News of Bon Accord Centre in Aberdeen being sold has sparked a reaction from readers on social media.

The Press and Journal reported the news yesterday and readers’ comments have been flooding in.

EP Properties, led by Zakir Issa – brother of EG Group bosses Mohsin and Zuber, who own Asda in a joint venture with TDR Capital – has purchased the mall from administrators.

It is not yet known what the plans are for Bon Accord with readers unsure what it means for the future of the shopping centre.

What you think

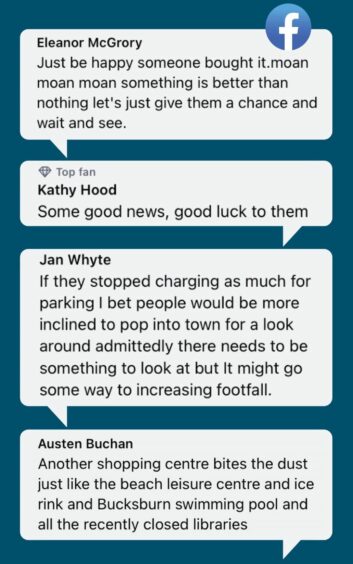

Posting on Facebook, Belinda Ross said: “Brilliant news let’s hope there will be the same shops back again and obviously shops that are well priced that will attract customers.”

Mandy Macdonald replied: “They won’t do it without reducing the rents.”

Hossa Skandary-Macpherson said: “I see a positive outcome! Prosperity! Aberdeen will become a vibrant city again and a tourist destination before heading to Highlands.”

Austen Buchan said: “Another shopping centre bites the dust just like the beach leisure centre and ice rink and Bucksburn swimming pool and all the recently closed libraries.”

Rent charges to rise?

Lynne Copland said: “In 2003 it sold for £31million….this deal is around £10million…no profits made…hence I’m thinking where are they going with this??”

Ian Anderson said: “Going by the experience of other cities, it would not surprise me if they rack up rental charges, driving all the shops out and leaving them with a white elephant which they will abandon and the council will demolish.”

A current tenant within the mall, who did not want to be named, said: “We got informed mid March on the sale and signed the update of the leases.

“We haven’t had direct communication with the owners and they haven’t shared with us their plans for the centres.

“We’re currently in lease negotiations so I can’t say anymore at this point.”

‘Good news’

Meanwhile, Aberdeen Inspired chief executive Adrian Watson described the sale as “good news” for the city centre.

“It is reassuring to see that the Bon Accord Centre sale has now gone through and in welcoming the new owners we are excited to see their ambitious plans to build this business, which so many people in the city and north-east hold such affection for.

“Respecting the challenges to bricks and mortar retail generally, this is good news for our own city centre and we look forward to continuing to work closely with the Bon Accord team on a number of fronts”, he said.

Aberdeen and Grampian Chamber of Commerce policy and marketing director Ryan Crighton said: “Hopefully this is the start of a new chapter for the mall, which is such an important part of our city centre.

“It looks like the price paid is a fraction of what the centre was worth just a few years ago, so I hope we see substantial investment in the diversification of the centre to broaden its appeal for today’s consumers.

“A successful Bon Accord Centre means a successful city centre, so the whole city is rooting for the new owners and we wish them every success.”

Mr Issa’s company, EP Properties, has a commercial property portfolio across the UK, with the only other Scottish site being Blantyre Industrial Estate near Glasgow.

The company’s website says it is a UK-based investment company which specialises in acquiring, letting and selling commercial property.

EP Properties and Bon Accord Centre have both been approached for comment.