The chancellor’s plans to overhaul the system of dividend taxation risks hitting North Sea’s oil contractors that act as “one-man bands”, an accountancy firm has warned.

The Government will axe the dividend tax credit and replace it with a new tax-free dividend allowance of £5,000 a year for all taxpayers.

The rates of dividend tax will be set at 7.5% for basic rate taxpayers, 32.5% for higher rate taxpayers and 38.1% for additional rate taxpayers.

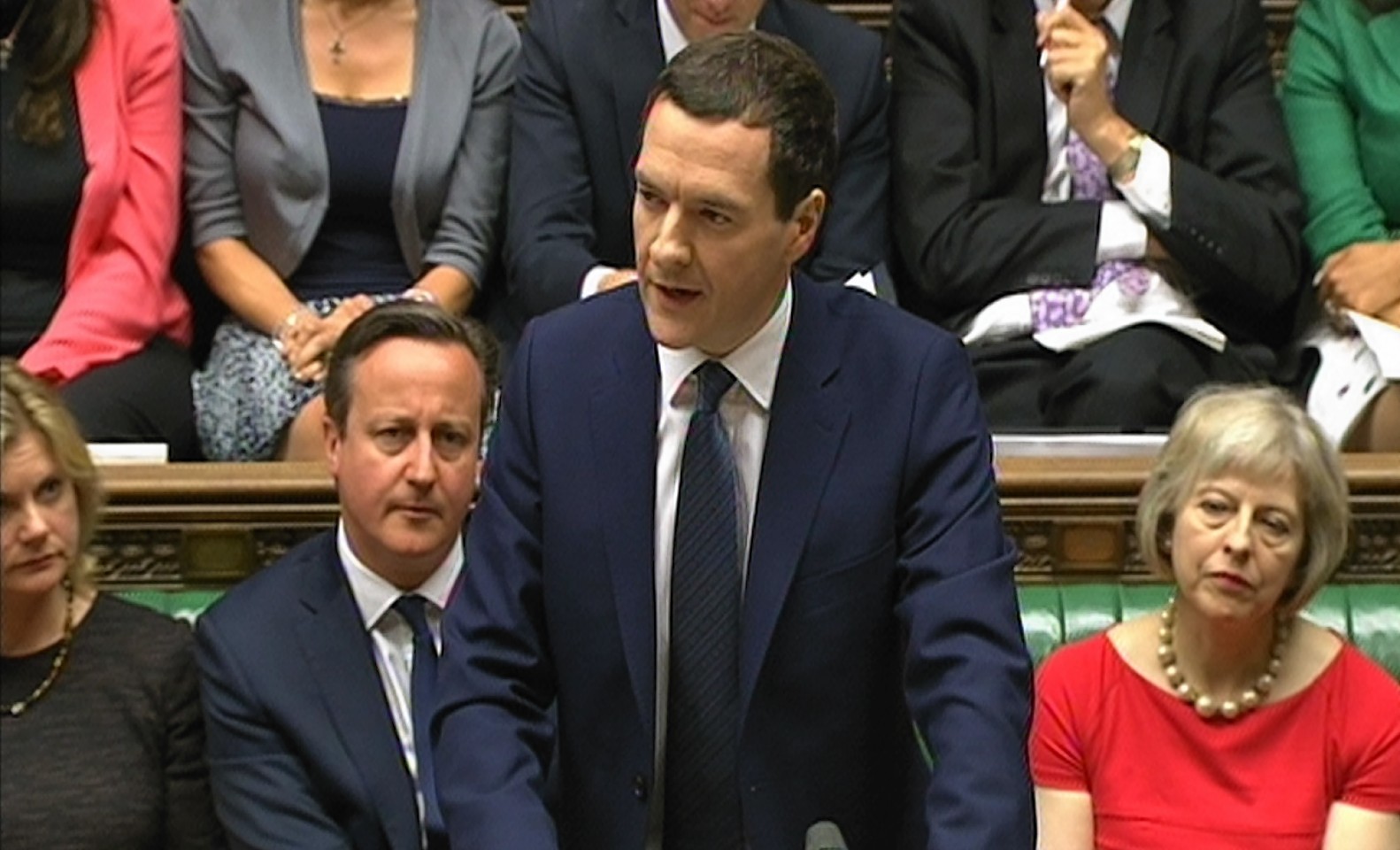

Mr Osborne claimed those earning over £140,000 will pay more in tax, while 85% of taxpayers will see no change or be better off, while over one million people will be better off.

John Hannah, managing partner, at north-east accountants SBP, said: “Many contractors in the oil and gas sector operate as ‘one-man band’ limited companies, paying low director salaries, but with high dividends. The Chancellor’s announcement that there will be higher taxes on dividends above £5,000 could see these people being taxed heavily while having day rates cut due to the low oil price.”

Mr Osborne also announced plans to crack down on wealthy non-UK domiciled individuals who use their status to avoid paying full UK taxes.

Mr Osborne said permanent non-dom tax status will be scrapped and that anyone resident in the UK for more than 15 of the past 20 years will now pay full British taxes on all worldwide income and gains.

This means so-called non-doms will pay the same tax as everyone else in the UK.

The Chancellor announced a package of measures tightening up who qualifies for non-dom status, which will come into effect from April 2017 and will raise £1.5 billion in additional tax over this parliament.