Shell delivered a record $40 billion (£32.2bn) profit in 2022, the highest in its 115-year history.

Critics and campaigners branded the figure as “sickening” and called for even further windfall taxes to be imposed.

Others argued that cash handed back to shareholders should instead by used to fund the move away from oil and gas to green technologies that support the UK and Scotland’s aims to be ‘net zero’ carbon emitting nations.

The numbers

Overall global pre-tax income of $64.8 billion in 2022 comes as Russia’s invasion of Ukraine allowed the energy giant to hand shareholders unprecedented returns.

The UK company also posted record fourth-quarter profit of $9.8 billion on the back of a strong recovery in earnings from its international liquefied natural gas (LNG) trading, beating analyst forecasts for an $8bn profit.

The firm also announced it would spend $4bn billion in a new program to buy its own shares over the next three months.

In his first quarterly results announcement since taking the top role, Shell chief executive Wael Sawan said the firm should be viewed as a “trusted partner through the energy transition”.

In a statement, he said: “Our results in Q4 and across the full year demonstrate the strength of Shell’s differentiated portfolio, as well as our capacity to deliver vital energy to our customers in a volatile world.

“We believe that Shell is well positioned to be the trusted partner through the energy transition.

“As we continue to put our ‘powering progress’ strategy into action, we will build on our core strengths, further simplify the organisation and focus on performance.

“We intend to remain disciplined while delivering compelling shareholder returns, as demonstrated by the 15% dividend increase and the $4 billion share buyback programme announced today.”

Pay for green energy not shareholder benefits

The profit figure put the spotlight on Shell’s investment in the shift to the cleaner energy as well as how much it should pay in UK tax where the spiralling cost of oil and gas has heavily impacted consumers.

In rewarding shareholders, Shell is adding fuel to the fire of those that want to see a harsher windfall tax enacted on the sector.

Julie Palmer, partner at Begbies Traynor, said: “At a time where businesses and consumers are grappling spiralling energy bills, record profits like these will certainly reignite calls for higher levels of taxation for the beneficiaries of such an inflationary environment – despite windfall taxes having already being imposed.

“If ‘big oil’ companies like Shell are to avoid further tax hits, they need to show that profits like this are being used to fund a transition to green renewable power.

Julie Palmer, partner at Begbies Traynor

“If ‘big oil’ companies like Shell are to avoid further tax hits, they need to show that profits like this are being used to fund a transition to green renewable power.

“Like oil, record profits like this won’t last forever, and Shell needs to make sure it keeps ahead of the curve in a world target to net zero.”

Stuart Lamont, investment manager at RBC Brewin Dolphin, said: “Shell’s record profit for the year will only intensify calls for more to be done to claw back profits from energy companies in the current environment.

“The politics of it all aside, the events of the last year have seen Shell’s earnings, cashflow, and debt position improve significantly and shareholders are benefitting through another share buyback programme and an increased dividend.

“Looking ahead, however, investors will want a sense of what the future strategic direction of the company will be under the new CEO.”

Shell fights back against demands

Despite its profits, UK Government efforts to cut in on them in a windfall tax – known as the Energy Profits Levy (EPL) – have proved unpopular with the company.

Shell warned in November that it would evaluate plans to spend up to £25bn in the UK over the next decade following the government’s decision to increase tax on oil and gas producers.

Supporters highlight that most of Shell’s profits come from global operations and not in the UK, adding that UK-headquartered companies like Shell and BP have the heaviest tax burden on their operations.

Combined with other duties, the EPL took the headline rate of tax on oil and gas companies to 75%.

In the UK, Shell’s chief financial officer Sinead Gorman says the company paid over “$100 million of cash tax” last year.

That is expected to rise to more than $500 million for 2023 due to the hike in the EPL.

Ms Gorman told an investor call that less than 5% of Shell’s global revenue is made in the UK.

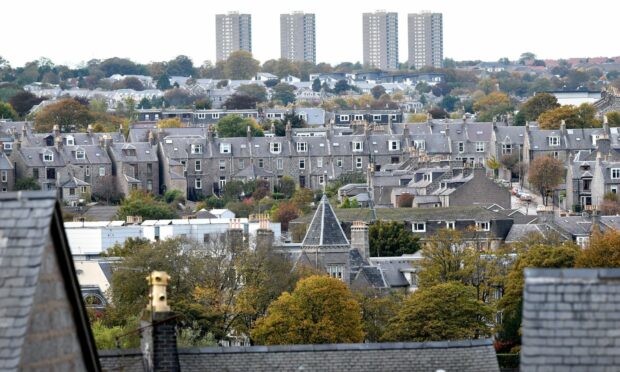

In Aberdeen, Shell is currently moving from its home in Tullos to city centre offices, reflecting its smaller North Sea footprint.

The firm sold more than half of its North Sea assets to Chrysaor – now known as Harbour Energy – in a $3.8bn deal in 2017.

Both Labour and the Liberal Democrats called for a “proper windfall tax” to be imposed on the oil and gas sector to help struggling households.

But trade body Offshore Energies UK has accused them of offering “false hopes”, underlining that Shell’s profits are global, and therefore can’t be touched by UK taxes.

Mike Tholen, OEUK’s director of sustainability, said it was wrong to offer such false hopes to consumers: “These calls for extra windfall taxes on profits made outside the UK make no sense and could never be implemented.

“The UK is subject to global tax agreements which say that it cannot tax profits made by companies outside of the UK.”

‘Sickening’

Environmental groups are accusing Shell of “profiteering from climate destruction and immense human suffering”.

Activists were also quick out of the blocks, targeting the group’s London headquarters at first light on Thursday morning.

The Scottish Green party labelled the company’s results as “sickening”.

The energy and environment spokesperson, Mark Ruskell said: “Many will be sickened and angry by the obscene level of profits reported by Shell and the other oil and gas giants, who have enriched themselves at the cost of our planet.

“There can be no justification for a system that allows this kind of profiteering, especially when so many are suffering. It is a sign of how broken things add and why they need to change.

“It underlines exactly why we need to break the link between fossil fuel prices and bills, and support the many households and families who have been plunged into fuel poverty over the last 12 months.

“With the climate emergency worsening, we don’t have time to waste. Our world is on fire. A windfall tax full of loopholes is not enough. We need action from every government and a generation-defining investment in renewables.

“Renewable energy is the cheapest and cleanest energy available. If we are to build a cleaner, greener and better future then that is what we need to be investing in. We must move on from oil and gas and finally start leaving it in the ground.

“Yet, at the same time as we are taking important steps here in Scotland, we are being held back by a Tory government that is more interested in the bumper profits of its friends in the fossil fuel industry than it is with our environment.”

Mr Ruskell added: “Whether it is the oil and gas industry in Aberdeen, or the Mossmorran processing plant in Fife, we need an urgent and just transition for our communities and workers. Not just here in Scotland, but around the world.”

It comes after four Greenpeace protestors boarded the White Marlin vessel earlier this week and “occupied” the Shell Penguins FPSO it is transporting.

Penguins is destined for the North Sea, where it will be the oil giant’s first new manned vessel for the UK in 30 years.

Our four brave activists occupying the 34,000 tonne oil platform on its way to the North Sea have a message for Shell's CEO 👇🏽

They are responding to its announcement of record annual profits #MakeShellPay pic.twitter.com/A7gcMjI51A

— Greenpeace (@Greenpeace) February 2, 2023

Penguins is destined for the North Sea, where it will be the oil giant’s first new manned vessel for the UK in 30 years.

UK Government wants Shell to invest in UK green energy

Mick Lynch, general secretary of the Rail, Maritime and Transport (RMT) union, said of Shell’s profit announcement: “Profits and dividends on this scale when millions of people cannot heat or eat a square meal in their homes demonstrates the remorseless and unjust nature of this industry.

“We’ve made some progress through the Energy Services Agreement but pay and conditions for the thousands of offshore oil and gas contractors who actually do the work to keep oil and gas flowing from under the North Sea have not improved much since the collapse of the oil price in 2014, since when over 200,000 jobs have been lost.

“Yet for the likes of Shell, BP and Total it’s back to record profits and dividends.

“This industry is out of control, and it must be taxed, regulated and owned in the public interest, or private individuals will sail off to their tax havens with the profits generated off the backs of our members taking with them any notion of a Just Transition for workers to a zero carbon economy.”

TUC general secretary Paul Nowak said: “The time for excuses is over.

“The Government must impose a larger windfall tax on energy companies. Billions are being left on the table.

“Instead of holding down the pay of paramedics, teachers, firefighters and millions of other hard-pressed public servants, ministers should be making big oil and gas pay their fair share.”

No 10 said that while it “absolutely” understood people’s anger over Shell’s record haul, the current windfall tax strikes a balance between helping with energy bills and encouraging investment.

The Government would “of course” want to see oil and gas giants invest more in the UK, Downing Street has said.

However, there are no plans to increase the windfall tax on oil and gas giants, Downing Street has indicated.

Asked whether Shell is investing enough, the Prime Minister’s official spokesman told reporters: “Of course we’d always want to see companies invest more in the UK, certainly.”

Pressed on whether Rishi Sunak is concerned that Shell appears to be ploughing much of its record profits back into dividends and share buybacks, the official said: “It’s not for me to comment on decisions made by individual companies.

“Obviously, we are seeing Shell make substantive investments here in the UK. And obviously their profits announced today our global profits, includes all the profits made outside of the UK.”

The official also said: “We have made clear that we want to encourage reinvestment of the sector’s profits to support the economy, jobs and energy security. And that’s why the more investment a firm makes into to the UK the less tax they pay.”

Conversation