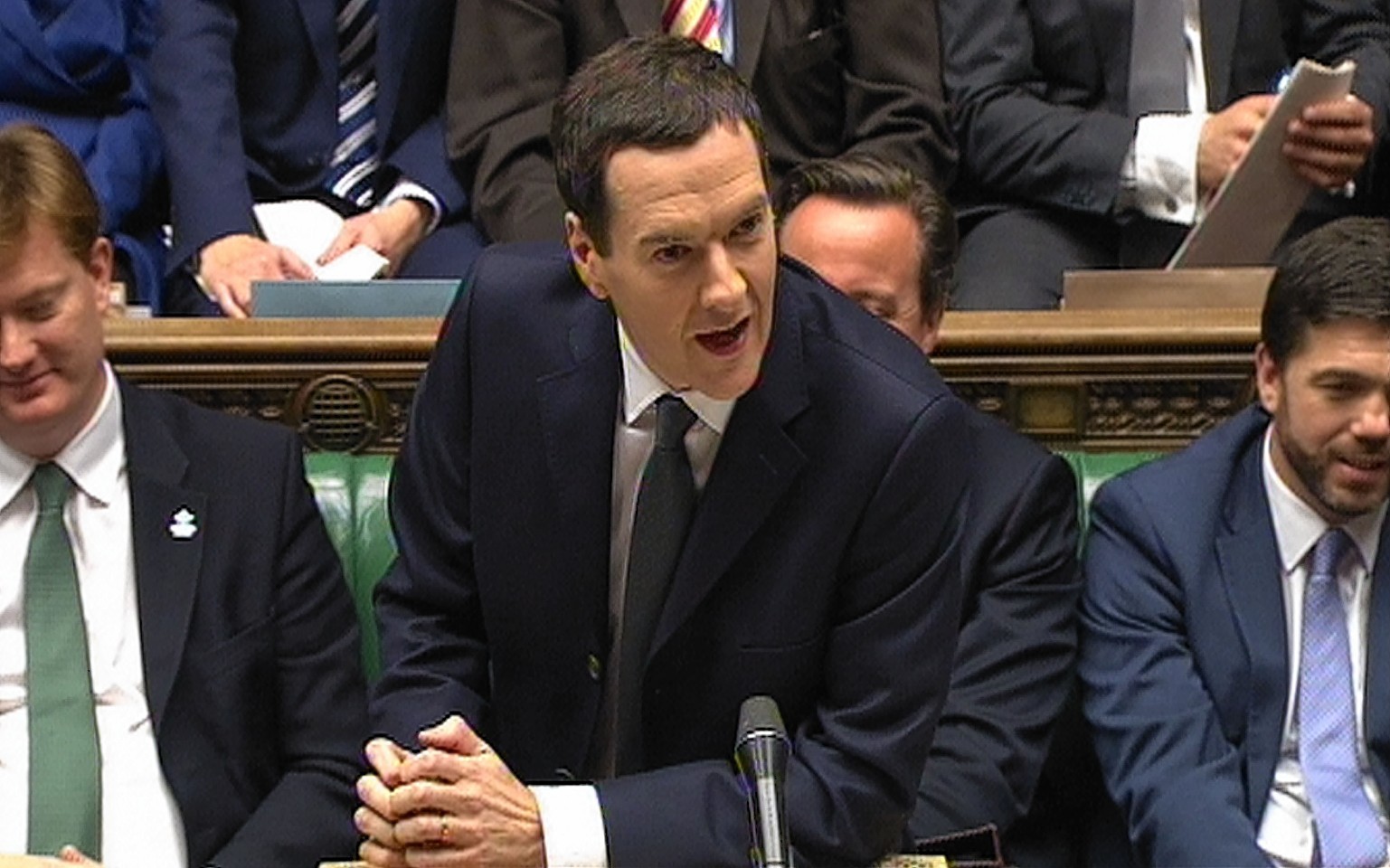

Chancellor George Osborne has confirmed that he will cut North Sea oil and gas taxes.

He pledged to reduce the supplementary charge from 32% to 30%, expand the ring-fenced expenditure supplement from six to 10 years, and introduce a new cluster area allowance.

The UK Government insisted that the changes would trigger billions of pounds of investment in the North Sea and create thousands of new jobs.

The cut in the supplementary charge represents a partial climb-down by the chancellor, who infamously almost wiped out investment at a stroke when he hiked it from 20% to 32% without consultation in 2011.

Danny Alexander, the chief secretary to the Treasury, will travel to Aberdeen tomorrow to unveil the government’s detailed plans for the North Sea and our sister website Energy Voice will be there to speak to him.

Reflecting on the statement John Hutchinson, managing Partner of Epi-V, specialist investors in oil and gas, said: “Tax reduction for the North Sea provides a much needed vote of confidence to the UK oil and gas industry.

“Investors have been concerned about ageing wells, declining production levels and current sliding oil prices, but the chancellor’s statement today should encourage investment into innovative, new ways to extract oil from more difficult places, more cheaply, more efficiently and with lower risk.”

However, not everyone was impressed with Osborne’s pledges, Dame Anne Begg, MP for Aberdeen South, said: “In March 2011, when oil price was $102 a barrel the chancellor, George Osborne, ratcheted up the supplemental charge on offshore oil and gas companies from 20% to 32%.

“Today, when oil stands at just $70 a barrel, he reduces the tax by only two percentage points to 30%.

“I don’t think that such a minimal reduction will be enough to change the investment decisions of the oil companies.

“When Danny Alexander comes to Aberdeen on Thursday he needs to explain why he thinks that $100 a barrel taxes are suitable for a $70 a barrel world.”

To find out everything Mr Osborne said with regards to the North Sea and for full reaction from Oil and Gas UK chief executive Malcolm Webb, visit our sister website Energy Voice.