A total of 17 projects have been chosen out of 74 applications for the ScotWind offshore wind licensing round.

Nearly £700 million will be paid by the successful applicants in option fees and passed to the Scottish Government for public spending.

The area of seabed covered by the 17 projects, with a combined potential generating capacity of 25 gigawatts (GW) totals more than 2,700 square miles.

Hailing the “truly historic” potential of ScotWind, First Minister Nicola Sturgeon said it would deliver opportunities for high quality green jobs for decades to come.

She added: “ScotWind puts Scotland at the forefront of the global development of offshore wind, represents a massive step forward in our transition to net-zero, and will help deliver the supply chain investments and high quality jobs that will make the climate transition a fair one.

People working right now in the oil and gas sector in the north-east of Scotland can be confident of opportunities for their future.”

Nicola Sturgeon, first minister.

“It allows us to make huge progress in decarbonising our energy supply – vital if we are to reduce Scotland’s emissions – while securing investment in the Scottish supply chain of at least £1 billion for every gigawatt of power.

“And because Scotland’s workers are superbly placed with transferable skills to capitalise on the transition to new energy sources, we have every reason to be optimistic about the number of jobs that can be created.

“That means, for example, that people working right now in the oil and gas sector in the north-east of Scotland can be confident of opportunities for their future.”

Ms Sturgeon continued: “The spread of projects across our waters promises economic benefits for communities the length and breadth of the country, ensuring Scotland benefits directly from the revolution in energy generation that is coming.

“There is no doubt that the scale of this opportunity is transformational – both for our environment and the economy.”

Announcing the licensing round lease option successes, including BP Shell and SSE Renewables, Crown Estate Scotland (CES) said early indications suggested it would lead to a multibillion-pound supply chain investment in Scotland.

The potential power generated will provide for “the expanding electrification of the Scottish economy as we move to net-zero,” CES added.

This is good business – making disciplined investments and demonstrating what an integrated energy company can do; we can’t wait to get to work.”

Bernard Looney, chief executive, BP.

Simon Hodge, chief executive, CES, said: “Today’s results are a fantastic vote of confidence in Scotland’s ability to transform our energy sector.

“Just a couple of months after hosting COP26, we’ve now taken a major step towards powering our future economy with renewable electricity.

“In addition to the environmental benefits, this also represents a major investment in the Scottish economy, with around £700m being delivered straight into the public finances and billions of pounds worth of supply chain commitments.

“The variety and scale of the projects that will progress onto the next stages shows both the remarkable progress of the offshore wind sector, and a clear sign that Scotland is set to be a major hub for the further development of this technology in the years to come.”

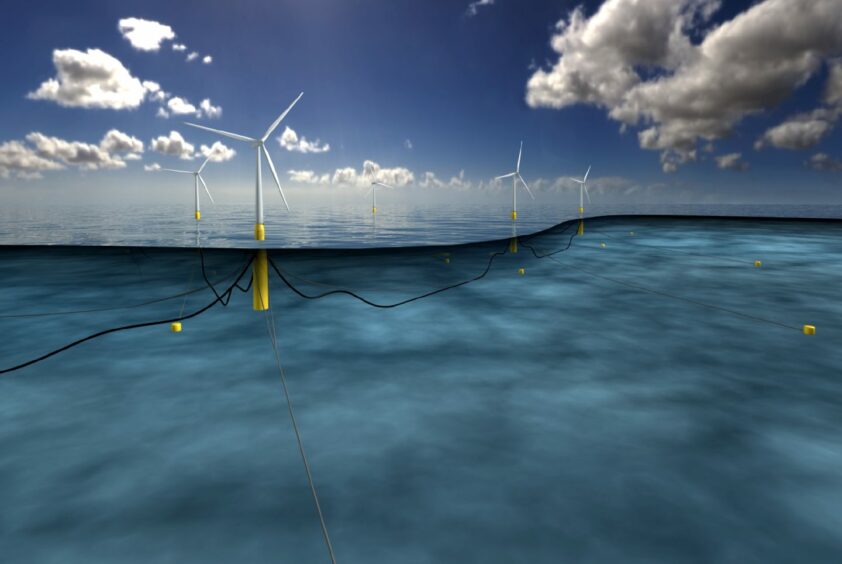

CES added: “This is just the first stage of the long process these projects will have to go through before we see turbines going into the water, as the projects evolve through consenting, financing, and planning stages.

“Responsibility for these stages does not sit with Crown Estate Scotland, and projects will only progress to a full seabed lease once all these various planning stages have been completed.

The 17 successful projects, with option fees, type of offshore wind technology and generating capacity are:

- BP Alternative Energy Investments, £85.9m, fixed, 2,907 megawatts (MW).

- SSE Renewables, £85.9m, floating, 2,6.10MW.

- Falck Renewables, £28m, floating, 1,200MW.

- Shell New Energies, £86m, floating, 2,000MW.

- Vattenfall, £20m, floating, 798MW.

- DEME, £18.7m, fixed, 1,008MW.

- DEME, £20m, floating, 1,008MW.

- Falck Renewables, £25.6m, floating, 1,000MW.

- Ocean Winds, £42.9m, fixed, 1,000MW.

- Falck Renewables, £13.4m, floating, 500MW.

- Scottish Power Renewables, £68.4m, floating, 3,000MW,

- BayWa, £33m, floating, 960MW.

- Offshore Wind Power, £65.7m, fixed, 2,000MW.

- Northland Power, £3.9m, floating, 1,500MW.

- Magnora, £10.3m, mixed, 495MW.

- Northland Power, £16.1m, fixed, 840MW.

- Scottish Power Renewables, £75.4m, fixed, 2,000MW.

Trade body OGUK said traditionally fossil fuel energy firms were “at the head of the pack, building on and adapting their oil and gas expertise to speed up greener energies like wind”.

BP’s successful bid, with German company EnBW as partner involves potential generating capacity of 2.9GW – enough to power more than 3 million homes.

It is expected to support up to £10 billion of investment in offshore wind development, skills and opportunities in hydrogen and electric vehicle (EV) charging.

BP’s lease site, covering about 332 square miles, is located around 37.3 miles off the coast of Aberdeen.

Bernard Looney, chief executive, BP, said: “Our plans go much further than just the turbines offshore.

“They see us investing in projects and in people p from EV charging to green hydrogen – aligned with Scotland’s energy transition plans.

“This is good business – making disciplined investments and demonstrating what an integrated energy company can do; we can’t wait to get to work.”

Shell’s partnership with ScottishPower has won two leases for floating offshore wind farms, representing a total of 5GW, off the east and north-east coast of Scotland.

Wael Sawan, integrated gas and renewables and energy solutions director, Shell, said: “Shell and ScottishPower can now look forward to generating floating wind power at significant scale in the UK to accelerate the country’s transition towards net-zero.

“Floating wind plays to our strengths in deeper offshore projects, and we are well-placed to help advance the wider take-up of this important clean energy source.”

This is a pivotal moment that will reinforce the UK’s position as the global leader in offshore wind and boost the UK economy.”

Keith Anderson, CEO, ScottishPower.

ScottishPower also secured its own lease for a fixed turbine site near Islay.

Keith Anderson, the Glasgow-based company’s CEO, said: “Offshore wind is set to become the backbone of the UK’s energy mix and will do the heavy lifting as we ramp up the production of clean electricity on the journey to net-zero.

“Our ScotWind projects will play a massive part in that and make the best use of our fantastic natural resources to help power the UK’s transition from fossil fuels to renewables and a better future, quicker.

“They will also deliver investment, support jobs and boost supply chains – particularly in areas like the north-east that play a key role in the energy sector 0 opening up immense opportunities for businesses and institutions across the country.”

Mr Anderson added: “This is a pivotal moment that will reinforce the UK’s position as the global leader in offshore wind and boost the UK economy.”

Projects like these can help reduce the UK’s exposure to volatile wholesale markets.”

Alistair Phillips Davies, chief executive, SSE.

SSE Renewables and its ScotWind partners, Japanese conglomerate Marubeni Corporation and Danish fund management company Copenhagen Infrastructure Partners through one of its funds, have been awarded the rights for 331.3 square miles of seabed to develop an offshore wind project of up to 2.6GW of capacity off the east coast of Scotland.

Alistair Phillips Davies, CEO, SSE, said: “Projects like these can help reduce the UK’s exposure to volatile wholesale markets, keeping prices down for consumers and creating skilled jobs in the process.

“This ScotWind project will also lead to billions more direct and indirect investment into the Scottish economy over its lifetime.”

Floating Energy Allyance, a partnership between BayWa, Elicio, and BW Ideol, has secured an option agreement for a site about 47 miles north-east of Fraserburgh.

Gordon MacDougall, managing director of the UK renewables arm of Germany-based BayWa, said the project would be one of the world’s largest floating offshore wind farms when built, helping to meet Scotland’s net-zero target and “putting the country at the very forefront of the global growth of this new technology”.

Mr MacDougall added: “It also has the potential to support thousands of jobs here in Scotland during construction and several hundred direct and indirect jobs on an ongoing basis over its lifetime.”

Aberdeen Harbour Board CEO Bob Sanguinetti said ScotWind would, ultimately, ensure the Granite City and surrounding area “maintains its position as the energy capital of Europe”.

North-east entrepreneur Sir Ian Wood said the licences were a “crucial step” in repositioning the region as the “net-zero energy capital of Europe.”

And Aberdeen and Grampian Chamber of Commerce CEO Russell Borthwick called it “a very big day for the UK energy sector, and for the Aberdeen region in particular”.

Aberdeen ‘uniquely positioned’

Mr Borthwick added: “Aberdeen is uniquely positioned to be at the heart of supporting offshore wind development and operations, and several major operators have indicated that it will site global centres of excellence here.”

Claire Mack, CEO at industry body Scottish Renewables, said: “Today’s announcement on the outcome of the first ScotWind leasing round is an exciting and significant moment in Scotland’s renewable energy story, with offshore wind set to make a major contribution to bringing about our net-zero future.

“The potential for 17 new projects creates huge ambition for our sector to deliver on, and will require strong collaboration to deliver maximum impact for our economy and environment.”

Ms Mack added: “These lease offers add greatly to our existing pipeline of projects in construction and development.

“It is particularly exciting to see wind farms able to progress right around our coast, from Islay in the west, to Lewis and Orkney and right down the east coast.

“This means a new range of communities are set to benefit from the growing economic impact of the offshore wind sector.”

‘Significant appetite for investment’

Melanie Grimmitt, head of energy at law firm Pinsent Masons, said: “This leasing round has shown there is significant appetite for investment – borne out by the international and domestic, new and traditional developer groupings bidding to secure seabed rights.”

Greenpeace UK policy director Doug Parr said: “Renewables are clearly the way forward, and this announcement marks a colossal step forward in UK offshore wind delivery.”

Meanwhile, the Scottish Fishermen’s Federation (SFF) said it was “anxious and concerned” about the potential impact of these and future offshore renewables projects,

SFF CEO Elspeth Macdonald added: “Proper scrutiny must be given to developers’ claims that offshore windfarms and fishing activity can co-exist with little change to existing patterns of activity, since our experience to date shows very strongly that the opposite is the case.”