Freeze rates, cut tax and invest in entrepreneurs.

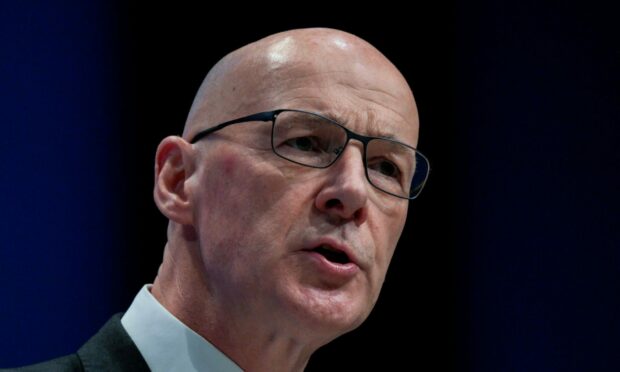

These are the three demands issued by Aberdeen and Grampian Chamber of Commerce (AGCC) to Deputy First Minister John Swinney, who will deliver the 2023/24 budget on Thursday.

The chamber has outlined “priority areas” for the acting Finance Secretary in order to “to drive growth and productivity”.

In particular, the chamber has called on Mr Swinney, who is acting as Finance Secretary while Kate Forbes is on maternity leave, to use tax levers the Scottish Government holds to set “competitive rates” to “encourage aspirational professionals to live and work here”.

This would include “reviewing” lands buildings transaction tax (LBTT), the tax applied to residential and commercial land and buildings sales. It is equivalent to stamp duty in England but rates are higher in Scotland.

Scottish budget a ‘critical test’

AGCC Chief Executive Russell Borthwick said: “We know that businesses have experienced some of the very toughest conditions over recent years, particularly in our region, with an oil price shock, cost of pandemic restrictions, impact of Brexit and spiralling inflation.

“This week’s Scottish budget is a critical test for John Swinney — and the decisions he takes could mean sink or swim for many businesses across the north-east of Scotland in the coming months.”

Mr Borthwick argued freezing the rate known as “poundage” which sets the amounts businesses pay based on the value of their premises would support businesses as well as help boost city centres.

Many businesses in the north-east are hoping taxes known as non-domestic rates will be lower come April 2023.

This emerged in a recent draft revaluation which corrected some very high valuations set in 2015 – albeit the figures released by the assessor revealed some major winners and losers with some facing big increases in business rates bills next year – depending on what Mr Swinney says this week.

“We want businesses to be given the comfort of a rates freeze, against a rising tide of costs, so they can invest for the future. It would also be a welcome boost for our city and town centres and the well-known challenges they continue to face,” he said.

Cut tax

Mr Borthwick added Scotland could improve it’s competitiveness by cutting tax, despite the public finances facing unprecedented pressures.

He said: “We want Scotland to be the most competitive nation in a globally competitive UK — we don’t achieve that by taxing young, aspirational people a hefty surcharge simply for wishing to make their lives here.

“While we respect that a balance has to be found in funding public services, the best way to do that is growing our tax base and creating high-quality jobs, not taxing people through the nose.”

Fund entrepreneurs

The AGCC boss further pointed to the decline in support for business start-ups and support through Scottish Enterprise.

“And finally, in challenging times governments will look at where they can cut their cloth,” he said.

“We are absolutely clear this must not be to the cost of investing in new business start-ups and scale-ups.

“We’ve seen, for example, a £62 million real terms cut to the budget of Scottish Enterprise in recent years — there are better places to seek government efficiencies than pulling the rug out from underneath Scotland’s entrepreneurs who are the very people who can create the conditions for success in our economy over the long term.

“We look forward to a budget this week which prioritises growth, productivity, allows Scotland to compete and lets business lead from the front in delivery.”

…or raise taxes

However, Strathclyde University’s Fraser of Allander Institute’s pre-budget report has suggested the Scottish government could use tax levers to “raise more revenue” to help soften the blow of a “deteriorating” economy.

Setting out concerns that high inflation will “eat away” at living standards over the next two years, the influential think tank highlighted the Scottish Government has some room to manoeuvre.

The institute’s report highlighted the UK Government’s autumn statement will see Scotland receive an extra £1.5 billion over 2023/24 and 2024/25, which will more or less offset the inflationary impacts to the Scottish economy.

Professor Mairi Spowage, director of the institute, said: “John Swinney is getting set to present his first budget in seven years, in what he acknowledged is an unprecedently tricky time for the Scottish public finances.

“The challenges he has been dealing with for 2022/23 ease a bit for 2023/24: there was some additional money announced at the autumn statement which generated around £1 billion of consequentials, offsetting the inflationary pressures on the budget.

“But there is also flexibility that the Deputy First Minister has for the next financial year that were not available to him for this year – the Scottish Government does have tax powers that could be used, if he wishes, to raise more revenue.”