bn from the oil and gas industry in 2023-24, with just over half of that from the windfall tax.

The watchdog said this would represent an “all-time high” for receipts for the sector.

Harbour Energy, the UK’s largest producer and investor in two carbon capture clusters in Britain, said it intends to cut jobs in Aberdeen – understood to number in the hundreds – with the windfall tax the main driver.

Another independent, EnQuest, said the North Sea is no longer its major area for growth.

The levy means a headline tax rate of 75% for the sector, with the windfall tax accounting for 35% of that.

Mr Crighton added the sector was still on the hook for significant taxes.

He said. “Do not let these numbers make you think the oil and gas sector has gotten away lightly here – operators are paying nearly £70million per day under the current regime, an unsustainable tax burden which is making the North Sea increasingly uncompetitive.”

Trade body Offshore Energies UK warned in November that it risked “driving out investment” from Britain, which would see the country import more oil and gas from overseas with higher emissions and without the associated economic benefits.

Professor Kemp said: “We have looked at the windfall profits tax and we think it will adversely affect investment decisions, both for exploration and for development, particularly of relatively small fields. Unfortunately, a lot of them are already there, but not yet developed.”

Uncertainty rife

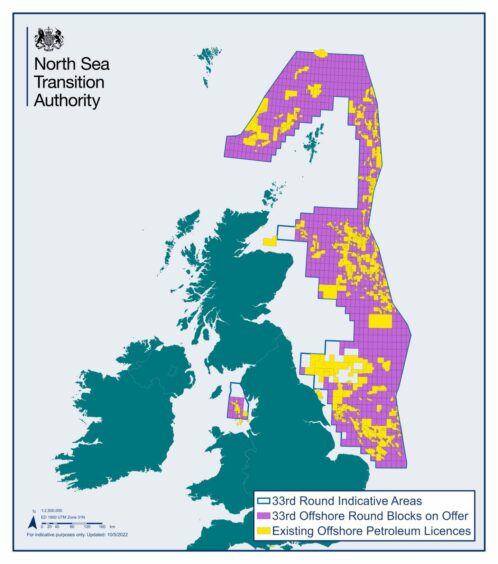

Such doubt, particularly around tax, could also impact any fields uncovered as part of the 33rd North Sea exploration licensing round.

The UK Government doubled down on its energy profits levy in November, increasing it by 10%, extending its runtime and removing a clause linking it to the oil price.

When combined with other taxes on the sector, the changes mean oil and gas companies will pay 75% on their profits until at least 2028, even if another downturn hits.

An investment allowance has been included to incentivise spending, but Professor Kemp says “not every company is in that situation”, while some new entrants don’t pay enough tax for it to make a difference.

Fears being realised

Fears that companies would negatively respond to the fiscal changes have already materialised.

TotalEnergies is cutting its North Sea spend, while Harbour Energy shunned the North Sea Transition Authority’s (NSTA) latest licensing round, as well as announcing job cuts.

Professor Kemp believes the impacts of the tax will continue to seep through, particularly given there’s good deal of trepidation it may be extended beyond 2028.

“With the windfall tax as well, our modelling is suggesting smaller fields may not be possible economically and that the levy is having a negative effect. This would work its way through to decisions on whether to apply for licences.

“When it comes to the field development plans, investors will use long-term projection of prices that will be much lower that what we’ve seen over the last year or so.

“Putting all that together, the investment outlook is very mixed. The risks are quite high because of the big oil and gas price uncertainty, the fact costs are rising in general and because of the windfall tax. There is much uncertainty.”