Fuel prices will continue to climb due to a perfect storm caused by Covid and the Ukraine crisis, a professor has warned.

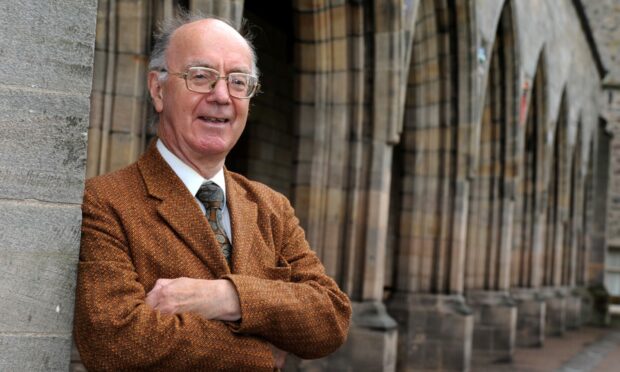

Aberdeen University’s Alex Kemp, who teaches petroleum economics, explained the rising costs.

Prof Kemp explained that the price of crude oil was already high as the energy industry tried to recover from the pandemic, so the hit of sanctions on Russian oil has heightened the situation.

He told BBC’s Good Morning Scotland: “The explanation is that the price had already risen quite a bit when the world’s economy was rising out of Covid induced recession.

“It was tight then, now we have a new phenomenon with the war, traders are becoming very anxious about the effects of sanctions that are being levied and there are plenty stories about them being enhanced.”

Why can’t other countries increase oil production to make up for it?

Prof Kemp said the Organization of the Petroleum Exporting Countries (OPEC) plays a part in how much its member countries produce.

He explained that the American Government had been putting pressure on OPEC to increase production to battle climbing prices but, so far, they have resisted.

“They have resisted, they made a long-term plan which they’re broadly adhering to and so far they’ve been reluctant to move from it,” he said.

“They still meet monthly and no doubt there will be increased pressure for those members that can increase production to do so.

“Not all of them can, in fact some of them are producing less than their quota, for example Venezuela, but we can expect that there will be efforts made by the US Government in particular to get more production from them.”

Is there a backup plan in place?

It is possible that countries could use reserves that they must have in place by order of the International Energy Agency.

The current plan is to release 60 million barrels from these stocks, most of which would come from the US, but some would also come from the UK.

However, Prof Kemp said even this number of barrels won’t make a huge difference to the current situation.

He said: “Unfortunately from what we know 60m barrels that is what’s being discussed would not really have a big effect on the market.

“I don’t think the 60m barrels will be enough to make a big difference”

What will happen to fuel prices?

Mr Kemp said he thinks it’s unlikely prices will stabilise or drop in the near future, especially when there are talks of tightened and increased sanctions.

He said: “If you’re asking ‘will the price at the pump continue to rise because the crude oil price is rising’ then there is a danger that that will take place because, as we are seeing now, the fighting is likely to continue and therefore the sanctions are likely to continue.

“For the short-term, for a matter of weeks anyway, we can’t expect the price to fall, it’s more likely it will rise.”