Can I afford to retire? Figuring out if you have enough money for retirement is tricky, but it’s also incredibly important.

-

Some Press and Journal online content is funded by outside parties. The revenue from this helps to sustain our independent news gathering. You will always know if you are reading paid-for material as it will be clearly labelled as “Partnership” on the site and on social media channels.

This can take two different forms.

“Presented by”

This means the content has been paid for and produced by the named advertiser.

“In partnership with”

This means the content has been paid for and approved by the named advertiser but written and edited by our own commercial content team.

We spoke to Martin Welsh and Kieran Taylor, financial advisers and co-founders of Welsh and Taylor Wealth, for their views on affording retirement.

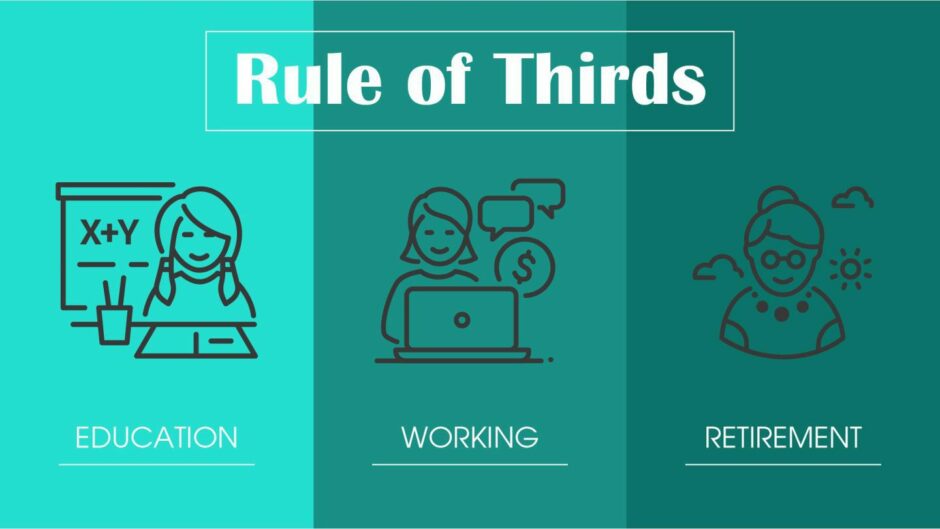

Martin explains this using his ‘rule of thirds’ approach: “If the first third of your life is education, then the second third of your life is working and the last third is retirement. It’s probably only in the middle third that you are earning money, so it is wise to think about saving money to pay for that future, for that final third.”

Because, when it comes to retirement, the best plan of action is to take control. Kieran explains: “In the world of retirement today, there is far less certainty. There are not as many final salary pension schemes anymore and so there is more responsibility on the individual to make sure retirement works for them. The impetus is on the person now and not on a company.”

However, you can seek advice and, importantly, you can arm yourself with the right information to combat any fears or doubts you have about affording retirement.

Here are some essential answers to common questions that may help you make a plan for the future.

6 key pension questions when planning for retirement

1. What pensions do you have?

Martin says: “The starting point is to look at where you are at now and what pensions you might have already in place?

“Usually, people come in with several pensions as a result of having moved jobs a few times.

There are a few ways to find your pensions, including:

- Ask your past employers what pension providers were in use during your employment with them.

- Ask the pension providers (if you remember the names) to confirm any pensions you have with themselves.

- Use the government’s free Pension Tracing Service.

2. How actively managed are your pension funds?

Once you know what pensions you have, find out the finer details to see if they are delivering maximum value for you.

Kieran explains: “Often what happens is you have accumulated a few pensions from former workplace schemes. Generally for these schemes, everyone is put into the same fund. But if you are 20 years away from retirement or if you are looking to retire in the next 12 months, your investment strategies are going to be completely different.”

Martin adds: “Sometimes people are taking more risk than they should be or less risk than they should be, and ultimately, they are just not getting the growth that they deserve.”

The key here is creating a bespoke plan in line with your goals and then constantly reviewing your pension fund, something a financial adviser like Welsh and Taylor Wealth can help with.

3. Should you consolidate your pensions?

Kieran explains: “Most people think it is an all or nothing decision, and that having one scheme will be easier. Sometimes that does make sense. But on the other hand, some people think that having different pension providers means they are not putting all their eggs in one basket.”

Kieran says it is a confusing area and there is no one-size-fits-all answer to this question.

Seek advice to see if consolidating your pensions is worthwhile for you – it could pay off in the long run. Martin says: “Sometimes we will move the pensions across into one managed portfolio that we keep a very close eye on. We review that year-on-year and we see the funds working harder.

“For example, we met with one of our business owner clients and conducted his review last week and his portfolio has grown by 3.4%. Now, when we backtrack to where we transferred it from, if we had not moved it, he would have lost 12.5%.

“So that client is 15.9% better off just because he moved his pension, but the result could have been more dramatic as he would have lost money if he hadn’t moved it.”

4. How much money will you need to retire?

We all have different ideas of what constitutes a reasonable amount of money to live off. Martin says: “Some people want yachts in their retirement and fancy handbags. Other people want to live a really nice, simple lifestyle and a chipper every Friday is a treat.”

Welsh and Taylor Wealth use a cashflow modelling system to compare how much a client has in their pension pot now and how much they’ll need, and then build a plan to address any gaps.

However, this is only as accurate as the information you put into the cashflow modelling system.

One of the best things you can do to determine how much money you’ll need for retirement is to keep a close eye on what you spend now.

Kieran adds: “You are the CEO of your own life, it’s your job to run yourself. You need to do audits every year like big companies do.

“So, how much do you spend on food shopping, your mortgage and car insurance? Then, what do you earn?

“It is simple addition and subtraction, but if you get that bit right, you have far more opportunity to get your retirement plan right. That is what we can help with.”

5. Can you shorten the gap between your pension and how much money you’ll need for retirement?

Once you know how much money you will need for retirement, it is time to project forward to see if your pension will provide enough or if you will have a gap.

Martin advises: “The sooner you know about a gap, the sooner you can start addressing it.

“Let’s break it into bitesize chunks. Let’s make it manageable. It might be setting up a monthly investment into your pension. It might be trying to cut down on certain costs in your personal life or your business, so you can put more into a pension or another tax advantage vehicle that will allow you to build wealth for the future.

“And then it is constantly reviewing that. So every single year, reviewing your plan with an adviser, seeing the progress you have made and making sure that your goals remain achievable.”

6. Is your business your pension?

Don’t fall into the trap of thinking that your business is your pension. You might plan to sell your business and use that profit to fund your retirement, but what if you go bankrupt before then? Or, what if by the time you get to retirement, your business is in a bad place and isn’t worth as much as you hoped?

Kieran explains: “It is important to build your own personal wealth while you are running a business. Business owners know that its fraught with uncertainty, and you might not get what you want for your business at the time you need it the most.”

Martin adds: “However, if you put money into your pension, then no matter what happens to your business, you have still got that pension to fall back on and you should be able to save a lot of tax along the way as well.”

Even if you are planning to sell your business one day, focus on maximising its value and have a succession or exit plan, but make sure to fund your pension at the same time.

Kieran says: “The business world goes up, down, sideway, it can be unpredictable. After 20 or 30 years of riding that rollercoaster, some assurances and certainties in your life will be much appreciated. If you have looked after your personal finances, you can jump off the business rollercoaster and know you will be ok.”

Ask the experts ‘can I afford to retire?’

It is good to have information and ask questions of this nature when you are thinking about funding your retirement.

That’s what Welsh and Taylor Wealth is here for. Martin and Keiran will listen to you and understand your needs, so that they can then develop a bespoke plan that will help you realise your dream retirement. They will take the stress and worry away from you, helping you track your pension pot and manage your funds before and during retirement.

A financial advisor is with you every step of the way in your life’s journey.

Welsh & Taylor Wealth provide access to a range of useful tools designed to help you financially plan for your dream retirement.

Click here to download a complimentary Retire at 55 guide to find out what Welsh & Taylor Wealth can do to help now.

Welsh and Taylor Wealth is an Appointed Representative of and represents only St. James’s Place Wealth Management plc (which is authorised and regulated by the Financial Conduct Authority) for the purpose of advising solely on the group’s wealth management products and services, more details of which are set out on the group’s website.

The ‘St. James’s Place Partnership’ and the titles ‘Partner’ and ‘Partner Practice’ are marketing terms used to describe St. James’s Place representatives. Welsh & Taylor Wealth is the trading name of WTW Ltd.