When Her Majesty’s Revenue and Customs (HMRC) commissioners are disappointed it usually means that a great many people are happy.

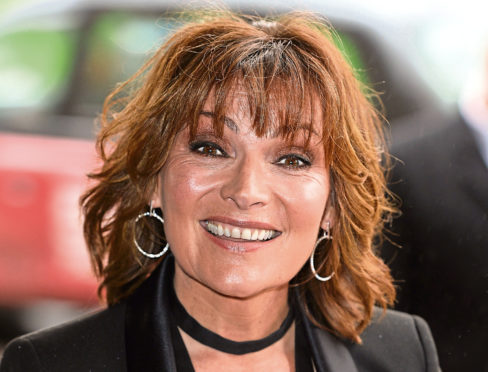

HMRC has said it is “disappointed” and considering an appeal after a tribunal judge ruled that TV personality Lorraine Kelly was not an employee but self-employed.

In 2016, Kelly was landed with a £1.2 million bill for tax and PRSI (pay-related social insurance contributions) when HMRC decided she was an employee of ITV and not a freelance contractor as she had maintained.

But she appealed and Judge Jennifer Dean ruled that her contractual relationship with ITV was a “contract for services and not that of employer and employee”.

It was noted that Kelly remained free to carry out work elsewhere, and she did not receive sick pay, paid holiday or other benefits employees typically have.

The question of whether you are an employee or a contractor does not just affect TV personalities.

Self-employed building subcontractors working largely for one contractor on a site often enter into that grey area, where HMRC could argue they have become an employee.

As the gig economy grows, so does the number of workers who need to consider whether they are contractors or employees.

Those employing freelance staff also need to be aware that workers being treated as contractors can gain employment rights in certain circumstances.

If employers fail to recognise this, they will be breaking the law.

HMRC’s opinion on whether a worker is an employee can have an impact on tax liability and a worker’s ability to write off expenses against tax.

Even if your contract specifically says you are not an employee, HMRC will look at the bigger picture.

UK Government advice says that a worker is likely to be self-employed if most of the following apply:

l They put in bids or give quotes to get work;

l They’re not under direct supervision when working;

l They submit invoices for the work they’ve done;

l They’re responsible for paying their own National Insurance and tax;

l They don’t get holiday or sick pay when they’re not working;

l They operate under a contract – sometimes known as a “contract for services” or “consultancy agreement” – which uses terms such as “self-employed”, “consultant” or an “independent contractor”.

But the position is rarely clear-cut. Workers and employers would benefit from a better understanding of the nuances of definitions used to determine whether someone is an employee or a contractor.