The company granted a £1.3 million taxpayer-backed loan to set up Aberdeen’s Resident X has been dissolved – casting new doubt on the council’s effort to recoup its cash.

Resident X was launched by Aberdam entrepreneurs David Griffiths and Michael Robertson in December 2022.

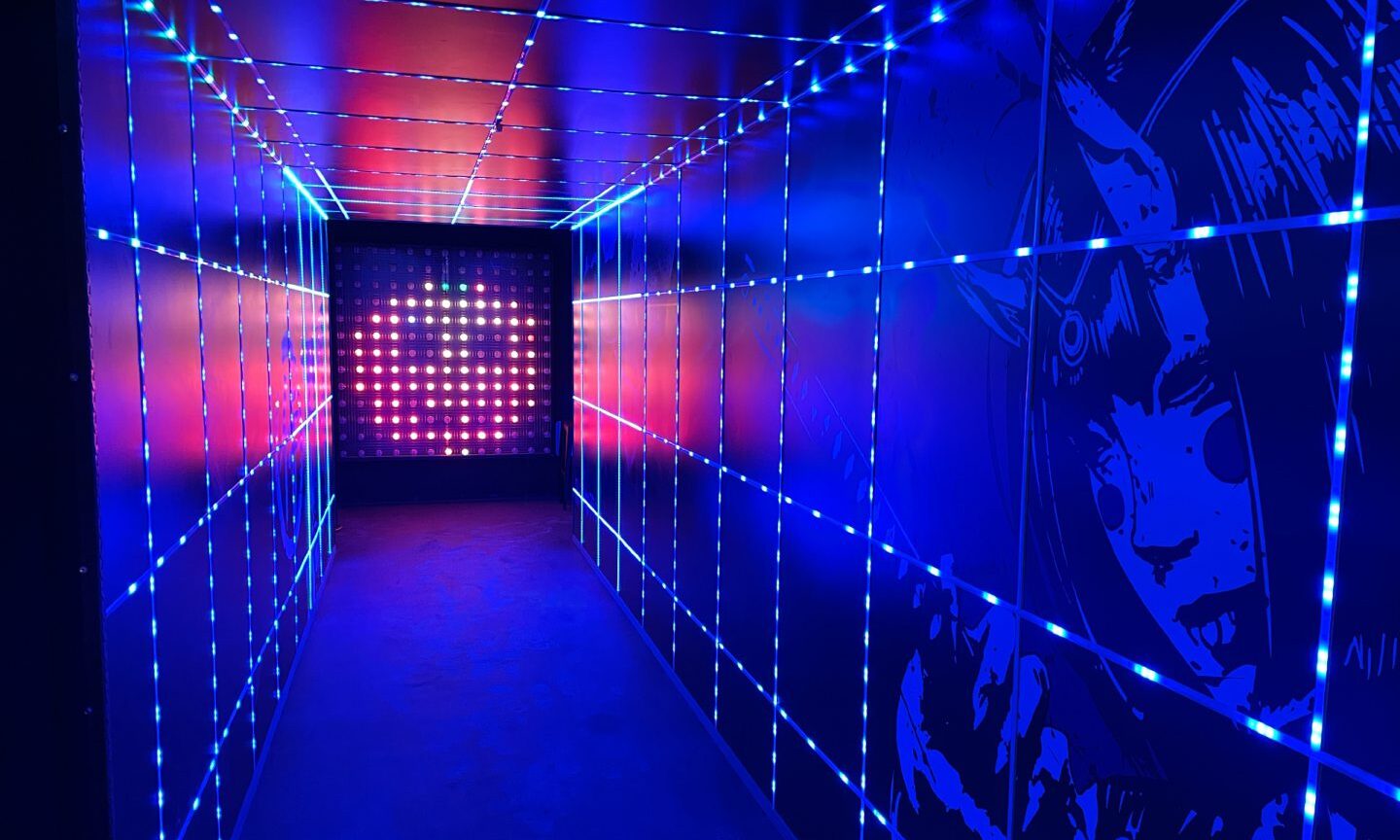

The modern venue was hailed as an “Instagrammers playground”.

The trendy 10,000sq ft space took up two storeys – with space for four street food vendors and two cocktail bars.

Mr Griffiths said he was “convinced” the premises would “positively contribute to city centre regeneration for years to come”.

And, to help make Resident X a reality, council finance bosses fronted up more than £1m to get the venue in its own Marischal Square complex fitted out.

But by September 2023, the local authority admitted the venture had “failed”.

Resident X company was taken over after city centre venue closed

And once the lease was surrendered, the Resident X Ltd company was taken over by Fife businessman Neville Taylor.

This meant the council would pursue Mr Taylor, the sole director, rather than the Aberdeen businessmen, for repayment of the loan.

Those efforts may now have suffered a major setback.

Earlier this year, Mr Taylor was forbidden from acting as a company director for nine years after he admitted trying to assist 12 other firms to dodge their liabilities.

And now AguiaRes Developments – the new name for the scandal-laden Resident X firm – has been struck off.

Pressed for an answer, local founder of the “failed” company David Griffiths refused to say how he’d met Taylor and signed him up to take over.

Our exclusive investigation reveals:

- A watchdog’s verdict that the company was sold to the man behind a scheme set up “to subvert the rules”

- A look at the businesses investigated as part of the probe into Mr Taylor, and how he helped them avoid repayments

- And why the Aberdeen City Council debt is unlikely to be paid back

Who is Neville Taylor and what’s he to do with Resident X, David Griffiths and Michael Robertson?

The Resident X premises have been lying empty for many months.

Previously, The Press and Journal revealed Aberdeen City Council lent the Aberdam pair more than £1.3m to bring the failed vision to life.

A loan of £1m was first agreed in May 2022, provided as capital and a period of free rent.

The headline figure was increased later as construction costs soared, despite Resident X’s company accounts already showing cause for concern.

Subsequent tenants painted a picture of a cost-spiralling development, as David Griffiths and Michael Robertson still ran out of money even with the increased allowance from the taxpayer.

What was the council hoping for with Resident X?

To this day, tight-lipped council chiefs still won’t reveal how much of that public cash they have managed to claw back.

Optimistic city bosses had expected the loan to be repaid over the initial 15-year lease, agreed with the pair who could last only months.

The Resident X premises were later offered to a second, separate operator, Croft Aberdeen, as the council looked to make up some of its losses on setting up the neon non-runner.

But owners Ryan Clark and Andy Eager couldn’t make the Marischal Square venue work either and handed the keys back in September 2024.

David Griffiths and Michael Robertson’s ‘failed’ Resident X firm taken under Taylor’s wing

The rebranded Resident X company became one of more than 400 run by Neville Taylor when he took it on in 2023.

This January, Mr Taylor was banned from running any businesses.

The UK Government slapped him with the sanction for his key role in a scheme designed to get around processes to recover debts when companies go bust.

Taylor was 57 in January when he was disqualified.

But his current age is not clear, as he has several dates of birth throughout 1967 registered with the authorities.

He was listed with Companies House as a director of hundreds of firms when the Insolvency Service handed down the punishment.

It’s understood authorities are now looking at some of those companies who appear to have made use of his services.

New Resident X company was run from unassuming house in Dunfermline

The rechristened Resident X company became one of dozens of businesses registered at 63 Dunnock Road in Dunfermline – an unassuming new build family home to the south of the city.

Meanwhile, another of Mr Taylor’s companies, Aguia Group, was listed as holding “significant control” of the failed firm with Companies House.

The house in the Fife town is one of his main addresses, which also include properties in Herefordshire, Telford and Wakefield.

His abundance of businesses had caught the eye of authorities earlier in 2023 – particularly as the government looked to crack down on people trying to shirk debts including Covid bounce-back loans.

‘No motive for sale to Taylor other than to avoid debts’

The findings of a public inquiry into the running of a haulage firm in the west of England show Taylor had been on the radar for some time.

In May 2023, the Traffic Commissioner for the west of England, Kevin Rooney, probed why Taylor had bought a “debt-ridden” firm for £1.

He wrote: “I can find no motive for the sale to Neville Taylor other than to avoid the outstanding liabilities.

“This motive is confirmed by [the haulage firm’s previous director] when he described the decision to sell the debt-ridden [company] as ‘a no brainer’.”

His published determination on Gregory’s Transport explains the saddled company was sold to a firm called Atherton Corporate in early January 2023, and its sole director was replaced by Taylor.

After some light “background research”, the Traffic Commissioner expanded on Mr Taylor’s portfolio.

Mr Rooney added: “I found Mr Taylor – of Bridge Street, Kington, Herefordshire or of Dunnock Road, Dunfermline – to be listed as a director at Companies House of something in the region of 300 companies, ranging from drama schools, takeaway shops, electricians and now a haulage business.

“His date of birth varies between January, February, April, August and November 1967.

“On many companies, the accounts were showing as overdue.”

Looking at Atherton Corporate too, he found its website advertising a process companies overcome by debt can use to pay off their arrears.

“There were testimonials from service users describing how the service prevented future reputational damage from the insolvency,” Mr Rooney added.

What happened with Resident X accounts after Mr Taylor took over?

And a year after Mr Taylor’s Resident X/AguiaRes Developments takeover, a familiar sequence from across his portfolio began to play out.

In May 2024, he failed to lodge the accounts with Companies House.

Four months later, another documentary deadline was missed.

It’s a paperwork pattern showing up across the 12 Taylor-led companies probed by the Insolvency Service in January.

The P&J understands the dozen were identified as stand-out examples of the prolific Mr Taylor’s tactics… which investigators said were to “avoid legal duties as a director or seek to enable phoenixism”.

The Insolvency Service defines “phoenixing” as businesses or directors trading successively through a series of limited companies, which liquidate or dissolve leaving debts unpaid.

Of the 12 companies looked at, investigators found Mr Taylor had made “little or no attempt” to verify information, or secure records and assets as he took over at the point they’d ceased trading, but had not entered liquidation.

More than £7.6 million in assets across the firms – working in construction, human resources, education, farming, IT and water treatment – had gone missing by the time of their insolvency.

What did Mr Taylor get out of it?

Identifying him as a “key figure” in a scheme Mr Taylor “accepted” was designed to undermine the insolvency system, the government agency found he had been paid more than £250,000 to become sole director of the dozen firms in question.

And he was paid to do that by firm Atherton Corporate, which was headed by John Irvin.

As The P&J sought to speak to Mr Taylor previously, we managed to reach Ayrshire-based Mr Irvin.

He would only tell us Mr Taylor no longer worked for him.

The Daily Record since reported visiting the address of those behind Atherton at Dunfermline’s Dunnock Road recently, only to be met by the owner of the house who operates mailbox services for many reputable companies from there.

The Press and Journal then contacted Expost, a maildrop service listing 63 Dunnock Road as one of its mailboxes.

A representative for the company told us he would be unable to share contact details for Mr Taylor due to data protection laws.

The spokesman added that Mr Taylor was no longer using their address, a step Expost had taken “a while ago when we became aware of what was going on”.

“Any of the companies registered at our addresses with Neville Taylor as a director are no longer facilitated by our company,” he assured.

Atherton companies closed down by authorities

Meanwhile, Mr Irvin resigned from Atherton shortly before the Insolvency Service sought to wind up the company for facilitating the sales of struggling firms and encouraging directors to dispose of their assets before selling.

The probe also found the Atherton firms had incorrectly advised directors they would have no further responsibility for their company or its debts when they were sold and stripped of assets.

That action by the Insolvency Service also closed down Aguia Group – the company holding significant (more than 75%) control in the Resident X firm.

Atherton was found to have charged £18,000 to advise on the sale of companies when their debts were greater than £500,000.

Resident X company now dissolved

Despite the disqualification handed down in January, Mr Taylor was still listed as the active director of Resident X/AguiaRes Developments as recently as mid-April.

But now without an active director – and with Aguia Group also in the mire – Companies House set about the process of winding up Resident X/AguiaRes Developments in September.

The watchdog posted a final notice confirming Resident X/AguiaRes Developments was compulsorily struck off and dissolved on April 22.

That’s a step taken when companies go into default for not filing their accounts or other documents.

At the time it was dissolved, Resident X/AguiaRes Developments’ accounts were more than a year overdue.

It’s understood the strike-off will significantly harm Aberdeen City Council’s chances of recouping the outstanding Resident X debt.

When David Griffiths and Michael Robertson left Resident X, the council did manage to claim all the venue’s catering equipment as a means of grappling back some of its money.

What are the authorities saying about Resident X and Neville Taylor?

Companies House and the Insolvency Service would not comment on the books of individual firms.

But the Insolvency Service’s investigation and enforcement director Dave Magarth did speak out when Taylor’s disqualification was announced in January.

He said: “Neville Taylor hampered efforts by liquidators to identify assets, caused a widespread loss to creditors and breached his duties as a director to act in the best interest of the companies and creditors.

“He also accepted that his conduct was part of a scheme designed to subvert and undermine insolvency legislation.

“By disqualifying Taylor, we are making it clear that we will not tolerate those who avoid their legal duties as directors or seek to enable phoenixism.”

A spokesman said Aberdeen City Council “is not able” to comment as the Resident X debt is subject to a legal process at this time.

The Resident X premises remain resident-less at the time of publishing.

Resident X founder David Griffiths: ‘We’re not commenting, mate’

Resident X had been set up in August 2021, by David Griffiths and Michael Robertson, who closed their latest business – Shot ‘N’ Roll in Trinity Centre – only on Easter Monday.

The Press and Journal asked David Griffiths how he and Michael Robertson came to know Neville Taylor.

David Griffiths said: “We’re not commenting, mate.”

He declined our offer to let him hear our full list of questions, or to have us email them across for him to consider more fully.

Read more:

Exclusive: Resident X boss lifts lid on why million-pound food market failed

Restaurant bosses confirm plans to transform old Union Street bank – but council rules change needed

Conversation