Small businesses welcomed a smattering of tax breaks and a boost to lending but bigger firms were handed some tough punishment by the chancellor yesterday.

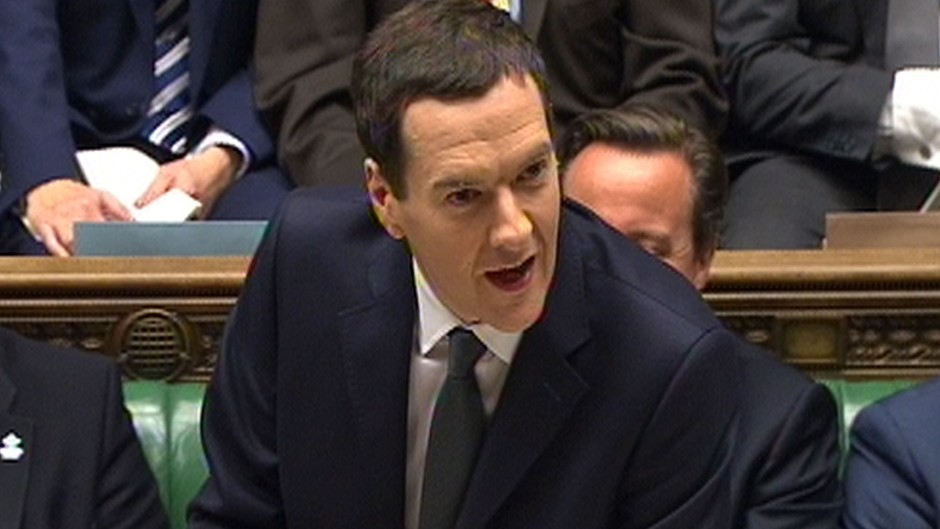

Changes to rules on bank profit offsets will raise almost £4billion for George Osborne’s Treasury. A 25% tax on profits generated by multinationals from economic activity in the UK – dubbed the “Google tax” because the arrangement is widely used by technology firms – is set to raise over £1billion over the next five years.

A package to boost bank lending to small and medium-sized businesses (SMEs) was welcomed in Scotland.

The Treasury has pledged £400million to extend government-backed venture capital funds which invest in SMEs, called Enterprise Capital Funds.

It also said it would guarantee up to £500million of new bank lending to SMEs.

Both schemes will be administered by the British Business Bank, which was set up by Vince Cable last year.

David Watt, Executive Director of the Institute of Directors Scotland said:

“For Scotland with its higher proportion of SMEs and family businesses, the announcement of almost £1 billion to boost start-ups and SMEs businesses is welcome. It is the right move for the future as today’s SMEs are tomorrow’s big businesses. However, we need to see how the support will actually reach the SMEs that are so vital to the growth of our economy.”

R&D tax credit increased for small firms to 230% and for large firms to 11%.

Liam Smyth, membership director at Aberdeen & Grampian Chamber of Commerce (AGCC), said:

“Business benefits from assistance with research and development as innovative businesses grow faster and create new jobs, products and markets. The Chancellor’s announcement that he is increasing the SME rate to 230% as well as streamlining the application process will be particularly welcomed in Scotland, with Aberdeen consistently in the list of top five cities for patents granted.”

But many business organisations were envious that Westminster pledged a “structural review” of business rates, which only affects England and Wales.

Andy Willox, the Federation of Small Businesses’ (FSB) Scottish policy convenor, said: “The FSB in Scotland and across the UK continues to press for reform of the business rates system to make our property tax system fit for the commercial realities of the 21st century.

“The Scottish Government’s landmark Small Business Bonus scheme continues to give Scottish firms an advantage. But the system north of the border is as archaic as it is elsewhere in the UK. The Scottish Government should commit to a parallel review, with nothing ruled out of bounds.”

The government will abolish Employer National Insurance Contributions for apprentices aged under 25 in an effort to boost skills and youth employment.

Policy relating to support for apprenticeships generally is devolved to the Scottish Government, but national insurance is not. It is thought employers of around 31,000 apprentices in Scotland could benefit.

Mr Smyth said: “Addressing the skills shortages by investing in our young workforce is vital for success so the abolition of employers’ National Insurance contributions to the upper earnings limit for apprentices aged under 25 will be a popular incentive for our members.”

Others offered ideas for the £213 million funding boost due to Scotland in Barnett consequentials, with some looking jealously at the £15billion pledged for roads projects in England by 2021.

Liz Cameron, Director and Chief Executive of Scottish Chamber of Commerce

“We welcome the additional £213 million that this Autumn Statement will deliver to the Scottish Government’s own budget. With regard to capital spending, we would like to see the UK Government’s ambitious long term strategy for spending on repairing and improving roads to be implemented by the Scottish Government here in Scotland. We have numerous transport bottlenecks in urgent need of allocated funding, including the A9 Berriedale Braes in Caithness and the Maybole Bypass in Ayrshire.”

Mr Willox added: “The state of many local roads in Scotland simply isn’t good enough. If there’s new money going to the Scottish Government, the smart move would be to set up a local infrastructure fund to fix our broken roads and deal with local traffic problems.”