The £1.1 billion deal to buy the operator of the controversial Cambo oil and gas field may have come with a discount for the new owner due to it being a “lightning rod” for environmental campaigners’ ire.

Ithaca Energy announced a deal Thursday night to buy Siccar Point Energy, operator of the North Sea Cambo field, for £1.1 billion.

An analyst said Ithaca must have benefitted from a lower price due to the strength of feeling around the West of Shetland project.

Cambo became a major symbol in the fight between environmental campaigners who believe fossil fuel production must end and big oil, which prefers a more gradual shift to low carbon energy in coming decades.

The project was famously shelved when energy giant Shell, a shareholder in the project, walked away following pressure from campaigners and the First Minister of Scotland.

However, another analyst suggested the price tag represented a “significant premium being paid” for the assets of Siccar Point.

The deal came hot on the heels of the UK government’s renewed support for the development of more North Sea oil and gas in its energy strategy.

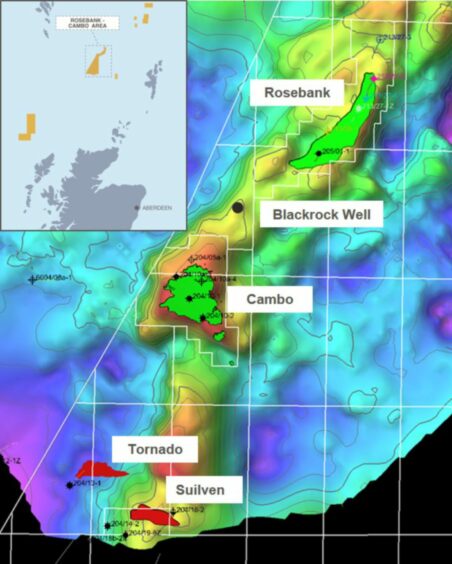

In addition to Siccar Point’s 70% stake in Cambo, the acquisition also means Ithaca will take a 20% stake in the nearby Rosebank field, majority owned by Norway’s Equinor, alongside shares of producing fields including Schiehallion, Mariner, and Jade.

Meanwhile, energy giant Shell retains its 30% non-operated holding in the controversial project for the moment, having said in December it wouldn’t progress it to an investment decision.

Ithaca, which is owned by Israeli energy firm Delek, said it expects to make a “final investment decision” (FID) on the field next year.

Bet on ‘lightning rod’ development

Analyst claimed that the Cambo “lightning rod” for controversy must have merited a discount in price for Ithaca’s deal.

Ashley Kelty, of investment bank Panmure Gordon, said the acquisition would create “one of the largest independents on the UKCS” and that it was “encouraging” to see further investment in the basin.

Mr Kelty said there were no indications of the level of production or reserves acquired as part of the deal but that he expected Ithaca to pay around $7 per barrel of oil equivalent for the company’s proved and probable reserves.

“This would be competitive compared to some other deals, but it is a capex-intensive portfolio,” he said in a note.

“There must be a discount for taking on Cambo – the lightning rod development for the environmentalists.”

Ashley Kelty, Panmure Gordon

“And there must be a discount for taking on Cambo – the lightning rod development for the environmentalists.”

However, John Corr, VP and head of North Sea at Welligence Energy Analytics said the figures appeared to represent a “significant premium being paid” and one of the highest considerations on a per-flowing barrel basis seen in the basin in recent years.

He said the real value for Ithaca lay in its access to Cambo and Rosebank, which provide it with “a well-rounded resource and reserve inventory”, making for an attractive proposition ahead of a possible IPO later in the year.

But he added that the fields were still risky – despite being backed by Ithaca’s “deep pockets”.

“With the recently released UK’s Energy Strategy paper highlighting the need for indigenous supply, and the deep pockets of Ithaca, this potentially puts Cambo in a stronger position for progressing to development,” Mr Corr added.

“However, the challenges of operating in the harsh environment West of Shetland region should not be underestimated, and for Ithaca, which has until now been focused on the more benign North Sea, this seems like a significant bet on two high-risk developments.”

‘Red herring’

Campaigners against the field have said the acquisition does not “change the facts” regarding the project’s climate impact or its effect on energy prices.

Friends of the Earth Scotland’s climate and energy campaigner, Caroline Rance, branded the deal a “billion pound gamble” and insisted the project was still “doomed”.

She said: “It doesn’t matter which profiteering fossil fuel company has their name on the Cambo licence, it doesn’t change the facts about this doomed oil field.

“Exploiting Cambo will do nothing for soaring energy bills but it will further risk our collective safety by worsening climate change.

“The new owners of Cambo will be desperate to profit from their billion pound gamble meaning that they will be hellbent on selling any oil they might extract to the highest international bidder.

“Ithaca would take the profits but the public would bear the risk.”

Greenpeace UK’s oil and gas campaigner, Philip Evans, called the move a “red herring.”

“Cambo’s oil won’t improve UK energy security since the kind that can be extracted from this field can’t be processed in UK refineries.

“Claims to the contrary are simply lies,” he said.

“The answer to the UK’s energy security does not lie in fossil fuels but in home grown renewables – both offshore and onshore – and stopping the energy waste in our homes. These fast-to-roll-out solutions will also slash emissions and bring down energy bills.”

The field will still need to seek formal approval for development, having been granted a two-year licence extension last month.

Ms Rance called on the government to reject Cambo “and all new fields”, and for both UK and Scottish Governments to “urgently focus” on scaling up renewable energy, insulating homes and increasing the number of homes heated by green systems.