Gillian McColgan, tax director at Johnston Carmichael, one of the top 10 accountancy and business advisory firms in the UK, discusses the impact of recent government budgetary announcements on the north-east of Scotland.

-

Some Press and Journal online content is funded by outside parties. The revenue from this helps to sustain our independent news gathering. You will always know if you are reading paid-for material as it will be clearly labelled as “Partnership” on the site and on social media channels.

This can take two different forms.

“Presented by”

This means the content has been paid for and produced by the named advertiser.

“In partnership with”

This means the content has been paid for and approved by the named advertiser but written and edited by our own commercial content team.

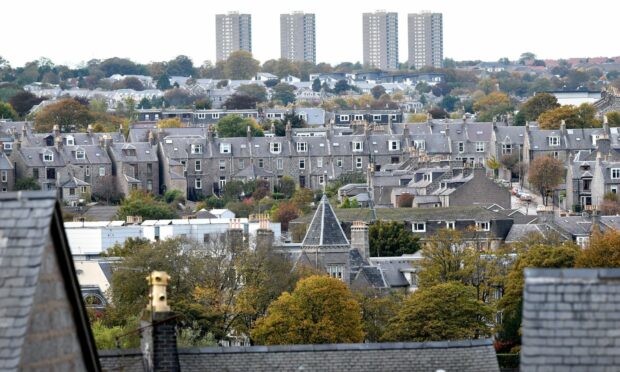

The north-east has been at the centre of some significant UK government announcements in recent months, including funding for carbon capture technology and the granting of new oil and gas licences.

But when it came to the Autumn Statement there was little of note for the region, as the Chancellor opted for a steady-as-she-goes approach that aims to boost British business and make work pay.

The much trailed ‘full expensing’ tax break was an extension of a measure already in place until 2026 but will largely benefit larger and successful companies. Businesses need to be profitable to claim the tax relief on offer for investment in qualifying plant and machinery.

That said, it provides some certainty for corporates considering substantial capital investment. It could also have the indirect effect of shoring up operators in the supply chain, especially those involved in infrastructure projects required for the energy transition.

Despite a focus on net zero, few of Jeremy Hunt’s 110 measures will have any more direct impact on north-east businesses than those in other regions.

That said, with a significant proportion of businesses in the region active in R&D, proposals for a new and ‘simplified’ R&D tax relief, combining the existing research and development expenditure credit and SME schemes, will be of interest. However, these reforms are unlikely to be welcomed by the majority of smaller businesses, which could see a significant reduction in R&D tax relief.

The winners, again, will be the largest companies, which will see an increase in relief and enhanced ability to claim for subcontracted R&D. Further still, much of the potential benefit of a single merged scheme is undone by the need for a parallel scheme for ‘R&D intensive’ SMEs. Businesses that are unsure about the new rules or wish to maximise opportunities should seek specialist advice.

Any larger, international groups that had been hoping for a delay in the implementation of new OECD Pillar 2 reforms on a global minimum tax rate will be disappointed. The government recommitted to implementing this in line with the expected timeframe and responded to calls for delay by listing many other countries that are implementing it this year and explained that if the UK delays the additional tax will be collected by those other countries.

The Undertaxed Payment Rule (UTPR) will be brought into UK legislation for accounting periods beginning on or after December 31 2024, and the existing legislation for the Multinational Top-up Tax and Domestic Top-up Tax will go ahead as planned with effect from January 1 2024. These rules only apply to groups with consolidated turnover of over 750 million Euros.

A cut in the main rate of National Insurance from 12% to 10% from 6 January 2024 will lift net wages at a time when households are facing increased energy costs. A rise in the National Living Wage next April and its extension to workers aged 21 and over will also have a positive impact on take-home pay. Unfortunately, the flip side is it will increase costs for employers at a time when they continue to grapple with higher costs across the board.

At least there was early Christmas cheer for the hospitality sector with the announcement of a freeze on alcohol duty until August 1 2024 that has been welcomed by our Scotch whisky industry as providing much needed stability.

We’ll drink to that.