Aberdeen firm RMSpumptools (RMS) will be taken over twice during the second half of 2024.

The Press and Journal revealed last month it was changing hands for £90 million.

But it has now emerged the buyer, US-based oilfield technology company ChampionX, is itself going to be acquired by energy services giant SLB in an all-share deal worth more than £60 billion.

So, by the end of this year RMS will be part of a global group which in 2023 employed around 111,000 people and turned over about £26.4bn.

RMS designs and manufactures completion systems and components for electrical submersible pump applications in the oil and gas industry.

The company employs 130 people across operations in the UK, Saudi Arabia and the United Arab Emirates.

Its total headcount includes about 40 workers in Aberdeen.

Currently owned by Cumbria-based James Fisher and Sons, the business has its headquarters in Wellheads Industrial Estate in Dyce.

It is to be integrated into ChampionX’s production and automation technologies division.

The sale of RMS to Texas-headquartered ChampionX is subject to shareholder and regulatory approvals, among other conditions.

But it is expected to complete early in the second half of 2024.

ChampionX shareholders to own 9% of enlarged group after SLB takeover

SLB, formerly Schlumberger, expects its takeover of ChampionX to complete “before the end of 2024”.

ChampionX shareholders will get 0.735 shares in SLB in exchange for each unit of

ChampionX stock.

The deal is worth 32.28p per share and ChampionX investors will end up with about 9% of SLB.

According to Houston-based SLB, oil and gas industry customers will benefit from “the enhanced portfolio, geographical reach and technology innovation”.

The company said: “SLB’s comprehensive production and recovery portfolio will provide solutions throughout the full lifecycle of the well to increase customer production, reduce overall cost of ownership and lower carbon emissions.

“This will help our global customers drive efficiency and longevity of producing assets.”

US energy services giant expects bumper efficiency savings

SLB expects annual pre-tax efficiency savings of about £318m within three years, with 70-80% realised in 2026 and the rest in 2027.

It added: “Our intention is to leverage the best aspects of both organisations.”

Our companies share a vision for the future of energy that leverages technology and innovation to solve our customers’ most complex problems.”

ChampionX president and chief executive Soma Somasundaram said: “Becoming part of SLB will give us a much broader portfolio.

“Our companies share a vision for the future of energy that leverages technology and innovation to solve our customers’ most complex problems.

“I am confident that our talented employees will benefit from greater opportunities as part of a larger organisation.”

Aberdeen firm’s top bosses staying on

RMS was created in 2009 through a merger of two Fisher-owned companies, Pumptools and Remote Marine Systems.

Fisher had snapped up Remote Marine Systems in 2004, as part of a £7.3m acquisition of three businesses. Pumptools was acquired three years later, for £7.7m.

RMS’s current management team includes managing director Doug Harwell, finance director Martin Marsh and sales director Ted Boueri. They all plan to stay on after the business changes hands.

Fisher said the sale was line with its strategy to “simplify and focus” its portfolio.

Estimates for last year suggest RMS generated revenue of £43m, earnings before interest, taxes, depreciation, and amortisation of £12m and operating profits of £11m.

As of December 31 2023, RMS had total assets of around £26m.

Fisher said its net proceeds from the sale would likely total about £83m after taking into account “cash-like and debt-like items” and estimated transaction costs.

ChampionX, SLB and their existing footprint in and around Aberdeen

ChampionX describes itself as “a global leader in chemistry solutions, artificial lift systems, and highly engineered equipment and technologies”.

The group employs more than 7,300 people across operations in 60-plus countries.

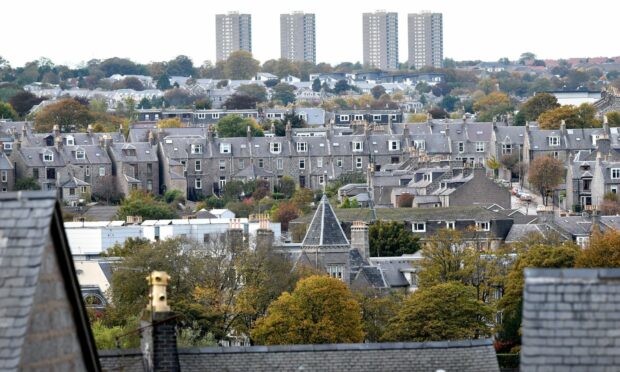

Its UK locations already include a base in Aberdeen, on Peterseat Drive in Altens.

SLB is active in more than 120 countries.

The group already has a big presence in the north-east, with operations in Aberdeen, Westhill and Inverurie.

These include its performance centre in the Taqa building at the Prime Four business park in Kingswells, Aberdeen.

SLB describes the facility as a “one-stop shop for collaboration, enabling deeper engagement between all industry partners” across digital, oil and gas, and new energy technologies.

Conversation