The tightening race for the White House has sent shivers through the markets as early hopes for a swift and decisive win for Hillary Clinton melted away.

Share benchmarks were sent tumbling across Asia as the battle to win in Florida, a key swing state, went down to the wire and Donald Trump gained the lead in the electoral college votes.

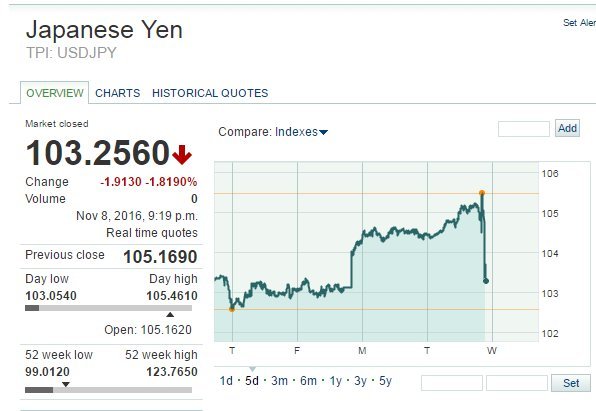

Japan’s Nikkei 225 index dropped 2.4% to 16,777.85 as the US dollar sank against the Japanese yen, a trend that would be unfavourable to exporters. Hong Kong’s Hang Seng slid 1.7% to 22,514.70. The Mexican peso also slipped.

South Korea’s Kospi index fell 1.4% to 1,976.49 and Australia’s S&P ASX/200 lost 1.2% to 5,196.70.

LIVE: Follow the election night here

Analysts have predicted a wave of volatility should Mr Trump triumph in the Sunshine State, where the result is expected to herald who will win outright.

Trading floors in Tokyo and Seoul were up on opening as exit polls suggested Democratic nominee Mrs Clinton had a modest lead over her Republican rival.

But those early gains fell away as the tycoon racked up wins, including a haul of college votes in Texas, reflecting investor concern over what a Trump presidency might mean for the economy and trade.

On his blue collar ticket, Mr Trump has threatened to tear up international trade agreements and pursue an aggressive policy to reshore jobs.

Trevor Charsley, senior markets adviser at AFEX, said: “Since Hillary Clinton was cleared again by the FBI the market has been quietly pricing in her victory.

“The Dow Jones and S&P have pushed higher by 3% in the last 48 hours with the FTSE also rising 2.5%. The dollar has firmed 1.5% against the pound, 1% against the euro, but has lost 1.5% against the CAD as the market sees a Clinton victory as preserving the Nafta agreement which is very important to the Canadian and Mexican economy.

“However, early results are showing a very tight race, tighter than the market expected, and as such the dollar and the US equity markets have lost some of their earlier gains.

“The market is now waiting for the Florida result which has an important 29 electoral votes attached to it. If Florida, or the other key states, declare for Trump we may see some real volatility ensue.”

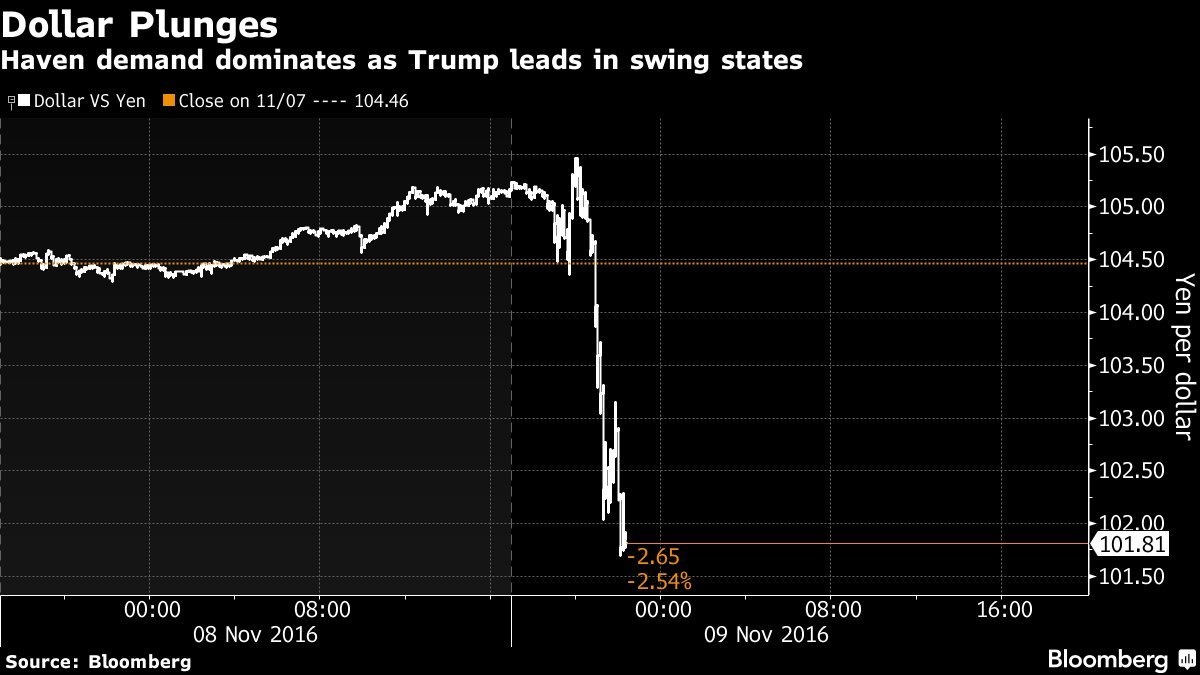

Neil Wilson at ETX Capital described “chaos” beginning to set in as the likelihood of Florida choosing the Republican candidate grew, prompting investors to take shelter.

“There was a major sell-off in stocks while havens like the yen and gold are soaring as the Sunshine States gives Trump a very good chance at the White House. Dow futures are down more than 450 points and USD/JPY is trading at just above 102.

“Mexico’s peso is getting whacked and has plunged to close to 20 against the dollar – down nearly 10% from its high earlier this morning. The proxy trade is speaking loud and clear at the moment.

“This is huge – there is now a very real prospect that Trump will win and so markets are repricing everything. Our election index is now just giving Trump the nod over Clinton – an incredible turnaround.

“But it’s not over and we can expect massive volatility here on in until we get results from all the states. Pennsylvania and Ohio still vital for the final result and these are still too close to call.

“Trump is in the lead in Ohio at the moment, but this could change. Virginia and Michigan are also key.

“This could yet be a massive overreaction by markets as it’s not a done deal by any means. If Clinton claims it from here there will be a huge rally in the markets.”

The pound rose 1% against the dollar at 1.2497 and the euro was up 1.86% at 1.1231 on two-day figures.