A dispute over alleged defects in an Aberdeen city centre office complex has been linked to the demise of construction firm Stewart Milne Group (SMG).

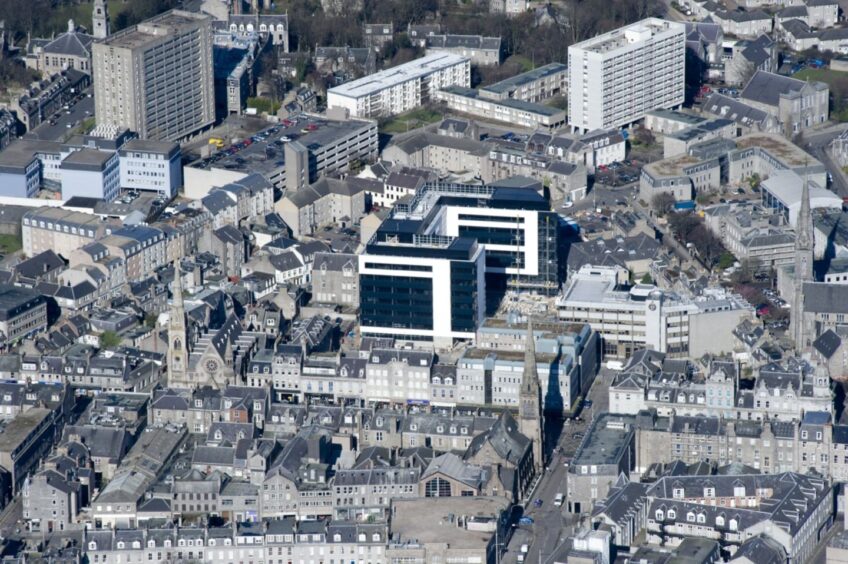

Union Plaza, on Union Wynd, is owned by financial services giant Legal & General (L&G).

Completed by SMG in July 2008 after a £25 million-plus investment, it belonged to its builder for about six years before being acquired by L&G for £54.8m.

The modern new building attracted a string of big name tenants including Deloitte, Paull & Williamsons – now part of Burness Paull – and Aberdeen Asset Management.

That was then, what about now?

Delloite is still there today but the development, comprising 120,000sq ft of office accommodation over seven open-plan floors, is largely bereft of tenants. Former occupants including Burness Paull have deserted it for other locations in the city.

A listing with property giant Savills highlights a swathe of available space in the “contemporary Grade A office building”.

Simmering away in the background all this time has been a legal dispute which some property experts believe may have caused the downfall of SMG.

L&G sued SMG and architects Halliday Fraser Munro (HFM) over “defects”.

The complaint boils down to L&G’s concerns about water ingress in the basement and inadequate “paint protection systems” to shield steelwork against the risk of both fire and corrosion. Court of Session papers also highlight “other defects in fire protection”.

Such defects can impact on “collateral warranties” and liabilities in the event of something going wrong.

Read more: Where did it all go wrong for Stewart Milne Group?

L&G only became aware of the alleged paint protection shortcomings in November 2018.

This was after an independent investigation into the design, specification and application of paintwork in the Union Plaza basements.

The lawsuit included a sum of £350,000 – sought from SMG, HFM and civil and structural engineering firm Fairhurst to cover the cost of investigations and initial remedial works.

It is believed the total liability, whoever eventually accepts responsibility for it, could run into many millions of pounds.

SMG is now in administration, leaving the legal situation up in the air. Businesses which have gone bust cannot easily be sued.

L&G refused to comment and Aberdeen-based HFM did not respond.

Meanwhile, Deloitte is understood to be looking for new offices in Aberdeen.

And L&G is thought to be mulling a major refurbishment and “repositioning” of Union Plaza.

Expert says Union Plaza is ‘real reason’ behind Stuart Milne Group going under

One property expert told The Press & Journal he believed the legal battle over the office complex was “the real reason why the lender (Bank of Scotland) decided to pull the plug”.

Housebuilder SMG, based in Westhill, Aberdeenshire, went into administration on January 8.

A total of 217 jobs were axed and 112 retained to help with the winding up of operations.

Scottish subsidiaries of SMG ceased trading with immediate effect and all live projects were halted.

SMG’s unfinished housebuilding projects include Charleston in Aberdeen, Dunnottar Park in Stonehaven, Monarch’s Rise in Arbroath, Ballumbie Rise in Dundee and Hunter’s Meadow in Auchterarder.

Read more: All our stories on the collapse of Stewart Milne Group

SMG reported its best annual profits for almost a decade last July.

Pre-tax profits of £16.5 million from continuing operations were boosted by a £48.1m gain from the sale of a £100m turnover timber systems business in December 2021.

The company would have been in the red again – following losses of £13.1m in the 2020-21 trading year – were it not for the sale of Stewart Milne Timber Systems to Fife-based James Donaldson & Sons for an undisclosed sum.

SMG also reported a “strong” cash position at the year-end, October 31, 2022, with £15.8m left in the kitty after the firm repaid £61m of debt to the Bank of Scotland.

According to accounts lodged at Companies House, the bank later extended a £114m overdraft until June 30 2024.

But efforts to sell SMG, allowing founder Stewart Milne to retire, came to nothing.

Bank pulls the plug on SMG

And the lender’s patience, after years of relatively high debt levels at the company seems to have worn thin.

Following SMG’s collapse, a spokeswoman for the bank highlighted “several years of support and forbearance” as well as “multiple maturity extensions” to its borrowing.

Conversation