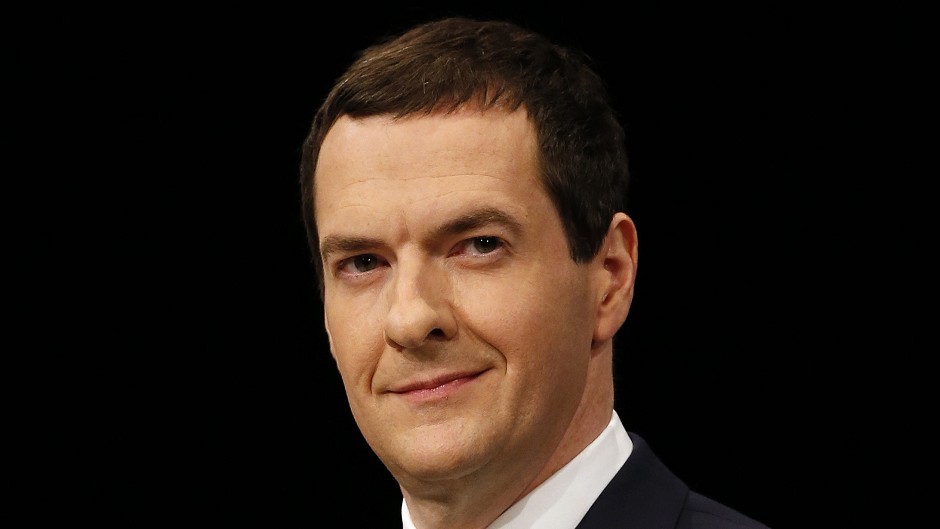

As George Osborne completes preparations on his Autumn statement this week, business owners, contractors established as “personal service companies” and public sector workers should watch out, professionals have warned.

Following a defeat in the House of Lords over proposed tax credit cuts, the chancellor will be looking to fill a £4.4billion gap in his budget when he presents the statement on Wednesday.

Gill Pryde, partner in charge of tax at Anderson Anderson Brown (AAB) says a 7.5% increase of tax rates on dividends due to come into force in April may be brought in on Wednesday.

Those planning to declare dividends in the next few months, should consider taking action now, she said.

Ms Pryde said: “The Treasury has already said that it is anticipating a spike in tax revenues from dividends being accelerated to beat the increase in rates in April, so it doesn’t seem sensible to curtail that by increasing the rates now”.

In a further move on owner managers, Entrepreneurs Relief (ER), which gives business owners a lower rate of capital gains tax of 10%, is also set to be targeted after the tax break cost the exchequer far more than anticipated.

Derek Mitchell, head of private client services at AAB, expects that restricting transfers of shares between family members to maximise this relief could be restricted “in the spirit of ‘anti-avoidance’ as it has been over the last 12 months”.

Meanwhile, IR35 or personal service companies have been under attack from the Chancellor with the proposed removal of tax relief for travel and subsistence costs and the increase in dividend tax.

The Chancellor may also introduce new rules under which consultants would be required to move onto the payroll of the company they are working for, if their work lasts more than one month.

“Losing ER and imposing NIC after one month would almost certainly see the end of the tax attractiveness of personal service companies” said Ms Pryde.

The generous tax reliefs under the Enterprise Investment Scheme (EIS) to encourage investment in new start-up companies or companies that need growth capital are also rumoured to be under review.

Meanwhile, Stuart Walker, financial planner with Johnston Carmichael Wealth expects the chancellor to look at pension reform to shore up shore up public finances.

“Following much speculation, there is real potential for the Exchequer to target so-called ‘gold-plated’ pension schemes for public sector employees,” he said.

“Whilst this would save the Treasury money, any reduction would, of course, have a significant impact on tens of thousands of workers’ pension pots.”