Plans to repeal contentious off-payroll working rules impacting numerous oil and gas workers have been scrapped.

As part of a host of U-turns on government proposals announced last month, new Chancellor Jeremy Hunt reversed moves to abolish reforms to the tax status of freelancers and self-employed contractors known as IR35.

It has been estimated the move will be worth around £2 billion to the exchequer.

The reforms to the IR35 rules were unveiled by his predecessor Kwasi Kwarteng in his mini-budget as part of a doomed effort to boost economic growth.

Mr Hunt ditched “almost all” the tax cuts announced by Mr Kwarteng in as he attempted to restore economic stability following weeks of turmoil on the financial markets.

The new Chancellor also scrapped April’s planned 1p cut to the basic rate of income tax, which will now stay at 20p indefinitely, raising an extra £6bn a year.

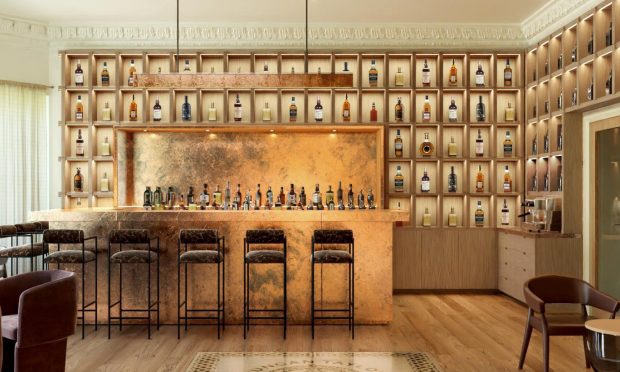

He also reversed a decision to freeze alcohol duty rates from February 2023, worth around £600 million a year, which has left a bad taste in the mouth of gin and whiskey producers.

Suggestion move could lose Conservatives the next election

It is a decision that has been condemned by experts, who have accused Mr Hunt of being part of the anti-growth coalition.

There has even been a suggestion the move could lose the Conservatives the next general election.

Confirming a reversal of almost all the tax cuts made by his predecessor Kwasi Kwarteng,

In a televised statement, the Chancellor – who only took office on Friday – sounded the final death knell for the Prime Minister’s free market experiment – dubbed “Trussonomics” – to kick-start economic growth through a programme of swingeing tax cuts and radical de-regulation.

WATCH NOW:

Watch the Chancellor @Jeremy_Hunt’s statement outlining the measures being brought forward from the Medium-Term Fiscal Plan that will support fiscal sustainability.https://t.co/faGd6A9YVp pic.twitter.com/1MWp4Y2ewv

— HM Treasury (@hmtreasury) October 17, 2022

He said: “Firstly, we will reverse almost all of the tax measures announced in the growth plan three weeks ago that have not started parliamentary legislation.

“So while we will continue with the abolition of the health and social care levy and stamp duty changes, we will no longer be proceeding with the cut to dividend tax rates, the reversal of off-payroll working reforms, introduced in 2017 and 2021, the new VAT free shopping scheme for non-UK visitors or the freeze on alcohol duty rates.”

‘Wrong decision at the wrong time’

Mr Hunt’s decision not to follow through with the move to scrap IR35 reforms will have incited a huge groan from oil and gas firms.

Research has previously shown the current intricacies of the rules are dissuading businesses from using self-employed contractors as well as causing freelancers to consider closing their businesses, retiring, or leaving the UK entirely.

Qdos chief executive Seb Maley said: “I’m lost for words. The chaos, uncertainty and disruption caused by the mini-budget is unprecedented.

“While U-turning on some tax cuts made sense, cancelling the repeal of IR35 reform is the wrong decision at the wrong time.

“It’s a knee-jerk reaction from the government and, in my opinion, won’t benefit the economy.”

Mr Maley explained that failure to scrap the complex rules affecting both contractors and their employers would stifle economic recovery.

“IR35 reform damages the flexibility of the UK labour market, which is key to economic growth,” he said.

“Many contractors left the sector after risk-averse businesses stopped engaging them. Repealing the reform would have opened the floodgates – a catalyst for the recovery of this sector.”

Short-lived celebration

There was jubilation last month when then-Chancellor Kwasi Kwarteng announced the government would be repealing IR35 reforms, which came into force for the private sector last year.

The rules put the onus on businesses to decide whether contractors are used more as regular staff, meaning they would have to pay a higher level of tax.

While the rules are designed to clamp down on people avoiding paying the correct level of tax, they have been repeatedly criticised for being overly complex.

Firms found to have used the wrong rules also face lofty fines, pushing many to implement blanket rules, or stop stop using freelancers altogether.

Initial commitment to repealing off-payroll rules ‘sensible’

Reacting to Mr Hunt’s statement, Dave Chaplin, CEO of tax compliance firm IR35 Shield, said the Chancellor’s latest moves would caused “significant harm” to the UK’s “army” of self-employed workers and large businesses alike.

“The government’s initial commitment to repealing the off-payroll rules was a sensible initiative and would have been a significant step forward for the UK’s army of self-employed people who are critical to the Government’s pro-growth agenda,” he said.

“Repealing off-payroll would have returned an essential level of certainty to contract transactions in the market economy, leading to economic growth.

“Instead, off-payroll will continue to cause significant harm to the self-employed, major businesses, the government and the economy.

Conservatives’ U-turn on repeal has thrown around half the genuinely self-employed contractors under the bus”

IR35 Shield CEO Dave Chaplin

“While we agree tax avoidance measures are sensible, the off-payroll rules over-extended, causing genuinely self-employed contractors to lose their rights to being their own boss.

“The Conservatives’ U-turn on the repeal has thrown around half the genuinely self-employed contractors under the bus and likely kissed goodbye to their success at the next general election.

“With the anti-growth effects of off-payroll it appears the pro-growth Conservatives have now joined the anti-growth coalition – as the saying goes ‘we are all in this together.’”

Conversation