The north-east business community is famed for its pioneering entrepreneurial spirit.

It has frequently shown determination and resilience in the face of the upturns and downturns synonymous with a cyclical oil and gas industry.

These traits will be vital as we seek to reposition the region as a globally recognised energy cluster, focused on the acceleration on new and green energies.

The scale of the opportunity before the region is massive.”

We are all acutely aware the coming years will see fundamental and essential shifts in how energy is generated.

There is widespread recognition of the need to decarbonise industry in the face of a pressing climate emergency.

The scale of the opportunity before the region is massive. A majority of all successful bids in ScotWind, the world’s largest commercial offshore wind leasing round, are within 100 nautical miles of Aberdeen.

Critical mass

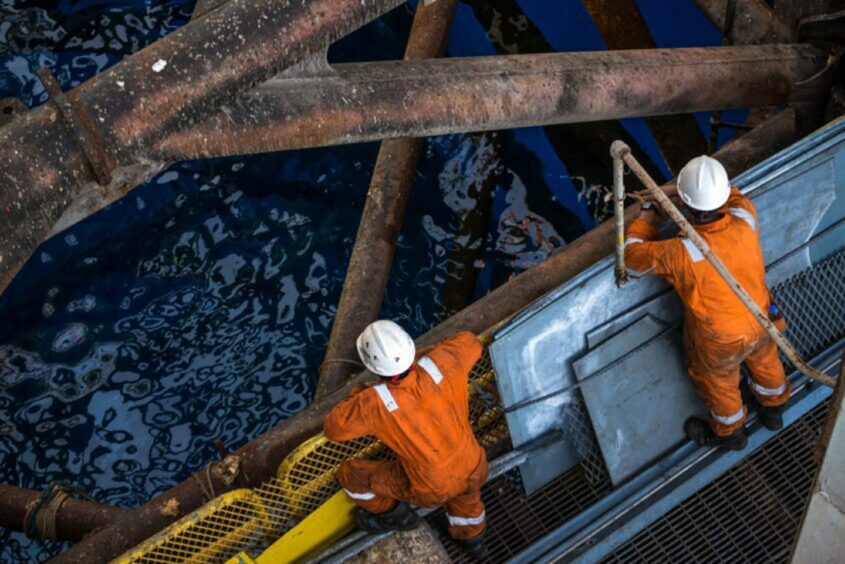

We already have a critical mass of diverse energy companies with the experience to support and deliver these complex projects.

And the region is ideally placed to support the high-value manufacturing, operations, maintenance and innovation required to deliver new developments at pace.

The area is also ideally placed to deliver a substantial proportion of the UK’s future low carbon hydrogen requirements – 20% of the 2030 target – as a result of a number of current and near-future projects.

These include the BP and Aberdeen City Council Hydrogen Hub joint venture, the innovative 10 megawatt ERM Dolphyn offshore floating hydrogen project at the Kincardine offshore windfarm and Vattenfall’s exciting Hydrogen Turbine 1 project.

The waters of the Buchan coast provide world-class storage sites for large-scale CO2 sequestration, equating to 24 gigatonnes of storage capacity within a 31-mile radius of the Acorn carbon capture and storage pipeline infrastructure.

I hope the UK Government gives the Acorn project its backing as a priority.

Transition a ‘staged process’

These represent a transformational pipeline of projects but the reality is these technologies simply aren’t scalable just now.

We must not forget the transition is, by definition, a staged process. If we are to continue to meet our energy security needs by as much domestic routes as possible, we require reliable supplies of oil and gas for years to come.

The future of that sector in the UK has become entangled in political wrangling.

The Scottish Government’s “presumption against future exploration” and the UK Government’s overly severe application of the windfall tax, or energy profits levy, is having an adverse impact on investment and jobs – precisely at the time we need to be maximising domestic energy security and supporting transition at pace.

In its latest Business Outlook Report, trade body Offshore Energies UK provided stark evidence on this very point.

It highlighted the cost of imports soared to £117 billion last year, from £54bn in 2021, breaking the £100bn barrier for the first time.

50 years of world-class know-how

And it warned UK consumers and businesses may face similar import bills in this and future years, especially if the windfall tax imposed on UK oil and gas operators remains unmodified.

The reality is this is not a binary choice between oil and gas and new energies.

Our ability to accelerate new energies is inextricably reliant on drawing on the critical mass of skills, infrastructure and financial capital built up through 50 years of a world-class oil and gas industry.

Retaining fossil fuels in the medium term doesn’t mean continuing to pollute the environment. Rapidly developing technology makes it possible to significantly reduce the carbon footprint of oil and gas.

In 2021 the UK Government and oil and gas industry agreed the North Sea Transition Deal to reduce emissions by 25% of 2018 levels by 2027, rising to 50% by 2030.

A year later the industry had cut carbon emissions by 11% of the 2018 level, equivalent to taking a million cars off the roads for a year.

‘Shoulder to the wheel’ effort now required in Aberdeen

Fossil fuels currently account for 44.2% of UK electricity generation, compared with 40.5% from renewables. As such, it’s impossible to dispense with them just yet.

The best policy is to exploit them domestically, rather than import them.

Its proximity to the geology of oil and gas in the UK North Sea has given Aberdeen a natural geographical advantage in capitalising on the economic spoils of oil and gas.

This is not necessarily so for renewables so to ensure the city cements its position as a globally renowned new energy cluster requires a collective shoulder to the wheel, across government and industry.

We must have a sensible approach from our policymakers – one that recognises energy transition cannot happen overnight and appreciates the key to its acceleration is by unlocking the skills and experience of our world-class oil and gas industry.

Martin Gilbert is co-founder and former chief executive of Aberdeen Asset Management and chairman of AssetCo, Toscafund and Revolut.

Conversation