Almost 100 north-east families whose lives were shattered by a master conman have appealed for officials to “do the right thing” and refund them.

It comes as a Press and Journal investigation reached Westminster and sparked new demands for dozens of debt-ridden north-east families to get justice.

Crooked money man Alistair Greig, 68, of Cairnbulg, scammed 297 people from the region out of a total of £12.8 million in a sophisticated Ponzi scheme spanning two decades and was jailed for 14 years, later reduced to 10.

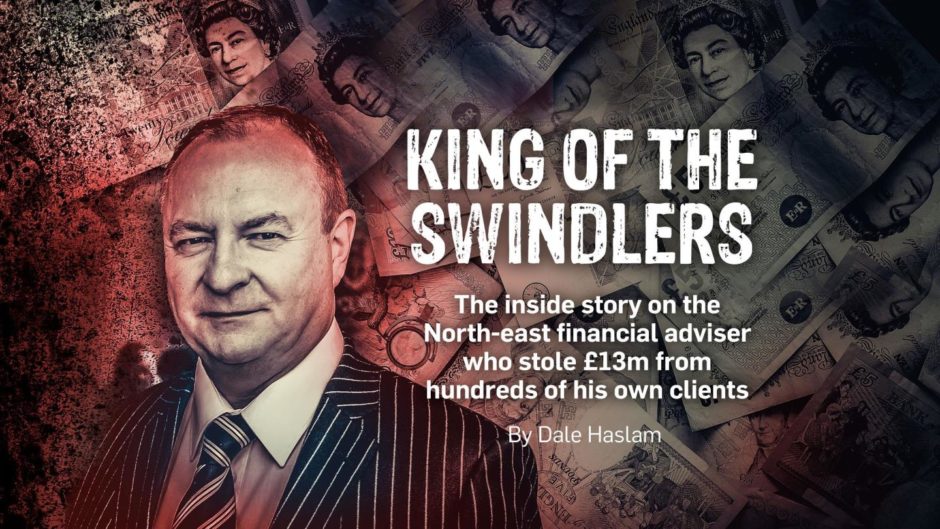

We exposed the details of Greig’s crimes as boss of Midas Financial Services (Scotland), along with a raft of failings from a financial regulator, in our award-winning six-part series King of the Swindlers.

Now, MPs have debated the findings and want the body that failed Greig’s victims to pay them back almost £2 million.

Some 194 people who applied for UK Government compensation got payments of up to £85,000 each – but only because 95 of them had previously taken legal action.

Three red flags missed

That legal action cost those 95 people a total of £1,903,619.92 – roughly £20,000 each.

And they were doubly penalised because much of their £85,000 compensation payments went to lawyers.

Our probe found the Financial Services Authority missed three warning signs about Greig’s lies but failed to act upon them.

Had the FSA acted, all but two of Greig’s victims would have been saved and not lost money.

While the Financial Conduct Authority – the FSA’s successor – has apologised to the victims for failing them, it is refusing to pay them back.

The UK Government’s Treasury ministry is reviewing the way the FCA oversees financial firms on the back of the scam – but won’t compel the FCA to pay up.

‘It really was soul destroying’

Among the group of 95 are James and Mabel Stewart, who lost a total of £363,000 to the fraud.

They got £170,000 compensation from the Financial Services Compensation Scheme (FSCS).

But £61,000 of that was swallowed in lawyers’ fees, and they spent another £60,000 bringing legal action which paved the way for compensation.

Mrs Stewart, 75, of Portlethen, said: “When we found out we’d lost our money, it knocked us for six. It really was soul destroying.

“The money we lost was supposed to be a nest egg for our three children and four grandchildren.

“I’m 75 and James is 78. Losing this money absolutely shattered both of us.

“It put a dampener on our retirement. James hasn’t got the pension pot he had. It’s been hard.

“We couldn’t afford a car. We had to sell a caravan to help us to get through.

“Getting our legal fees back would mean an awful lot. The FCA should do the right thing and refund us.”

For them, £1.9m is a drop in the ocean. To us it is the difference between paying the bills into our retirement or not.”

Sally Paton

Another of the 95 is Sally Paton, 68, of Hilton, Aberdeen.

Although she received compensation she is still £36,000 in the red due to the fraud.

Ms Paton said: “The compensation only came about because of the group of 95 taking legal action, and paying between £15,000 to £20,000 each for that.

“Given that the FCA has publicly apologised for failing to spot red flags that would have prevented Greig’s offences, the least they can do is put things right.

“For them, £1.9m is a drop in the ocean. To us it is the difference between paying the bills into our retirement or not.”

Orkney and Shetland MP Alistair Carmichael, whose constituents are among Greig’s victims, organised the debate at Westminster Hall in which our investigation was cited.

Mr Carmichael said: “The only reason compensation has been paid so far is the sheer dogged determination of the group of 95.

The 95 are never going to get psychological closure from this fraud unless they are properly compensated.”

Orkney and Shetland MP Alistair Carmichael

“It is just downright wrong that they are left still out of pocket when there’s no doubt that, if they hadn’t done what they did – pushing the FCA to do their job – nobody would have got anything.

“The 95 are never going to get psychological closure from this fraud unless they are properly compensated.”

‘Badly let down’

Gordon MP Richard Thomson also joined the debate as some of his constituents lost their savings to Greig’s scam.

Mr Thomson said: “Although the only person responsible for investors’ losses is Greig himself, it’s clear the investors were badly let down at a number of key stages by regulators who should have been there to protect them.

“Although many will have been substantially compensated by the statutory scheme, many more have been left significantly out of pocket.

“Fully compensating investors would most obviously restore people’s financial loss, but more importantly, it would allow people to start to put the trauma of this fraud behind them, as well as righting the wrongs of the regulators failing to adequately do their job.

“It’s right that Parliament continues to look at this case to see what further lessons can be learned.

It would not be appropriate for the FCA to pay the legal fees for a case which it wasn’t directly involved in.”

An FCA spokeswoman

“Whatever else can be salvaged in financial terms should also be used to compensate victims.”

‘The FSA could have acted on intelligence’

An FCA spokeswoman said: “It would not be appropriate for the FCA to pay the legal fees for a case which it wasn’t directly involved in.

“We acknowledged there were occasions on which our predecessor organisation, the FSA, could have acted on intelligence received in relation to Midas and apologised to those affected for not doing so.

“The independent Complaints Commissioner considered the Midas case and concluded it would not be appropriate for the FCA to pay compensation in this instance.”

The Treasury declined to comment but, during the debate, Treasury Minister John Glen said any decision on FCA compensation to victims “is clearly something that is governed by its protocols”.

Major developments

He added: “The FCA acknowledges the FSA’s prior failings to do the job as it should have.

“I hope we can learn from this very sad case”.

There will be two major developments later this year.

Mr Carmichael is fighting for a Select Committee of MPs to grill FCA chiefs about the issue which could heap pressure for compensation.

And the Crown Office will attempt to persuade a judge at Edinburgh High Court that the £829,736.87 Greig has left in his accounts should be forfeited.

Any proceeds usually go to the Scottish court system.

But Mr Carmichael said he believes that cash could instead be handed to the 95 “if there is political will to make it happen. It ought to happen.”

However, such a decision cannot be made until after a confiscation hearing set for June 20.