To celebrate the finale of the football season, the team at Gary Walker Wealth Management had a very enjoyable evening with our friends at Aberdeen FC.

As well as getting a chance to give Kelle Roos some goalkeeping tips – just joking – we were able to talk with invited guests and players about financial planning for children.

We speak to a lot of clients about investing for their children, and it is a very important part of financial planning.

Building a nest egg for your kids doesn’t need to break the bank and could make a huge difference to their future.

Parents, grandparents and other family members are often keen to give children a head start in life for when they reach a certain age. Buying a first home or helping them to start their own business can be made far more affordable by starting to save early.

Introducing the concept of saving and the benefits of investing for the long term to your child at an early age is also a great way to encourage smart money habits long before they become adults.

There are several savings methods that can help a child’s money to potentially grow as fast as they do.

Junior Isas

A junior individual savings account (Jisa) is a very attractive option.

There are two types, a junior cash Isa and junior stocks and shares Isa.

Anyone can pay into the Jisa – parents, grandparents, godparents, friends or other family members, although only parents and legal guardians can actually set one up.

Like all Isas, you won’t pay capital gains or income tax on them.

You can pay up to £9,000 into a Jisa during the 2023-24 tax year.

Money held in a Jisa is locked in until the child reaches 18, after which it can be converted into an adult Isa and continue to enjoy the same tax advantages.

Pension fund

Starting a pension for a child, many decades away from their retirement, may sound like an odd thing to do, but can make a big difference. Even small amounts invested over decades could grow into a substantial pot over time.

Children can have a pension as soon as they are born. Setting one up can bring significant tax advantages since, as you save, the UK Government adds a generous tax relief.

Including the relief, a total of £3,600 can be contributed into a pension scheme in any single tax year.

Building a nest egg for your kids doesn’t need to break the bank and could make a huge difference to their future.”

Just like Jisas, a parent or legal guardian must set one up. But anyone can pay into the pension.

Saving this way may help also mitigate an inheritance tax (IHT) liability. Payments from grandparents, for example, may be covered by the annual £3,000 IHT gifting allowance, or the exemption for payments made out of income.

A financial adviser can help you discover the smartest ways to save for your children or grandchildren.

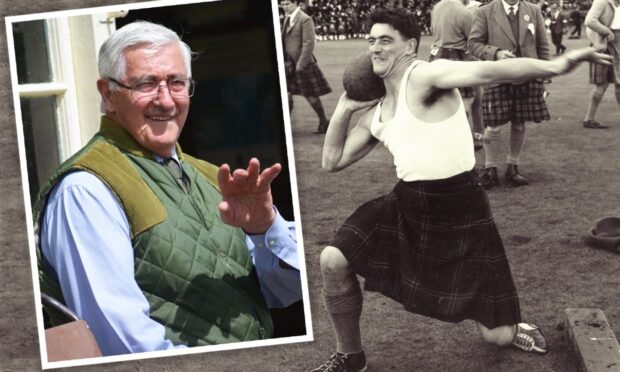

Gary Walker is the founder and managing director of Aberdeen firm Gary Walker Wealth Management, a principal partner practice of St James’s Place.

Conversation