August marks the month when many parents are preparing to bid farewell to their children as they head off for a new adventure at university.

Graduates earn around £10,000 more a year than those who don’t go to university, according to UK government figures. University students also learn to become independent, develop new skills, and meet people from all walks of life.

On the flipside, many students graduate with enormous levels of debt. They might not need to pay it all back, as repayments won’t kick in until they earn more than the income threshold, which is £25,000 for Scottish students or £27,295 for the rest of the UK. However, having tens of thousands of pounds of debt hanging over you can be disheartening.

Paying for university costs out of your own savings could give your child a valuable head start in life, potentially enabling them to get on to the property ladder sooner than their peers. Yet our recent survey found many parents underestimate just how much university costs. If you haven’t factored the true cost of university into your financial plan, you might not be able to make the contribution you’d like.

How much does university really cost?

For people who live in Scotland and go to university in Scotland, tuition fees are £1,820 a year, but Student Awards Agency Scotland (SAAS) will usually pay these fees if your child meets the eligibility criteria. In general, they need to have lived in Scotland for three years before starting their course.

If your child wants to attend university elsewhere in the UK or is a resident of England, Wales or Northern Ireland, tuition fees will cost up to £9,250 per year, or £27,750 for a three-year course.

For those living away from home, there are also living costs to consider. According to Save the Student, these costs average at £795 per month for the typical UK student, which adds up to around £28,620 for a three-year course or £38,160 for a four-year course. Bear in mind that an undergraduate degree in Scotland usually lasts four years, compared with three years in the rest of the UK.

So, depending on where your child chooses to study, you could be looking at a total figure of between £38,000 and £56,000 – and that’s in today’s money. For parents planning ahead, these figures could be closer to £50,000 and £75,000 in 15 years’ time, assuming an inflation rate of 2% per annum.

In a recent survey, Brewin Dolphin found that 35% of respondents thought it would cost between £20,000 and £39,000 to put a child through university, and another 9% thought it would cost less than £20,000. In other words, they underestimated the cost of university in Scotland in 15 years’ time by a huge £10,000 to £20,000, meaning they could find their household finances significantly squeezed.

How to plan ahead

These are daunting sums of money, but they could be achievable if you plan early enough. Brewin Dolphin’s analysis shows that if you invested £200 a month over 15 years, you could build up a pot worth almost £54,000, based on an annual return of 5% after charges. Assuming your child qualifies for free university tuition in Scotland, this could be more than enough to pay for four years of living costs in 15 years’ time.

If you were able to increase your monthly investment to £280, you could potentially build up just over £75,000, which could cover three years’ worth of tuition fees elsewhere in the UK, plus living costs, in 15 years’ time.

Remember, these figures are dependent on achieving a 5% return on your money each year. According to Money Saving Expert, the highest interest rate on a five-year fixed rate savings account is currently 1.66%, so if you leave all your money in cash you could face a significant shortfall.

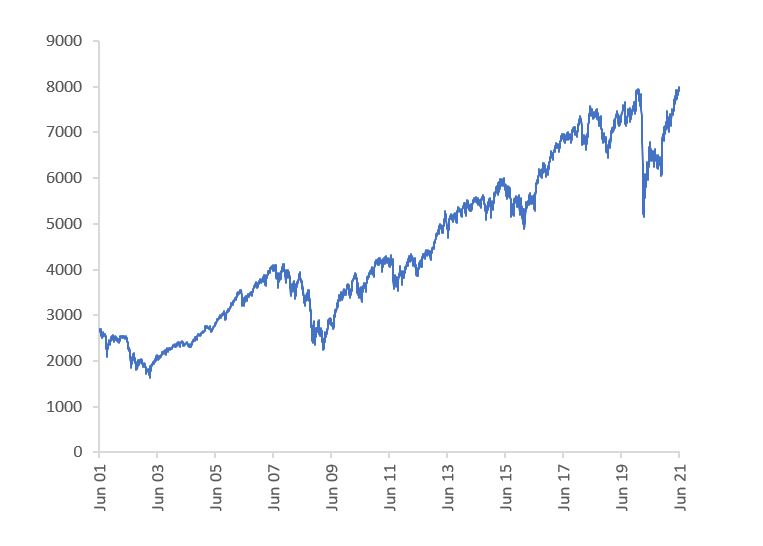

Investing in the stock market gives your money the opportunity to grow over the long term. For example, over the 20 years to June 2021, the FTSE All-Share Index produced an average annual return of 9.79% on a ‘total return’ basis (i.e. combining share price changes and dividend income). Bear in mind this is just an average figure – share price values go down as well as up, as the chart below shows.

It’s important to realise that the stock market carries risk and you can’t rely on past performance as an indicator for future returns. However, history shows that over periods of ten or more years, the stock market tends to perform more strongly than cash, thereby boosting your chances of making a valuable contribution towards your child’s university fees.

If you’re not sure how to get started, speak to a financial adviser. They’ll be able to help you determine how much you need to save each month, and create an investment portfolio that ensures your money is working as hard as it should be. The sooner you begin, the greater your chances are of giving your child a debt-free start to life as an independent, working adult.

For more information or for some friendly advice contact Carrie Keenan on carrie.keenan@brewin.co.uk.

The value of investments, and any income from them, can fall and you may get back less than you invested.

Neither simulated nor actual past performance are reliable indicators of future performance. Performance is quoted before charges which will reduce illustrated performance.

Information is provided only as an example and is not a recommendation to pursue a particular strategy.

Information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness.