A single ward in Aberdeen will pay almost as much in extra council tax as the whole of Dundee.

Around 30,000 properties in the city will be affected by the Scottish Government decision to raise council tax on Band E-H homes.

In total, the extra tax burden on the Granite City for 2017-18 is estimated at £5.8million.

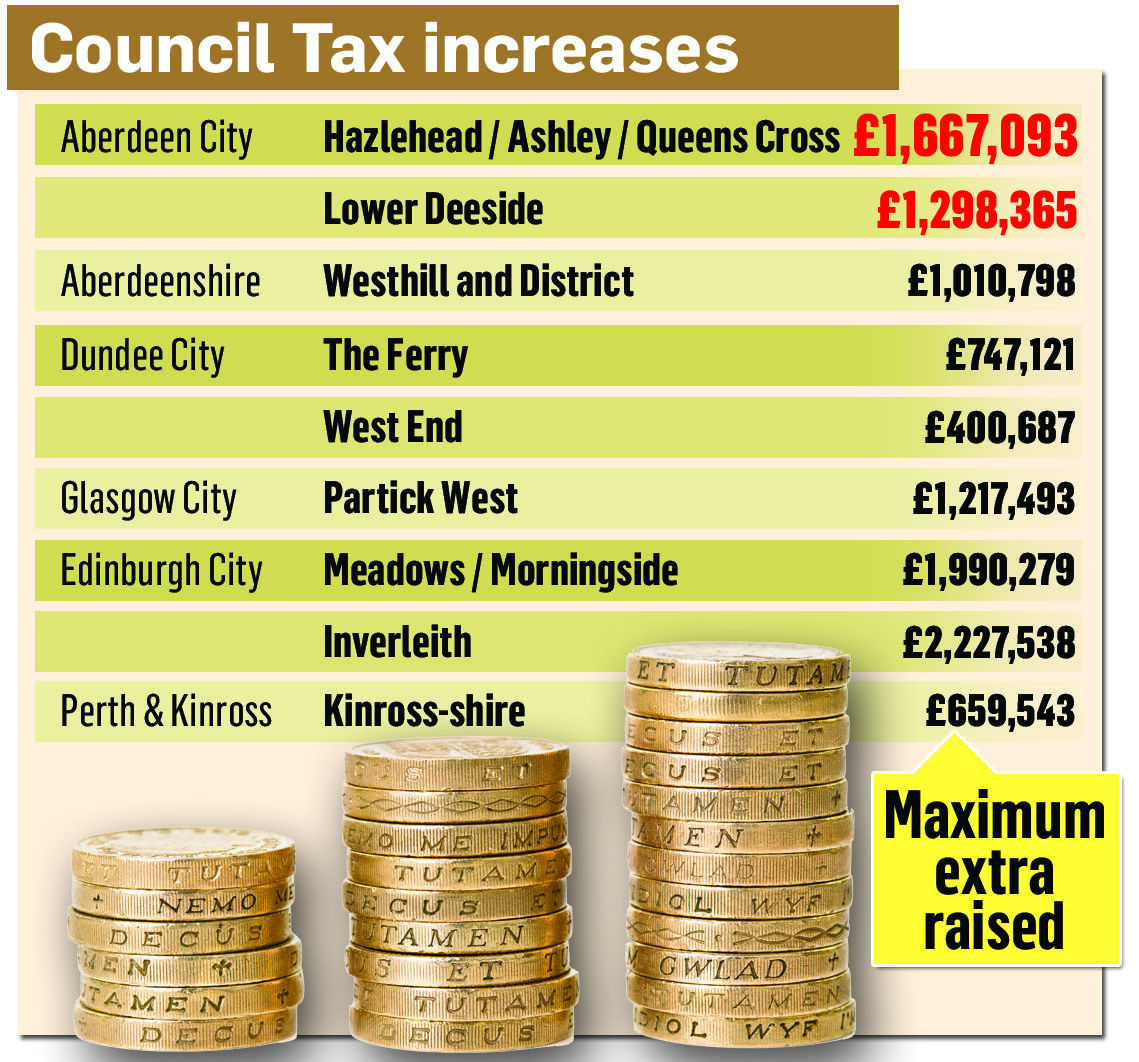

But Hazlehead, Ashley and Queen’s Cross will account for about £1.6million of that figure. And the Lower Deeside ward will contribute more than £1.2million.

Meanwhile, the extra contribution for every ward in Dundee will be just £1.87million.

The increases for Bands E, F, G and H homes in Aberdeen are all the highest affecting any local authority area in Scotland, with the average bill for a Band H home in the city rising by £550 a year.

The extra costs, which are due to come into force in April, follow a tough city council budget where council chiefs had to save more than £17.5million following a Scottish Government cut to the council’s grant.

For the first time in nine years, councils were given the power to raise rates by up to 3%. But the ruling Labour-led administration in Aberdeen declined to do so.

Ross Thomson, Conservative MSP for the north-east and councillor for Hazlehead, Ashley and Queen’s Cross, said: “These figures illustrate once again the extent to which the SNP’s council tax grab disproportionately hits this area.

“After a nine-year council tax freeze, people will not object to paying a little bit more, provided they see improvement in local services.

“However, the bill for my own ward alone is a staggering £1.6million. This comes while the SNP government is cutting funding for Aberdeen in real terms by nearly £15million.”

Council leader Jenny Laing said: “It’s ridiculous the Scottish Government can level such an increase on a local tax when councils don’t want to level it.

“As we have pointed out many times before, Aberdeen is disproportionately under-funded and over-taxed.”

A Scottish Government spokesman responded: “The decision on whether to increase, freeze or reduce council tax is a matter for the local authorities, but the freeze instigated by this administration has saved the average Band D household around £1,500 in total.

“In terms of funding for Aberdeen, we are helping deliver the Aberdeen City Deal and an additional £254 million of Scottish Government investment on top of it.”