The new UK tax year starts on April 6, meaning when the clock strikes midnight on April 5 you lose any unused allowances from the previous 12 months.

You can use your allowances at any time during the financial tax year but if you haven’t yet done this in 2021-22, here are some key points to consider.

Individual savings account (Isa)

Isas are savings accounts – for up to £20,000 per tax year – in a “tax wrapper’” because there is no tax payable on interest or investment gains.

They can be used to save cash, invest in stocks and shares, pay whole allowances or a combination of both.

But it is important to remember any unused Isa allowances cannot be carried forward, so use them or you will lose them.

Junior individual savings account (Jisa)

Junior Isas allow parents, friends and family to save and invest on behalf of a child, with a £9,000 limit for the current tax year. As with Isas, you cannot carry forward any unused Jisa allowances.

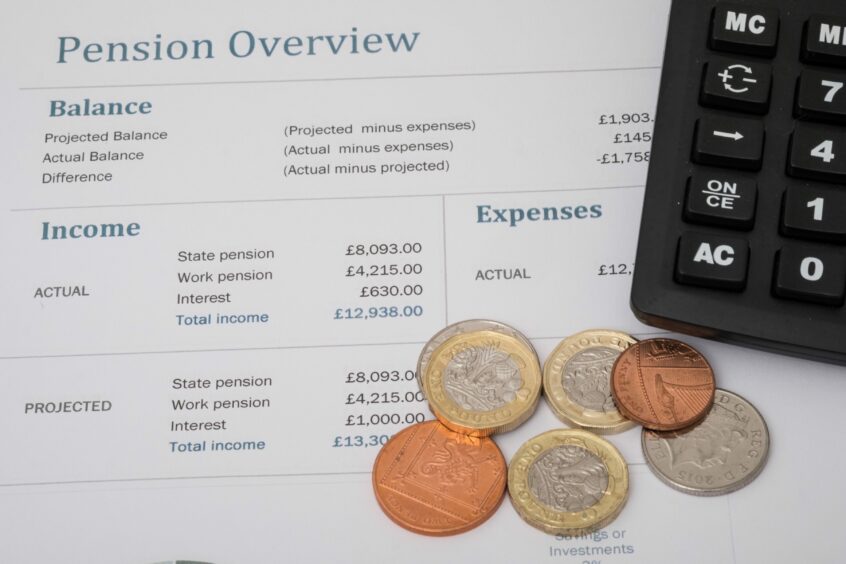

Pensions

The amount you pay into a pension and benefit from tax relief is based on your earnings and how much tax you pay.

The general rule is that you can contribute up to 100% of your earnings, with tax relief applying on contributions of up to £40,000 per tax year.

When calculating your pension input, include any contributions made in the tax year, such as gross personal and employer pension contributions, and third-party costs.

Unlike Isas, you can carry forward any unused pension allowances from three previous tax years.

You can contribute to a pension even if you don’t pay tax or have any earnings.

The annual pension contribution limit for non-earners is £3,600 gross, or £2,880 net.

For high-income individuals the annual allowance of £40,000 is tapered, limiting the amount of tax relief that can be claimed – reducing the annual allowance to as low as £4,000.

Don’t be caught out by the tapered annual allowance. Do your research, or discuss it with your accountant or financial planner.

Dividends

For the 2021-22 tax year, the first £2,000 you receive in dividends is tax-free. But after that, you’ll be taxed according to your income tax band.

Dividend tax will increase by 1.25% from April 6, so now could be the time to make some changes to how you manage your company shares or investment portfolio.

Gifting

You have a £3,000 per person annual “gift allowance”, which means you can give away assets or cash without it being added to the value of your estate for inheritance tax purposes.

Any part of the annual exemption not used in any tax year can be carried forward to the next.

A retirement cloud on the horizon – the Finance Act 2021-22

Keep a record of what you gift to family and friends. This makes it easier for the executor of your estate to work out during probate what parts of your estate are tax liable.

And don’t leave your tax year-end planning to the last minute. You may still lose unused allowances if the funds aren’t received before the deadlines imposed by your investment or pension provider.

Jane Cowie is a financial planner with Aberdeen-based Acumen Financial Planning.

At least 220,000 women will have died waiting for compensation for state pension bungle

Sunak’s tax cut and some post-Budget advice for struggling Scots