UK inflation has slowed again last month in a potential boost for cash-strapped households across the UK.

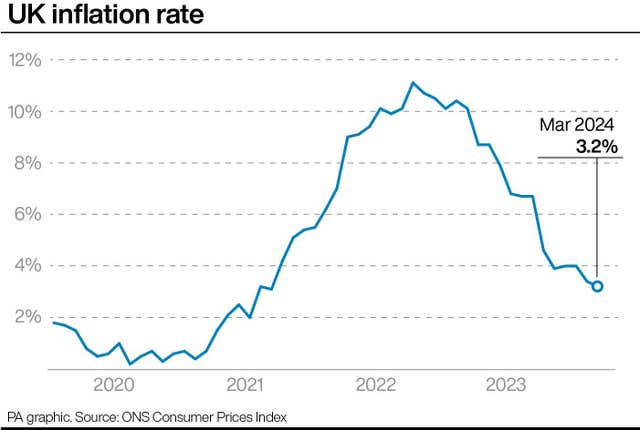

Official figures from the Office for National Statistics (ONS) showed Consumer Prices Index inflation stood at 3.2% in March, down from 3.4% in February.

It represents a major fall after inflation peaked at 11.1% in 2022 following a series of sharp interest rate hikes by the Bank of England.

Here we look at what is behind the fall and what it means for families and borrowers:

– What is inflation and why has it fallen?

Inflation is the term used to describe rising prices.

The inflation rate refers to how quickly prices are going up.

March’s inflation rate of 3.2% means that the same things that cost a household £100 a year ago now cost £103.20.

The fall of inflation was slightly less than expected, with economists having predicted it would hit 3.1% for the month.

– Does this mean the cost of living is falling?

Unfortunately not. Falling inflation does not mean prices are dropping, just that the pace of increases is slowing.

Inflation has been steadily easing back after hitting a peak of 11.1% in October 2022.

This is largely due to the significantly lower energy price cap compared with the eye-watering £2,500 limit seen at the end of 2022.

-What is going down in price?

Energy is the main area which is down notably year-on-year, and is due to fall further in April as the new price cap comes into force.

The ONS said on Wednesday that some food items have seen price decreases, such as meat, which was cheaper in March than it was in February.

The price of furniture and other household goods has also dropped, down 0.9% against March last year.

Housing costs also dropped, according to the figures.

-What is still getting more expensive?

Fuel is broadly cheaper than a year ago but has ticked higher in recent months, with the price of petrol up 2.6p per litre between February and March 2024 to stand at 144.8p per litre.

Meanwhile, some consumer items also saw increases. Alcohol and tobacco prices were up 12.1% for March, rising from an inflation rate of 11.9% the previous month.

Increases in the cost of health services and communication were also higher in March.

– What does the fall in inflation mean for interest rates?

Interest rates are currently at 5.25% after being held at the rate for the past five votes by Bank of England policy makers.

Economists have predicted that inflation is still on track to move near to the Bank’s 2% target rate next month, potentially falling below this by early summer.

As a result, economists and the financial markets have been predicting the Bank’s monetary policy committee will start looking to reduce rates.

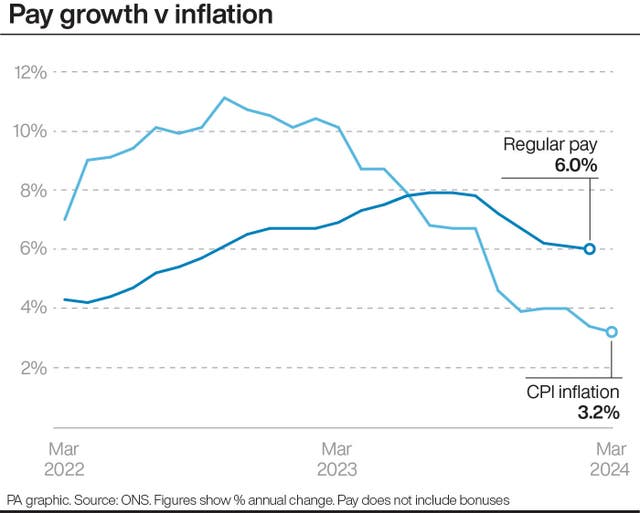

However, the higher-than-expected March reading, signs of persistent inflation in the services economy and continued wage growth have all caused many economists to push back their expectations for rate cuts.

For example, economists at ING and Pantheon Macroeconomics had earlier this month pointed towards a first cut in June but have put this back to August, while the financial markets have been even more pessimistic, suggesting it could take until November.

– Where is inflation set to go from here?

Broadly, most economists expect inflation continue to slow over the coming months.

Thomas Pugh, UK economist at RSM, said “inflation is likely to fall to around 2% in April before lurching below that in May”.

However, the Bank of England and Office for Budget Responsibility’s most recent forecasts have both projected that it will plateau in early summer before moving slightly higher later in the year.

It also comes amid warnings from the International Monetary Fund (IMF) that the escalation of conflict in the Middle East risks pushing up food and energy prices across the world.