With the period of mourning for Queen Elizabeth II now finished, Westminster will resume its push to tackle the UK’s economic woes.

The finishing touches are being put on a mini-budget, due to be delivered on Friday, which is likely to give further clarity on Liz Truss’ tactics to help households and businesses.

Most of the nuggets of interest for the oil and gas industry were likely unveiled by the new prime minister during her energy plan launch earlier this month.

But one issue that could rear its head this week is a review of IR35 laws.

In the early parts of her campaign, Ms Truss pledged to review controversial changes to the off-payroll working tax rules that went live in 2021.

Deemed by many to be overly complex, the reforms apply to contractors and the firms that use them, creating a real headache for oil and gas companies.

Pledge may not amount to much

It had been hoped that a change of government would allow for a review of the current IR35 laws, but Brian Rudkin, an employment expert at Johnston Carmichael, warns industry not to hold its breath.

He said: “The government sent out a loud and clear message in July this year that now is not the right time for major reform of the tax rules governing the status of workers for tax and national insurance contributions.

“These rules are fundamentally at the heart of the IR35 regime and so even if, as promised by Liz Truss, an IR35 review is announced in the forthcoming emergency budget, the outcome of such a review is more likely to involve minor changes than complete reform or abolishment of IR35.”

Chief executive of insurance provider Qdos, Seb Maley, echoes Mr Rudkin’s sentiments, adding that Ms Truss has given “no indication” about any specific alterations to the rules.

He said: “The main concern among contractors and businesses is that Truss’s promise to review IR35 was just a tactic to win votes and any subsequent review will turn out to be lip service.

“After all, there have been numerous reviews, consultations and inquiries into the IR35 legislation over the years, with very little change resulting from any of them.”

A complex situation

Her Majesty’s Revenue and Customs (HMRC) brought in the changes for the private sector on April 6, 2021.

Since then, the onus has been on firms to decide whether a contractor is self-employed, or whether are used in the same way as a full-time employee.

If they are judged to be the latter, they must pay the same amount of tax as a regular operative.

For those contractors that fall within the IR35 rules, meaning they are full-time employees, it has meant a big dent in their pre-reform wage.

Companies also face hefty fines if they are found not to be adhering to the new rules, even if it is accidental or down to a difference of opinion.

Research published earlier this year revealed that the intricacies and risks of the changes are putting businesses off using contractors.

Mr Rudkin said: “It is hoped that any review into IR35 goes deep enough to allow the government to properly understand the complexities and practical difficulties that businesses are facing in applying the rules as they stand.

“Addressing some of these commercial and day-to-day challenges will be an important step forward in reducing the burden of IR35 for engagers, labour providers and contractors, aligned with Liz Truss’ pledge to cut red tape for businesses.”

Aggravating labour shortage

In addition to dissuading employers from using contractors, it has led to a reduction in their number generally.

Around half of freelancers have mulled closing their businesses, retiring, or leaving the UK entirely due to IR35 reform, according to research.

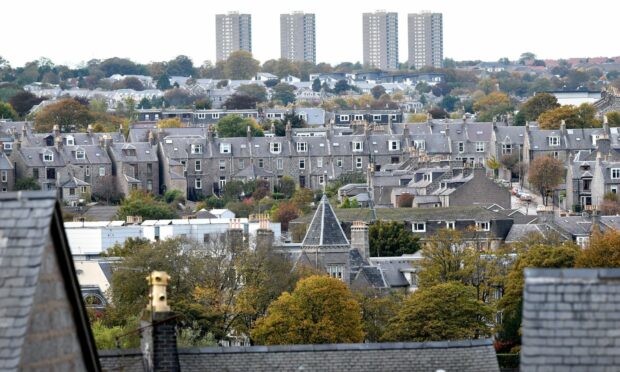

This comes as the oil and gas industry tries desperately to attract skilled workers, to aid both the North Sea energy security push, and the energy transition.

A lack of available workers, due in part to Brexit, is already hampering the sector’s ability to ramp up activity, and it is only tipped to get worse.

Mr Rudkin said: “IR35 isn’t the only cause of the energy sector’s current skills shortage but making IR35 simpler and easier to manage on a practical level would help to make it easier for businesses across the sector to onboard contractors and, importantly, for the sector to retain and attract experienced resource both in the short and the longer term.”

Contractors crucial to energy push

As part of her plans to overhaul the energy system, Ms Truss declared her want for the UK to be a net energy exporter by 2040.

It’s a mammoth ask, given the current deficit, and Matt Fryer, managing director at Brookson Group, says contractors will “play an essential role” in rebooting the energy industry.

He said: “It is essential that the Chancellor uses the emergency budget to unlock the flexible labour market.

“A number of very practical tax cuts for the self-employed would certainly help this sector of the economy to bounce back from recent economic turbulence. These could include revoking the planned hike in corporation tax and reversing Rishi Sunak’s NI increase from earlier in the year, which hits contractors working for umbrella companies twice as hard.

“The Prime Minister has also promised to review the IR35 tax laws for off-payroll workers, but it is unlikely she will reverse the recent changes which make hiring businesses responsible for ensuring tax compliance.

“In the short term, the best we can hope is that a review will encourage HMRC and the Treasury to work more closely with employers and SMEs to provide more focussed guidance on how to successfully navigate the legislation.”