Aberdeen’s economy is forecast to grow faster than any Scottish city in the next year – outstripping Edinburgh and Glasgow.

Huge growth in the hospitality sector, combined with predictions of a resurgence in the services industry has led experts to suggest year-on-year growth of 3%.

The rise in gross value added (GVA) would make the Granite City’s economy worth £16.1 billion, growing at a faster rate than Scotland’s two largest cities, which both are expected to increase by 2.5%.

In their latest UK Powerhouse study, law firm Irwin Mitchell and the Centre For Economics And Business Research (Cebr) also predict a 1.7% rise in employment – meaning 3,100 more people in work.

Predictions of Aberdeen having the fastest growing Scottish economy by the end of next year ‘testament to north-east’s resilience’

Chief executive at Aberdeen And Grampian Chamber of Commerce, Russell Borthwick, said the figures are “testament to the resilient nature of our region’s economy”.

He added: “There’s no doubt that the north-east has faced some acute challenges over the course of the pandemic, but the region also holds some enviable economic credentials.

“Our expertise in energy is already being applied to a range of exciting technologies that will deliver Scotland and the UK’s net-zero ambitions, such as offshore wind and hydrogen.

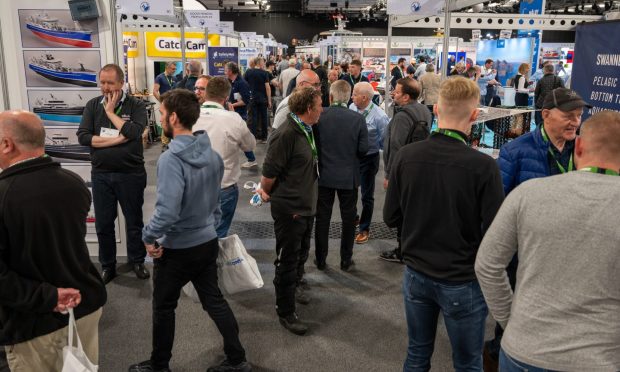

“Alongside this, we’re taking an active approach to build the north-east’s advantage in some of the key growth sectors of the future, like food, drink and tourism.”

The senior lobbyist said Thursday’s Scottish budget would be a “critical moment in our recovery”.

He wants the Covid-prompted business rates relief continued for retail, hospitality and aviation as well as more money put into transition training to ready oil and gas for the move to low carbon.

“Concrete steps like these will give businesses the confidence to invest and transform these positive predictions into reality,” he concluded.

Report highlights the bounce back of UK service sector after year ‘dominated’ by shipping hubs

The recovery of the service sector is a key theme throughout the UK Powerhouse report after a year “dominated” by cities with transport, distribution and storage centres.

After GVA decreased in all cities in 2020 as the coronavirus lockdown measures “played havoc” with business, it was shipping and courier services that benefitted most from the shift in shopping habits to the internet.

Ports like Southampton, which also has import and export routes to the EU, and key distribution centres like Milton Keynes top the list of local economies doing well in the last quarter of this year.

But looking towards the end of 2022, the UK’s service sector – and the cities where the big firms are based – are predicted to bounce back.

Reading, home to Microsoft’s UK headquarters, and the two university cities of Oxford and Cambridge are expected to prosper most from the shift, while Aberdeen – with its energy service industry – is forecast to enjoy the seventh-best growth in GVA.

Growth in employment will be slower though, with the north-east’s regional capital pencilled in for the 15th best growth, with Edinburgh in 10th.

Aberdeen forecast to have the fastest growing Scottish economy by the end of next year ‘heartening’, though hospitality boss highlights plethora of issues still to be overcome

Having struggled through the pandemic, news of a potential 35% growth for hospitality – compared to 3.5% in manufacturing – has been described as “heartening” by an Aberdeen hotelier.

Stephen Gow, general manager of The Chester, told us: “Hospitality businesses have faced some of the largest challenges with lockdowns and specific industry regulations, not to mention recruitment challenges and supply chain problems.

“Staff shortages following the pandemic, exacerbated by the effects of Brexit, have impacted hospitality more than many other sectors and if the prediction is for a significant growth in hospitality in Q4 of 2022, as an industry, we have a long way to go to recruit throughout the supply chain to prepare for this.

“Our business has noticed a trend towards our clients, in particular guests booking rooms, seeking top-end accommodation and we’re currently creating a series of six new suites to satisfy this demand.

“Continual investment in the product we offer to guests is at the heart of our plans for 2022.”