Private businesses in Scotland faced record rises in both the costs they paid and the prices they charged customers in March – but business activity driven by optimism was “strong”, a new report has found.

Supply bottlenecks, material scarcity, rising energy and fuel prices and Russia’s invasion of Ukraine led to record increases in both input costs and output prices, according to the latest Royal Bank of Scotland PMI.

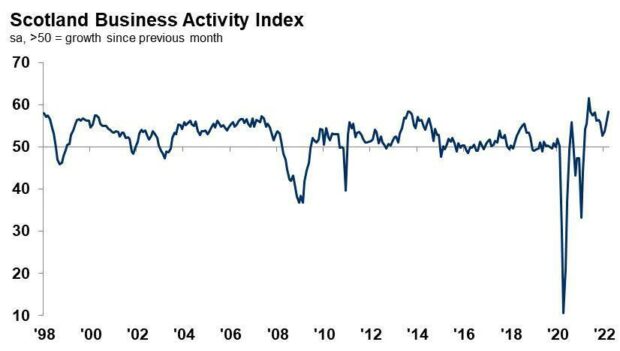

Nevertheless, the report’s seasonally adjusted headline business activity index showed a sharp increase in business activity for the service sector, driven by “greater optimism amid the easing of pandemic restrictions”.

However the data revealed a differing trend for manufacturers which reported a fall in output for the third time in four months.

Workforce numbers across the private sector also grew, according to the report.

Optimism

Scottish private sector firms indicated a further acceleration of new business in March, extending the current sequence of expansion to a year.

The latest uplift in new orders – driven “exclusively” by the services sector – was the sharpest in four months, the bank said.

Optimism towards the coming year remained strong in March across Scotland and registered above the long-run survey average.

However, sentiment weakened since February and was softer in Scotland compared to the UK as a whole.

Employee numbers rise

Scotland’s private sector registered a twelfth straight monthly rise in workforce numbers during March.

Staffing levels increased amid growing workload pressures and in preparation for a rise in business requirements in the months ahead, according to surveyed firms.

However, the rate of job creation slowed from February’s three month high and was weaker than that recorded for the UK as a whole.

The index measuring outstanding business indicated a further rise in unfinished business across the Scottish private sector.

Anecdotal evidence indicated that challenges in recruiting additional staff, combined with rising new orders, led to increased pressure on capacities. That said, the rate of backlog accumulation weakened slightly.

Cost rise steeply

Cost pressures faced by Scottish private sector companies remained steep in March, with the overall rate of input price inflation reaching a fresh record high.

By sector, manufacturers reported a quicker increase than services firms.

Respondents highlighted a variety of contributing factors such as increased material and energy prices, ongoing shortages, Brexit and the invasion of Ukraine.

However, the rate of input price inflation in Scotland did register marginally slower in comparison to the UK average.

… and prices businesses charge rise, too

Private sector companies in Scotland reported a seventeenth monthly rise in output charges in March.

In fact, the respective seasonally adjusted index hit a survey high and signalled a sharp increase in selling prices.

According to panellists, output charges were raised in line with higher input costs.

Overall, the rate of inflation registered broadly in line with that recorded for the UK as a whole.

Malcolm Buchanan, chair of the Scotland board of Royal Bank of Scotland, said the report revealed a “continued improvement across the Scottish private sector” although “substantial inflationary pressures persisted”.

He said: “The ongoing pandemic recovery and the resulting boost to client confidence supported activity and demand conditions.”

Growth was stronger for services sector businesses, while the manufacturing sector experienced a “slight contraction” – but both were affected by spiralling costs.

“Despite strong growth overall, supply-side issues and substantial inflationary pressures persisted, with the impact most noticeable across the manufacturing sector,” he said.

“However, services firms saw a record surge in costs in March amid soaring energy and fuel prices, which firms continued to pass on to clients.

“Given the current state of play with regards to inflation, the downside risks to the demand-side of the economy have intensified.

“But it was encouraging to see strong business sentiment, with firms optimistic for growth opportunities if the Covid-19 recovery continues.”

The seasonally adjusted headline Royal Bank of Scotland business activity index posted 58.4 in March, rising from February’s 55.5 and signalling the fastest expansion in nine months.