The end of the annual rush to file a tax return is set to be outlined by the chancellor as taxpayers will be able to log on to digital tax accounts.

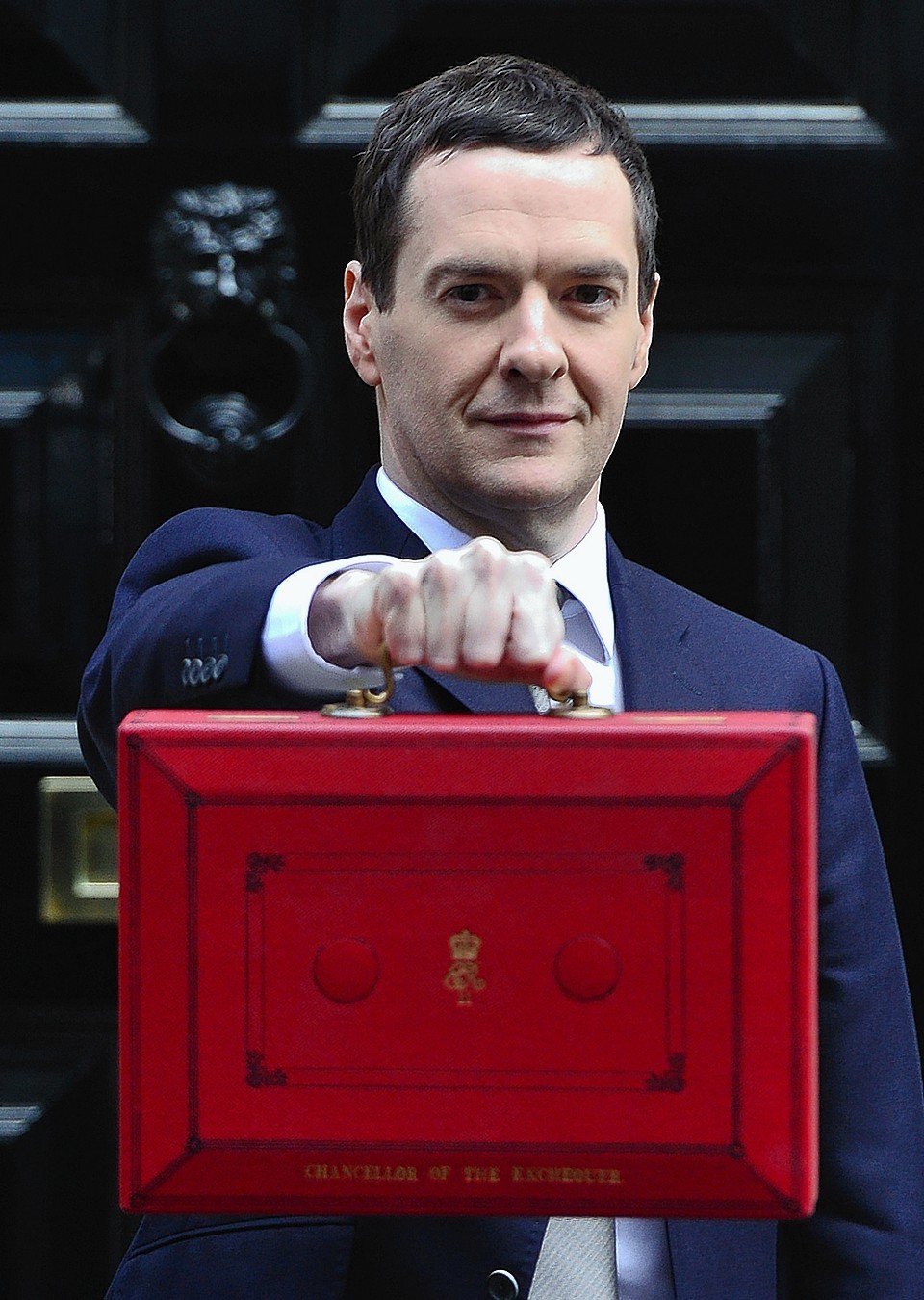

George Osborne will give details of how digital tax accounts, which taxpayers will be able to access from their smartphones, computers and iPads, will help them to manage their tax affairs in a similar way to doing their online banking.

The current tax system is seen as complex and time consuming, with 11 million people, of which four million run their own businesses, and 1.8 million companies in the UK having to fill in their tax return every year.

Taxpayers have to give HM Revenue and Customs (HMRC) information that it already knows, such as earnings and income already reported to it by employers or pension providers.

The budget will outline further details of the plan to switch to online tax returns by 2020.

The new accounts will enable taxpayers to see all their details in one place, in a similar way to using an online bank account.

The move promises to make it easier for all taxpayers to manage their affairs and pay tax at the right time, without having to fill in an annual tax return.

Those who are currently filing their returns on paper will still be able to do so if they prefer.

When someone logs into their account they will be able to see how their tax is calculated as well as all the taxes they need to pay.

They will be able to pay all the taxes they owe when it suits them, for example by linking their bank account so that they can pay in instalments or by direct debits.

They will also be able to use their accounts to sign up to other government services such as state pension forecasts and update their contact information.

Under the plans, by the end of the next parliament, 55 million people, including those who are in self-assessment as well as those who pay tax via PAYE (Pay As You Earn), and all small businesses, will have access to their own digital tax account.

By 2020, businesses will also be able to link their own accounting software to their digital tax account so they can feed in information on the day to day running of the business.

Further details of how the new digital tax accounts will be delivered will be set out later this year.