The Bank of England met again this week to discuss what it needs to do to tackle inflation.

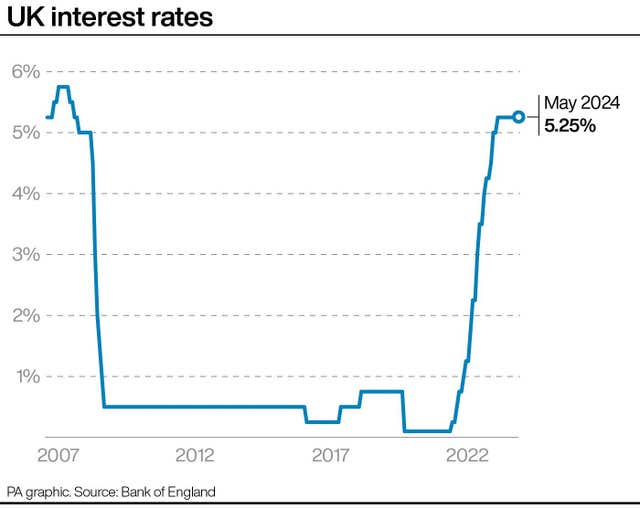

It spent 2022 and most of 2023 hiking interest rates, after sharp rises in the price of energy and food caused inflation to run rampant.

But since September last year, policymakers at the Bank have kept rates fixed at 5.25%, a decision which they stuck with this week.

Here the PA news agency looks at what the decision means, whether rates will fall soon and what the Bank expects to happen to the economy.

– What happened to interest rates on Thursday?

The Bank of England’s Monetary Policy Committee held the base interest rate at 5.25% in May’s meeting.

It is the sixth time it has kept rates unchanged since it stopped voting to increase rates in September.

The rate previously rose 14 straight times from late 2021, taking it from 0.1% to its highest level since the 2008 financial crisis.

– What will the decision to hold interest rates mean?

The base rate dictates how much the Bank of England charges commercial banks to borrow money, which influences what those banks charge customers for mortgages and loans.

Rate hikes in recent years have left mortgage rates much higher than was normal for most of the last decade.

Interest rates staying high means no reprieve for mortgage holders yet, with both variable mortgages and new fixed-rate mortgage deals staying expensive.

About 1.6 million deals are set to expire in 2024, according to the banking trade body UK Finance.

– What about inflation?

Moving interest rates up and down is the central bank’s main way of controlling inflation – the measure of how fast prices increase over time.

Inflation fell to 3.2% in March, down from a peak of 11.1% in October 2022, but still above the Bank’s target of 2%.

The Bank’s governor Andrew Bailey said on Thursday that he needed to see “more evidence that inflation will stay low before we can cut interest rates”.

– Will rates continue to stay the same, or could they go up or down?

The Bank’s Monetary Policy Committee, which makes rate decisions, is due to meet three more times between now and September.

Mr Bailey did not rule out cutting rates at the next meeting in June, stressing that upcoming economic data would be key to making a decision.

He said: “Let me be clear, a change in bank rate in June is neither ruled out nor a fait accompli.”

In this context, a “fait accompli” means something that is set in stone. In short, Mr Bailey refused to commit either way.

– What about the Government?

Some politicians have sought to pressure the Bank to cut rates in recent months, as it would be a further signal that inflation is falling.

With an election likely to be coming later this year, this would be helpful for the Conservatives, who want to show voters that the economy is doing well.

But Mr Bailey said on Thursday: “We are an independent central bank… When we are sitting in a room as the Monetary Policy Committee, we never discuss politics… It isn’t a consideration in that respect.”

– So is the economy doing well?

Mortgage rates are still high – but if inflation continues to fall, that would be a small positive for consumers, as it means prices on everyday shopping items are rising less fast than before.

The Bank’s latest economic report also indicated that gross domestic product is set to grow more than previous estimates over the next two years, driven in part by population growth.

It is still a complicated picture – but Mr Bailey said he is “optimistic that things are moving in the right direction” with the economy.