The Bank of England is expected to keep interest rates on hold on Thursday following better-than-expected economic growth in the months since the EU referendum.

Economists predict the Bank’s Monetary Policy Committee (MPC) will hold rates at 0.25%, having been cut to the record low in August as part of a post-Brexit stimulus package worth up to £170 billion.

While MPC minutes from the Bank’s September meeting suggested another cut was on the cards later this year, third quarter gross domestic product (GDP) growth may have quashed plans for further easing.

Howard Archer, chief European and UK economist at IHS Markit, said: “We had envisaged a spirited discussion within the MPC and very likely a split vote – probably in favour of no change in policy.

“However, resilient UK GDP growth of 0.5% quarter on quarter in the third quarter has highly likely ensured that the Bank of England will be sitting tight on monetary policy on Thursday and into 2017.

Consensus estimates were for GDP growth of 0.3%, while the Bank had expected a rise of between 0.2% and 0.3%.

The Bank’s latest forecasts are due to be published in its quarterly inflation report, which will be released alongside its interest rate decision and will be scoured for signs that fears of recession have been put to rest.

Given the latest figures, the Bank is likely to revise up its GDP growth forecasts for both 2016 and 2017 and nudge up inflation expectations after consumer prices jumped 1% in September amid rising clothes and fuel costs.

The Bank is currently pencilling in a rise to around its 2% target during the first half of 2017.

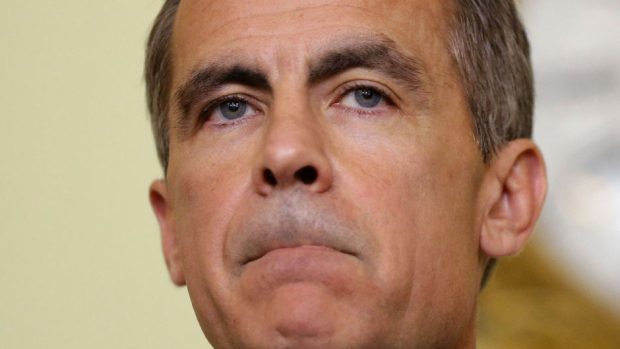

However, key policymakers, including governor Mark Carney, have suggested the bank might allow inflation to overshoot its target if it is driven by sterling weakness.

The weak pound is widely expected to drive up import costs and eventually feed through to consumer prices, following a near 20% fall against the US dollar and 15% drop against the euro since the Brexit vote in June.

The MPC may also choose to hold rates in light of the much-anticipated Autumn Statement on November 23.

Mr Carney last week said monetary policy has become overburdened and that he would welcome Government policies to help boost the economy.

But there are still concerns that the UK could be hit by a slowdown in private investment.

Last month the Bank’s deputy governor, Minouche Shafik, warned that any any reduction in economic “openness” could hit growth.

The Bank is not expected to make any changes to its corporate bond buying or quantitative easing programmes, which has been criticised by the the likes of Theresa May for helping inflate asset prices that she claims disproportionately benefit the rich, while record-low interest rates have hurt savers.

Mr Carney said he “absolutely” had sympathy for savers, but defended bank policy as working to support the entirety of the UK economy.