Bosses at Scotgold Resources are desperately trying to shore up its finances after “below plan” production from Scotland’s only commercial gold mine.

Shares in the Alternative Investment Market firm slumped more than 65% today after it highlighted the potential for a “material uncertainty” over its “very immediate” future.

The stock had regained only a fraction of its losses by market close, off more than 63% at 13.9p

Much of the firm’s recent output “turned to waste”, rather than deliver valuable gold.

Directors have determined to take steps to strengthen the company’s cash position.”

Scotgold Resources

Scotgold also revealed it had called in the police after the email accounts of executive directors were accessed by “unauthorised persons” and “specious emails” sent in their names to numerous people.

The company added: “Whilst we believe the vulnerability has been fixed, it is impossible to ever be certain of this. The police have also been informed on this matter and will continue to investigate.”

Strong January was followed by declining mining performance

But it was Scotgold’s latest update on production at its mine at Cononish, near Tyndrum in Argyll, that spooked investors.

The company had anticipated nearly 5,818 tons of mineralised ore would come out of the site during February and March following Q4 woes but record output in January.

But gold grades “began to decline significantly” and total ore production in February was negatively impacted, with about 977t mined and 1,441t processed, Scotgold said.

March ore mining output is expected to come in at 550-600t, with nearly 3,000t of waste also produced to “place into required areas for commencement of stope drilling”.

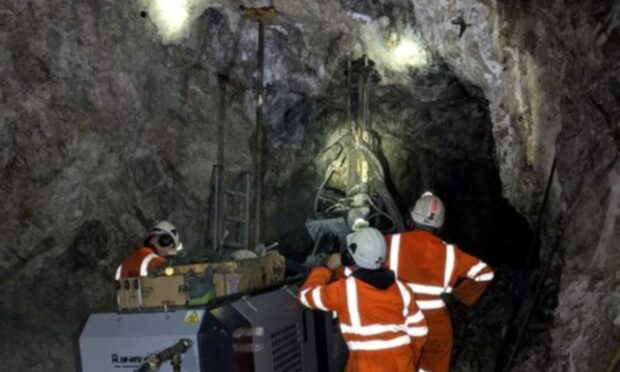

A stope is a dugout tunnel or space containing the ore being mined.

Long hole stope mining is a widely used method that supports cost effective and efficient extraction of ore.

‘Material uncertainty’

Announcing the poorer-than-expected mining performance, Scotgold said: “The company’s management team continuously assess the cash position.

“In the event, the planned commencement of long hole stoping in April is delayed, or… ore mined in April and the following months is significantly below the current mine plan, then a material uncertainty would exist that casts significant doubt over the ability of the consolidated entity to continue as a going concern in the very immediate term.

“In order to safeguard against this potential shortfall in working capital over the next few months the directors have determined to take steps to strengthen the company’s cash position.”

Scotgold’s bosses are in “advanced discussions with its gold offtake partner” to secure a £408,000 advance to assist with short-term working capital.

The firm added: “The directors of the company have also discussed, if the need arises, providing a short-term convertible loan.

Read how Scotgold’s trailblazing geologist Rachael Paul received a global honour for her work

“The ability of the consolidated entity to continue as a going concern over the long term will remain dependent on the quantity and grade of ore mined and processed being within a reasonable tolerance of the forecast quantity and grade, and adherence to the planned product shipment schedule.”

Last night, the company reported a “great day of stope drilling” at Cononish.

A great day of stope drilling at our Cononish Gold Mine in #Tyndrum, #scotland as we move towards long hole stope mining. Well done #team! #mining #ukmining #goldmining pic.twitter.com/WYkBT6ZmxT

— Scotgold Resources (@scotgoldresltd) March 26, 2023

The “first pour” of commercially produced gold from the mine was achieved on November 30 2020.

Scotgold has previously said Cononish is only the start of its Scottish gold ambitions.

The company holds 13 lease option agreements covering an area of nearly 1,120 square miles of the central Highlands, mostly in rural Perthshire.

Conversation