A couple embroiled in a second-home tax row have claimed their main residence is Shetland – despite spending most of their time abroad.

The family are so upset by being forced to pay a 200% council tax rate on their island property, they have taken the matter to court, claiming they live there.

Now, a sheriff has called for a fresh hearing in the case, which could have ramifications on second home tax rules across Scotland.

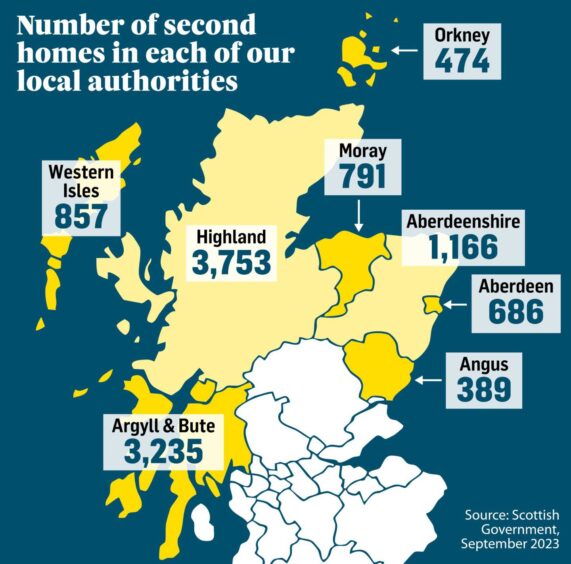

In April 2024, the Scottish Government allowed local authorities to double council tax bills for second homes – and all 32 of have since taken up the offer.

The policy aims to deter people from hoarding properties and thus blocking others from getting on the housing ladder – particularly as second homes got a 50% council discount before the new policy.

‘People are being forced out’

West Scotland MSP Ross Greer previously said: “Homes are not for hoarding”

“Everyone should be able to access good-quality and affordable homes.

“Yet, throughout Scotland, homes used as second properties sit empty for most of the year whilst people who grew up in the same community are forced out by high house prices or a lack of available properties.”

In Shetland, it means a home in band D would usually cost £1,987 in council tax.

It now costs £3,974 for second-home owners, who used to pay £993.50 when the discount was in place.

But one local authority has run into a problem.

Shetland couple’s court case

Shetland Council ordered a couple to pay the 200% rate on their second home – and they protested, taking the matter to court.

And now a sheriff has cast doubt over whether the couple should have to pay the higher rate.

At the centre of the case is the exact definition of the term “main residence”.

The court – the Upper Tribunal for Scotland – has decided to keep the couple’s identity private because their Shetland property is often empty.

The couple bought the house in November 2019.

They spend most of their time abroad because of the man’s employment.

Their children attend school in the country where the man works and they spend some time in the Shetland property during holidays.

Council expects couple to pay 200%

In the court papers, the man alleges that Shetland Council wrongly thought his work abroad did not have a fixed end date.

The court papers say: “There is an intention for the family to live (at the Shetland house) full time in due course, although the timescale for that may be a matter of dispute.”

The couple claim they shouldn’t have to pay the double rate because the Shetland house is their main residence, but the council disagrees.

According to the court papers, a previous case relating to a teacher in Southern England concluded that a main residence is whatever a reasonable person with knowledge of the facts would think it is.

With that in mind, Sheriff Frances McCartney suggested more evidence is needed in the Shetland couple’s case.

The sheriff said: “The question of whether a property is a main or sole residence is fact-sensitive.

“It requires the decision maker to have a clear understanding of the relevant facts.

“In a case such as this, that will include matters such as periods of time which the man and his family reside at the property in Shetland over an annual period, or perhaps over a number of years.

‘It’s not just time spent there that matters’

“(It will also include) the nature of their ties to each property that is in Shetland and abroad.

“(This includes) matters as dentists, doctors, schooling, registration to vote, correspondence addresses for administration issues including banking and insurance; the whereabouts of personal belongings beyond which are needed for day-to-day work.

“This might be, for example, family photographs, heirlooms, items of sentimental value.

“(Other factors include) their living arrangements abroad and the security of tenure at that other property.

“(It will include) the details of the contract of employment that the man is subject to abroad, and his security in relation to that contract and to any visa arrangements that apply to him or family members.

“There is an argument that it is not just a question of time spent at each property.”

Now, a fresh tribunal hearing will consider those factors and decide if the couple should be made to pay the double rate.

Decision could affect all of Scotland

According to Shetland Council, there are 221 second homes – which are defined as homes that are not a main residence but are occupied at least 25 days annually.

A council report claimed the levy would raise an extra £240,000 a year for the council’s general fund – and it benefits the region’s other local authorities too.

If the tribunal finds in the family’s favour, other second-home owners could also bring court challenges claiming it is their main residence despite spending little time there.

Such court successes could hamper councils’ ability to collect the extra levy and incentivise people to buy second properties.

The decision might also impact the collection of a second-home purchase tax, which the Scottish Government recently rose from 6% to 8%.

A Shetland Council spokesman said they could not comment while legal proceedings were ongoing.

The First Tier Tribunal of Scotland will announce its judgment on the couple’s case in due course.