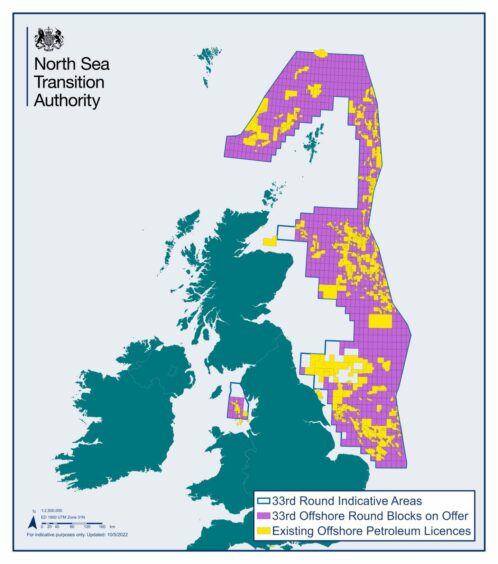

More than 100 bids have been lodged for the UK’s 33rd offshore oil and gas licensing round, the industry regulator has confirmed.

The North Sea Transition Authority (NSTA) said a total of 115 applications, covering 258 blocks and part-blocks, were submitted by 76 companies.

Designed to bolster the UK’s energy security, the round opened on October 7 and closed last week.

Zones in all sectors of the North Sea were on offer, including four priority areas known to contain oil and gas reserves.

According to NSTA, there was “very keen interest” in these clusters, and production could be achieved in as little as 18 months.

The latest process has attracted a similar level of interest to the 32nd licensing round, which received 104 applications for 245 blocks and part-blocks.

Held in 2019, a total of 768 blocks and part-blocks were offered in the previous round, compared with 931 this year.

NSTA will now make its way through the lodged bids, with a view to awarding licences “quickly” and supporting winners to “go into production as soon as appropriate”.

Results of the process are expected in late spring.

One company that will definitely not be awarded a licence is London-listed Harbour Energy, the largest producer in the North Sea, after it opted to shun the round due to the impacts of Westminster’s windfall tax.

It is one of a string of North Sea operators currently reviewing their spending plans following the increase of the levy on the sector to 75% in November.

Still hurdles to clear

After licensing, there are several necessary consents companies must secure before they can start to extract oil and gas.

For the first time, new projects will have to clear climate compatibility checkpoints; hurdles they must clear in order to receive approval.

But critics of the process argue these checkpoints will be little more than a formality.

The Scottish Government called for the rules to be tightened in its recent energy strategy.

Nick Richardson, head of exploration and new ventures, NSTA, said: “We have seen a strong response from industry to the round, which has exceeded application levels compared to previous rounds.

“We will now be working hard to analyse the applications with a view to awarding the first licences from the second quarter of 2023.”

Internal analysis conducted by NSTA puts the average time between discovery date and first production at around five years.

But it’s hoped that, given they consist of existing discoveries, priority cluster areas can yield first oil or gas in a shorter time.

Backbone of controversial energy security push

Formally announced during Liz Truss’ brief stint at prime minister, the licensing round is a key part of Westminster’s strategy for fortifying domestic energy security.

NSTA has also signed off on the reopening of the Rough gas storage facility, and encouraged operators to look at reopening closed wells.

The UK’s reliance on oil and gas imports was thrown into sharp focus last year following Russia’s attack on Ukraine.

But environmental groups have argued more licences will not have any impact on energy security or household bills, given the time it takes for new finds to be developed.

Greenpeace, Friends of the Earth and Uplift have even vowed to mount three separate legal challenges in a bid to derail the process.

Demand for decades to come

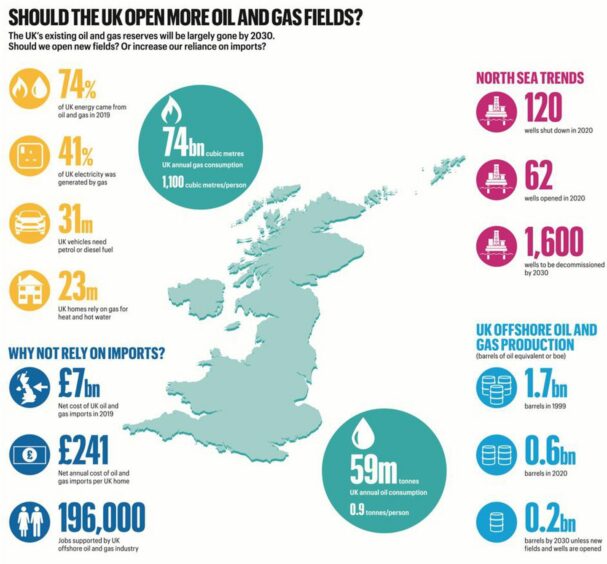

As it stands, oil and gas accounts for about 75% of they UK’s energy needs, and forecasts show it will continue to be part of the mix for decades to come – even as renewables are scaled up.

Industry is keen to push ahead with new developments, which tend to have lower emissions than older fields.

Consuming gas from the North Sea also reduces the need to import liquefied natural gas from overseas at a higher cost to the environment, NSTA said.

Between 2018 and 2021, carbon emissions from North Sea operations have dropped by more than one-fifth.

Projections indicate the sector is on track to meet reduction targets of 10% by 2025 and 25% by 2027 – agreed in the North Sea Transition Deal in 2021.

Energy and climate minister Graham Stuart said: “Putin’s illegal invasion of Ukraine has led to volatile global energy markets.

“It’s fantastic to see such interest from industry in this round, with the awarded licences set to play an important role in boosting domestic energy production and securing the UK’s long-term energy security of supply.”

Conversation