Norwegian energy giant Equinor is believed to be looking to sell a 20% stake in the controversial Rosebank oilfield west of Shetland.

The state-backed firm currently owns 80% of the asset, with Ithaca Energy holding the remaining 20%.

According to news agency Reuters, a 20% share in the project could fetch more than £1.2 billion.

UK’s largest untapped oilfield

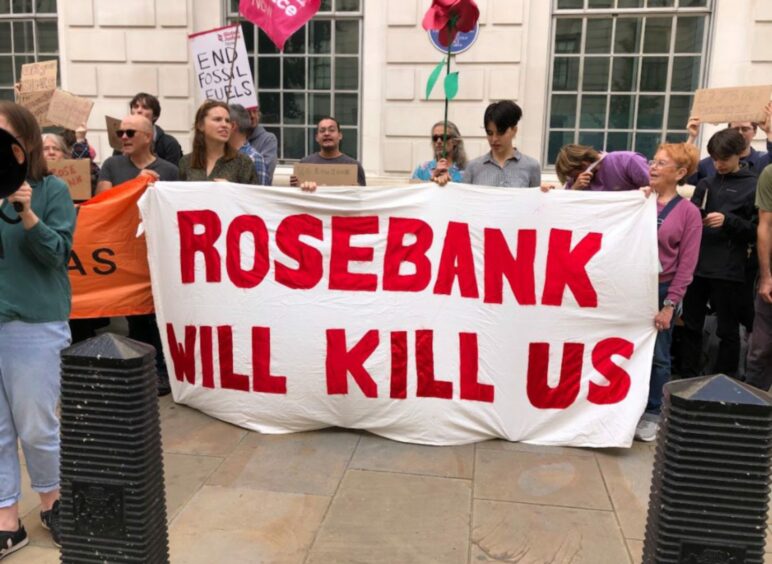

Rosebank is the UK’s largest untapped oilfield. Both it and the nearby Cambo oilfield, operated by Ithaca, have in recent years become battlegrounds for climate change protestors calling for a complete halt to oil and gas production in the UK North Sea.

UK-based supermajor Shell sold its 30% share in Cambo to operator Ithaca this year.

Yvonne Telford, research director at the Westwood Energy consultancy, said: “The key difference between Rosebank and Cambo is that Rosebank has been sanctioned for development by regulatory authorities and partners.

“A buyer will have more certainty on the progression and economics of the project.”

Rosebank investors need deep pockets

But they will also need to be well funded for an estimated £800 million-plus capital investment in the project, she added.

David Moseley, vice-president of operations for Europe at Welligence Energy Analytics, is predicting an even higher spend for any buyer.

Mr Moseley said: “Assuming a 20% stake, a potential buyer would have total outlays of over US$2 billion (more than £1.6bn) before first oil.

“It is more than likely that a significant portion of the rumoured $1.5bn (£1.2bn) price tag will be contingent on one or multiple potential trigger points, with oil and gas prices and first oil from the project arguably two of the most likely.”

Rosebank received a green light from the UK regulator, the North Sea Transition Authority, in September.

At the time it was said Equinor and Ithaca would together invest about £3.1bn in the project, which is targeting 300 million barrels of oil in two phases.

The development is expected support around 1,600 jobs at the height of construction and 450 UK roles during the lifetime of the field.

Rosebank could be producing through to 2051, according to Equinor, which declined to comment on the mooted stake sale .

Decision to sell share ‘not surprising’

Ms Telford said it was “not surprising” Equinor may be seeking to divest in Rosebank.

She added: “We estimate the net capital outlay… in addition to its net costs for other UK assets will exceed its produced UK revenue stream in 2025 and 2026.

“Although this is manageable for a company like Equinor, a reduction in the Rosebank stake would lower both its costs and risk exposure.”

Equinor acquired US major Chevron’s 40% working interest in Rosebank in 2018.

It took on a further 40% share from Suncor earlier this year as part of a £709m deal.

Conversation