Sir Ian Wood has said he is confident the UK Government will not cave into pressure over continued oil and gas production in the North Sea.

The need to pursue maximum economic recovery (MER) from the basin during the transition to net-zero is well understood at Westminster, the energy industry veteran added.

The government may not wish to publicly acknowledge MER has to be part of its energy strategy for decades to come, but privately it is likely a different story, Sir Ian, 78, said.

Highlighting a future shortfall in energy supply without MER, he added: “There is a lot of ground to be made up in oil and gas, and I think the government is aware of that.”

Best guess is we would still require 500,000 barrels a day of oil and gas to meet the country’s energy requirements.”

Sir Ian Wood

The oil and gas industry doyen, energy transition champion and Opportunity North East chairman (ONE) was one of four speakers taking part in The Press and Journal Business Breakfast, in association with Royal Bank of Scotland, and supported by Burness Paull and Aker Solutions.

Joining him in a strong line-up at the event – focused on green recovery and the energy transition – were Aker Solutions UK country manager Sian Lloyd Rees, Burness Paull partner Neil Smith and James Close, head of climate change at Scottish banking giant NatWest Group, which operates as Royal Bank of Scotland north of the border.

The government has faced growing pressure from climate change campaigners to scale back oil and gas activity in UK waters.

It has insisted it has no plans to ban North Sea exploration licensing rounds, contrary to suggestions in some media reports, and much to the relief of oil and gas producers and Scottish supply chain companies.

But future licensing auctions will be subjected to far greater scrutiny through the introduction of a “climate compatibility checkpoint”.

Shortfall

Spelling out the dilemma facing the government, Sir Ian said: “If we are really successful in developing our energy transition activities, renewables with carbon capture and storage could contribute 70% of the UK’s energy requirements by 2050.

“That is the UK Climate Change Committee’s estimate. And best guess is we would still require 500,000 barrels a day of oil and gas to meet the country’s energy requirements.

“OGA (the Oil and Gas Authority) estimates we may still be producing as much as 300,000 boe (barrels of oil equivalent) a day in 2050.

“That leaves us 200,000 barrels short which will inevitably have to be imported to meet the UK’s energy needs.”

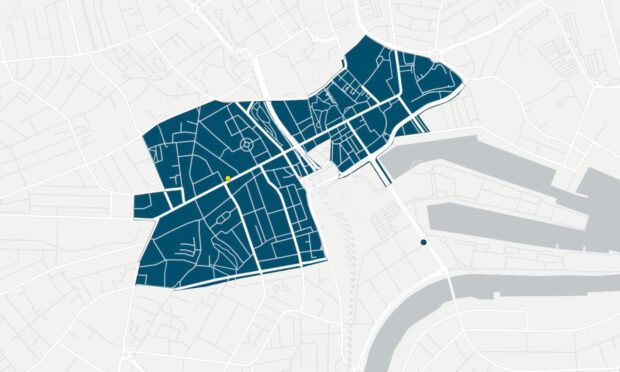

One’s plans for an Energy Transition Zone in Aberdeen is one of a raft of projects aimed at making the north-east a beacon of clean energy expertise, using skills developed in the oil and gas industry.

Ms Lloyd Rees said there was much progress being made, particularly with floating offshore wind schemes – a “sweet spot” for Aker Solutions and its services.

Skills developed by the oil and gas industry are “very relevant” in this nascent market, as well as carbon capture and storage, and hydrogen technologies, she added.

But she also warned there was more to do in terms of strategy to make sure the UK shares a “level playing field” with other countries in terms of research and development.

Oil and gas supply chain firms don’t need a crutch, just support to help them take advantage of emerging opportunities in cleaner energy, she said.

Ms Lloyd Rees co-chairs industry body OGUK, which negotiated the recently announced North Sea Transition Deal – worth £18 billion to the oil and gas sector – as it strives to meet the challenges of net-zero.

Mr Smith said the Covid-19 crisis had highlighted how huge challenges can be overcome in “incredible time” if both “urgency and focus” are applied.

The energy transition presents a different sort of challenge, he said, adding: “The issue we have got here is we are still trying to figure out what the best and most appropriate solutions to these opportunities are.”

The lawyer warned of a likely increase in protest activity confronting the oil and gas industry, despite fossil fuels being “part of the energy, mix for some time to come”.

He also said a squeeze on margins and intense competition in the sector as it tries to adapt will also likely mean more legal disputes.

Mr Close said Edinburgh-headquartered NatWest had a key role to play in the energy transition.

Aligning the group’s “purpose-led” strategy with the aims of the Paris Agreement on climate change will help break down barriers “among the 19 million people, families and customers we serve throughout the UK, so they can rebuild from the pandemic and thrive,” he added.

Mr Close said an established principle that “polluters pay” would put a large part of the onus of energy transition on the private sector, sending out an important message, but it was vital too for policymakers to make sure communities and jobs around the UK are not disrupted and have time to adapt.

The energy transition is “one of the big opportunities of our times,” Mr Close said, adding: “Taking the necessary actions to tackle climate change has the potential to create jobs and touch every family and community.”

Bank’s climate pledge

NatWest recently became one of 43 banks globally to join the Net Zero Banking Alliance, a coalition of financial services companies that have pledged to work together to help deliver the Paris Agreement.

As the banking sponsor of the COP26 climate summit in Glasgow later this year, NatWest says its membership of the alliance “demonstrates its commitment to work collaboratively with its peers, policymakers and other stakeholders to play its part in bringing about significant change at speed and to help build a more climate-resilient economy”.

Announcing the move, chief executive Alison Rose said: “We have already committed to halve the impact of our financed emissions by 2030 and we are now joining the ‘Business Ambition to 1.5C’, cementing our ambition to reach net-zero before 2050.”

Watch the video below for a full recording of the P&J’s latest virtual business breakfast event.