Pension Awareness Day 2022 (15th September) is just around the corner, but the UK is facing a serious problem in that not enough people are saving for their pension’s future. In the face of the recent cost of living crisis, should people continue to be encouraged to put away money for a rainy day, when it seems like the rainy day is here already?

The simple answer is yes. It is more important than ever to think about the long-term and to protect yourself financially for the future. Time flies, and while you may be young now, you will one day be glad that you safeguarded your wealth for your retirement.

-

Some Press and Journal online content is funded by outside parties. The revenue from this helps to sustain our independent news gathering. You will always know if you are reading paid-for material as it will be clearly labelled as “Partnership” on the site and on social media channels.

This can take two different forms.

“Presented by”

This means the content has been paid for and produced by the named advertiser.

“In partnership with”

This means the content has been paid for and approved by the named advertiser but written and edited by our own commercial content team.

Remember, not all of the measures needed to protect your pension requires additional financial commitment. There are plenty of easy, non-costly steps you can take to make the later years of your life as comfortable as possible and bring better outcomes for you and your loved ones in the long run.

Here are 6 things you can do to protect your pension this Pension Awareness Day.

-

1. Enrol in a pension scheme

Since 2012, employers must contribute a minimum of 3% of earnings to workplace pensions, so join up and stay enrolled. If you want to save more than the minimum, many businesses offer extra ‘matched contributions’ on top. For businesses, pension benefits offered to staff has become a core part of recruiting and retaining staff.

-

2. Check your National Insurance record

Modern workforces work more flexibly, take career breaks, go self-employed, etc., so it’s easy to accrue ‘missing years’ of qualifying National Insurance (NI) contributions. You’ll need 35 years of NI for a full State Pension under rules introduced in 2016, so take time to check your NI record every few years by getting a Pension Forecast at https://www.gov.uk/check-state-pension. You may be able to top-up contributions; if so, it’s likely to be a good investment.

-

3. Keep on top of admin

Changed jobs a few times, or not kept track of your pensions over the years? A pension adviser can help collate an overall picture for you. There’s around £20 billion of unclaimed UK pension pots already(1) – don’t let your savings add to that. Have you made a death benefit nomination on them all? In 2018, Royal London estimated that around 750,000 pension investors in the UK could end up with their pension pot being distributed on death in a way they don’t want.

-

4. Don’t wait to get advice

Discussing personal finances is a sensitive topic, and one that most people tend to avoid. In 2020, the Money and Pensions Service suggested around 29 million people don’t feel comfortable talking about money, despite almost half of them admitting they regularly worried about it(2). Whether you’re changing job roles, facing a change of marital status, inheriting money, or thinking about the next generation, a review of your pension arrangements is a ‘must-do’.

-

5. Stay invested no matter what

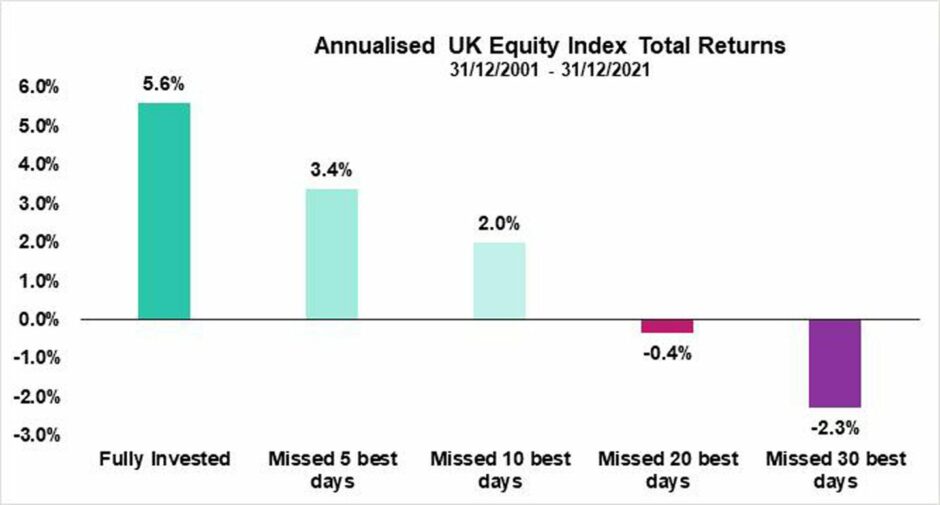

In 2022, we’ve had the crisis in Ukraine, global market volatility, soaring inflation and rising interest rates. 7IM believe that the best pension strategy is to stay disciplined and stay invested. A pension should be seen as a very long-term plan. Disinvesting to cash because of short-term market volatility can result in significant long-term losses. 7IM research shows that those who remain invested typically do better than those who try to cash out when volatility strikes. That’s because the best days in the market often closely follow the worst days. Indeed, 21 of the 30 best days came within two weeks of one of the 30 worst days. As the adage goes, what matters is ‘time in the market, not timing the market’.

-

6. Approaching retirement? Get to work now

Average life expectancy in the UK is currently 81.65 years and set to climb to 85.48 years by 2050 (4). It is likely you’ll need your pension savings to keep working hard for you for many years after retiring – and cash just won’t cut it. However, simply setting your strategy and leaving it untouched is not a sensible idea either. Your goals might have changed and the risk you are taking with your pension investments may no longer be appropriate. Work with a financial planner that uses financial modelling to ‘stress-test’ your options.

Overall, the key is staying flexible. Everyone’s circumstances are different, and can change suddenly. When they do, it’s important to consult an agile financial planning partner, who can adapt to help meet your needs, and keep things on track, particularly for those nearing or already in retirement.

Don’t forget to act this Pension Awareness Day. To learn more about 7IM and to speak with them about your financial planning needs, visit their website, or contact them at andy.bolden@7im.co.uk, elaine.mclachlan@7im.co.uk. You can also call them at 0131 297 3767.

The value of investments can go down as well as up and you could get back less than you invested. Past performance is not a guide to future returns. Investment in funds will not be suitable for everybody and you should make yourself aware of the risks before investing and if you are unsure, you should seek professional advice.

Tax rules are subject to change and taxation will vary depending on individual circumstances.

Seven Investment Management LLP is authorised and regulated by the Financial Conduct Authority.

(1) Source: Association of British Insurers (ABI) May 2020,

(2) Source: https://www.ftadviser.com/pensions/2018/02/26/more-than-750-000-people-may-pass-pension-to-wrong-person/

(3) Source: Money & Pensions Service

(4) Source: United Nations – World Population Prospects

Andy Bolden, Financial Planning Director, 7IM

Andy joined 7IM in 2021, bringing with him over 30 years of experience in advising clients on their financial planning and helping them achieve their goals. He is passionate about delivering quality solutions for clients, helping them to understand their key financial objectives, and providing advice while working collaboratively with their professional and legal advisers.

Elaine McLachlan, Private Client Director, 7IM

Elaine joined 7IM in 2021 and brought over 30 years of investment experience. Having started her career in fund management, Elaine has spent the past 20 years building relationships with a wide variety of private clients as their trusted adviser to help them achieve their financial goals.