A Caithness agricultural contractor who tried to swindle the taxman out of £36,000 with error-strewn fake invoices has avoided prison.

Ian Miller, formerly from Wick but living in Towerhill Road, Inverness, appeared for sentence at Inverness Sheriff Court and admitted the fraud amounting to £36,514.

The court previously heard how he submitted false VAT returns over several years but was foiled due to formatting and spelling errors.

Sheriff Ian Cruickshank heard that the 52-year-old had saved £12,000 towards repayment to HMRC and so decided against jailing him.

As an alternative, he ordered Miller to carry out 180 hours of unpaid work, which he restricted so Miller could continue to earn money to pay an additional penalty – a compensation order for £15,000.

The sheriff added: “Any further recovery can be through civil channels by HMRC.”

Defence solicitor Natalie Paterson explained that her client could no longer keep his agricultural business going while also being employed, but he continued to submit VAT returns.

Invoices were suspected to be false

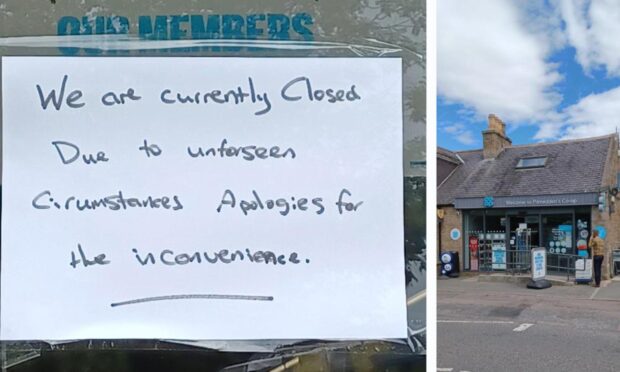

Fiscal depute Robert Weir previously told the court that an HMRC officer conducted a VAT compliance visit at Miller’s home address in Towerhill Road, Cradlehall, on January 13 2020 as the value of his repayments had remained fairly constant over several years.

Mr Weir said: “This is a risk indicator for HMRC. From January 2014 to July 2019, the accused had received £43,264.95 in VAT repayments from HMRC and now accepts £36,514 is falsely claimed.

“During the visit, he provided his purchase records, sales records and a business bank statement to HMRC.

“Initial inspection identified that the invoices supplied were copies, some with formatting and spelling errors and were suspected to be false.

“When questioned he admitted to creating and providing false invoices to help substantiate his claims for input tax but insisted his VAT repayment claims had been correct, and he had misplaced the originals.”

The court heard that an investigation of Miller’s bank accounts did not show any of the purchases he claimed to have made and no receipt of payment for any work the accused claimed to have carried out was shown on any bank statements.

His VAT record book also had incorrect invoice numbers and they were not in chronological order.

Mr Weir added: “The case was passed to HMRC Fraud Investigation Services for a criminal investigation. During an interview by HMRC Officers, he claimed that a friend helped him create fake invoices.

“He eventually admitted that he had not done any agricultural work at all since January 2014, that he had created false paperwork to provide to HMRC at the compliance visit and he had received VAT repayments from HMRC which he was not entitled to from 2014 onwards.”